Content

Published:

This is an archived release.

Low current account balance

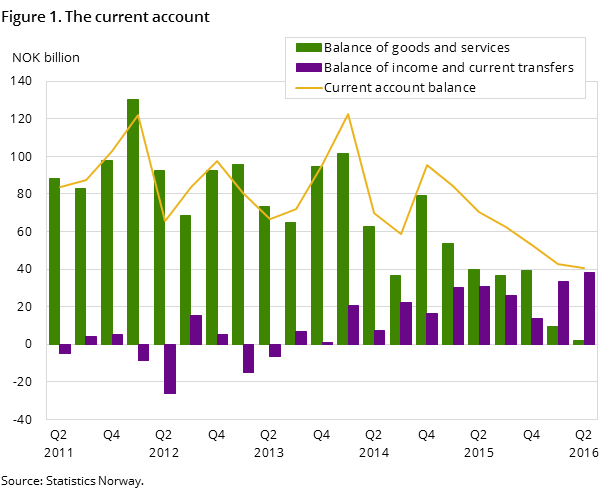

The current account balance ended at NOK 40 billion in the 2nd quarter of 2016. The financial income contributes more to the surplus than the balance of goods and services.

| 2nd quarter 2015 | 3rd quarter 2015 | 4th quarter 2015 | 1st quarter 2016 | 2nd quarter 2016 | |

|---|---|---|---|---|---|

| Current account balance | 70 518 | 62 542 | 52 851 | 42 814 | 40 311 |

| Balance of goods and services | 39 648 | 36 466 | 39 297 | 9 637 | 2 142 |

| Balance of income and current transfers | 30 870 | 26 076 | 13 554 | 33 177 | 38 169 |

| Capital transfers to abroad, net | 122 | 24 | 5 | 739 | 65 |

| Net lending, current account | 70 384 | 62 506 | 52 834 | 42 063 | 40 234 |

| Direct investment | 36 870 | 33 302 | 61 910 | 9 004 | 17 854 |

| Portofolio investment | 144 664 | 108 861 | 42 939 | -93 420 | 149 597 |

| Other investments | -131 439 | -96 941 | -36 749 | 57 456 | -52 130 |

| Reserve assets (IMF breakdown) | -5 422 | -25 359 | -34 793 | 45 234 | -5 376 |

| Net lending, financial account | 44 673 | 19 863 | 33 307 | 18 274 | 109 945 |

| Net errors and omissions | 25 711 | 42 643 | 19 527 | 23 789 | -69 711 |

The export in the 2nd quarter of 2016 was estimated at NOK 258 billon, which is about NOK 5 billion higher than the previous quarter. The export value of goods was reduced by about NOK 2 billion to NOK 176 billion in the 2nd quarter. The export value of oil and gas was reduced as a result of lower volume, but the price rose slightly from the 1st to the 2nd quarter. The export of traditional goods rose from the 1st to the 2nd quarter, but not enough to offset the decline in export value of oil and gas. Preliminary calculations show that export of services also rose from the 1st to 2nd quarter. This was partly due to normal seasonal growth in travel. For more information about exports and imports, including price and volume considerations and seasonal adjustments, please see the quarterly national accounts.

The value of imports of goods and services in the 2nd quarter of 2016 was NOK 256 billion. This is a growth of NOK 12 billion compared with the 1st quarter. This is mainly due to a rise in the import volume of goods. For services, a decline in prices was counteracted by a higher volume, resulting in a modest growth in the import value.

Balance of goods and services is estimated at roughly NOK 2 billion for the 2nd quarter of 2016. This is the lowest balance of goods and services since 1998.

Balance of income and current transfers dominating

The balance of income and current transfers ended at NOK 38 billion in the 2nd quarter of 2016, which is NOK 36 billion higher than the balance of goods and services. As in the 1st quarter of 2016, the phenomenon of income and current transfers being higher than the balance of goods and services was repeated. The combination of low oil and gas prices and high dividends on investments abroad, partly as a result of a low-priced NOK, are important factors here.

Increased investments in the financial account

The 2nd quarter of 2016 shows a rise in investments on the asset side, with total net purchases of financial assets amounting to NOK 223 billion. The increase in foreign direct investment was driven by intra-group trade credits and loans. Portfolio investment abroad went up by NOK 110 billion, after a decline the previous quarter. There were net purchases of debt securities, stocks and mutual fund shares. Other investments increased mainly due to Norwegian banks’ higher deposits abroad.

The liability side shows total net purchases of NOK 113 billion. Intra-group loans dominated the rise in foreign direct investment in Norway. Raised loans were also a substantial part of the increase in other investments, in addition to raised deposits in Norwegian banks. Reduced investment in short-term debt securities issued by Norwegian banks led to an overall decline in portfolio investment in Norway.

RevisionsOpen and readClose

For the current account: all figures in the current account have been revised for the years 2014 (final) and 2015 (preliminary). The 1st quarter in 2016 is also revised. The revisions have reduced net lending in 2014 and 2015 by NOK 31 billion and NOK 3 billion respectively. For the 1st quarter of 2016, net lending is reduced by approximately NOK 11 billion. For the financial account: due to new sources and calculations, the figures are revised dating back to the 1st quarter of 2012. This particularly affects the deposit-taking corporations, except the central bank.

Additional information

For more information about price and volume growth of exports and imports, see the quarterly national accounts.

More details about exports and imports of goods and services are available in the statistics on external trade in goods and services.

Contact

-

Håvard Sjølie

E-mail: havard.sjolie@ssb.no

tel.: (+47) 40 90 26 05

-

Linda Wietfeldt

E-mail: linda.wietfeldt@ssb.no

tel.: (+47) 40 90 25 48