Content

Published:

This is an archived release.

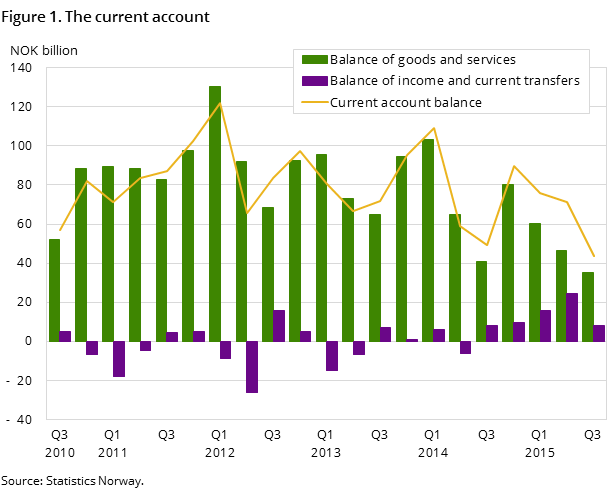

Reduced current account surplus

The 3rd quarter surplus on Norway’s current account with the rest of the world is estimated at NOK 44 billion. This is NOK 27 billion below the surplus of the 2nd quarter. Both the balance of goods and services and the income and transfers balance contributed to the decline.

| 3rd quarter 2014 | 4th quarter 2014 | 1st quarter 2015 | 2nd quarter 2015 | 3rd quarter 2015 | |

|---|---|---|---|---|---|

| Current account balance | 49 292 | 89 757 | 76 086 | 71 095 | 43 597 |

| Balance of goods and services | 41 017 | 80 359 | 60 512 | 46 645 | 35 309 |

| Balance of income and current transfers | 8 275 | 9 398 | 15 574 | 24 450 | 8 288 |

| Capital transfers to abroad, net | 78 | -113 | 719 | 122 | 24 |

| Net lending, current account | 49 214 | 89 870 | 75 355 | 70 973 | 43 573 |

| Direct investment | -10 633 | 86 853 | 30 431 | 32 916 | 42 921 |

| Portofolio investment | 17 662 | -4 703 | -13 044 | 166 743 | 37 993 |

| Other investments | -7 491 | 65 029 | -11 784 | -143 901 | -25 522 |

| Reserve assets (IMF breakdown) | 25 922 | -15 185 | 17 995 | -5 526 | -24 023 |

| Net lending, financial account | 25 460 | 131 994 | 23 598 | 50 232 | 31 369 |

| Net errors and omissions | 23 754 | -42 124 | 51 757 | 20 741 | 12 204 |

The export value of both crude oil and other goods decreased from the 2nd to the 3rd quarter of 2015. The total value of imports of goods and services was however higher, mostly due to the normal seasonal development in travel expenditures abroad in the 3rd quarter. The total balance of goods and services is estimated at NOK 35 billion, more than NOK 11 billion below the balance of the 2nd quarter. Compared to the 3rd quarter of 2014, the decline was however more modest. For more information about exports and imports, including price and volume considerations and seasonal adjustments, please see the quarterly national accounts .

Decline in balance of income and current transfers

The balance of income and current transfers ended at NOK 8 billion in the 3rd quarter, markedly lower than in the 2nd quarter. The decline was mainly due to a reduction in investment dividends received from the rest of the world, of NOK 43 billion, while dividends paid to the rest of the world were reduced by less than half that amount.

Reduced net lending in financial transactions

Net lending in the financial account amounted to NOK 31 billion in the 3rd quarter; NOK 19 billion lower than in the 2nd quarter. Transactions in financial assets amounted to NOK 227 billion, while on the liability side, the transactions were NOK 196 billion. ‘Other financial investments’ dominated on both sides, where transactions in assets were NOK 160 billion and transactions in liability were NOK 186 billion. The general government sector’s (including Government Pension Fund Global) lending amounted to NOK 52 billion, and the increase in loan debt amounted to NOK 37 billion. Repurchase agreements (repos) were considerable on both sides.

RevisionsOpen and readClose

Current Account

Both balance of goods and services and balance of income and current transfers have been revised for all quarters dating back to the 1st quarter of 2013. This is due to new information in conjunction with the calculation of final national accounts published on 9 September this year.

Revision of household assets abroad

The use of new data sources has led to a revision of household assets abroad dating back to the 1st quarter of 2005. This mainly has a negative effect on foreign direct investment, whilst the effect on portfolio investment is positive.

Due to new deposit codes reported for the sector deposit-taking corporations, there has been a revision of short-term and long-term deposits. Data are revised dating back to the 1st quarter of 2012.

Additional information

For more information about price and volume growth of exports and imports, see the quarterly national accounts.

More details about exports and imports of goods and services are available in the statistics on external trade in goods and services.

Contact

-

Håvard Sjølie

E-mail: havard.sjolie@ssb.no

tel.: (+47) 40 90 26 05

-

Linda Wietfeldt

E-mail: linda.wietfeldt@ssb.no

tel.: (+47) 40 90 25 48