Content

Published:

This is an archived release.

Current account surplus slightly down

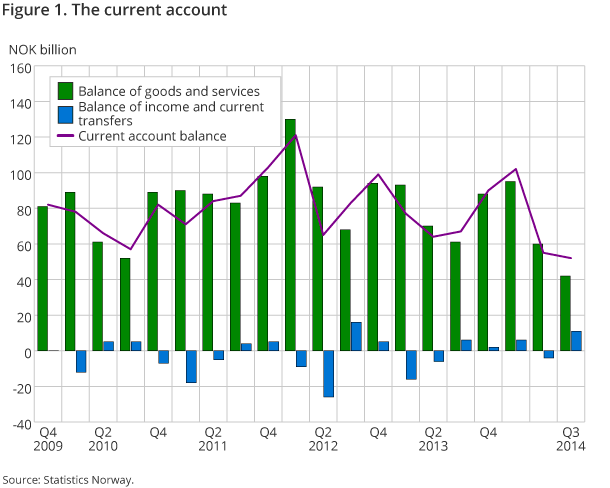

The surplus on Norway’s current account with the rest of the world ended at NOK 52 billion in the 3rd quarter of 2014. This was NOK 3 billion below the surplus of the previous quarter, and was due to a weakened goods and services balance.

| 3rd quarter 2013 | 4th quarter 2013 | 1st quarter 2014 | 2nd quarter 2014 | 3rd quarter 2014 | |

|---|---|---|---|---|---|

| Current account balance | 67 237 | 90 407 | 101 502 | 55 348 | 52 256 |

| Balance of goods and services | 61 135 | 88 078 | 95 345 | 59 845 | 41 630 |

| Balance of income and current transfers | 6 102 | 2 329 | 6 157 | -4 497 | 10 626 |

| Capital transfers to abroad, net | 144 | 300 | 736 | 257 | 39 |

| Net lending, current account | 67 086 | 90 099 | 100 754 | 55 089 | 52 217 |

| Direct investment | -24 458 | 44 423 | 41 492 | -6 452 | -19 637 |

| Portofolio investment | 73 076 | 55 392 | 62 778 | 69 542 | 17 024 |

| Other investments | -24 809 | 1 497 | -1 270 | 60 994 | 5 130 |

| Reserve assets (IMF breakdown) | 2 897 | -15 231 | 24 870 | 4 521 | 25 922 |

| Net lending, financial account | 26 706 | 86 081 | 127 870 | 128 605 | 28 439 |

| Net errors and omissions | 40 380 | 4 018 | -27 116 | -73 516 | 23 778 |

This publication is the first publication where the new international guidelines from Eurostat and IMF are incorporated. The new manual aims to give a better understanding of the economic globalisation. The new guidelines have been implemented back in time.

The trade in goods and services gave a surplus of NOK 42 billion, while the income and current transfers ended with a surplus of almost NOK 11 billion in the 3rd quarter of 2014. Accumulated over the first three quarters of 2014, the surplus on the current account was NOK 209 billion; the same as for the corresponding period in 2013.

Decreased goods and services balance

The value of exports of goods was NOK 207 billion in the 3rd quarter of 2014, of which crude oil and natural gas amounted to NOK 121 billion. Compared to the 2nd quarter, the exports of crude oil and natural gas were slightly down, while traditional goods were slightly up. The value of imports of goods was NOK 150 billion, up NOK 8 billion from the 2nd quarter.

Exports of services are estimated at NOK 78 billion for the 3rd quarter of 2014, only slightly above the 2nd quarter. Imports of services ended at NOK 93 billion in the 3rd quarter - well above the level of the previous quarter.

Surplus of income and transfers

There was a surplus in the income and transfers balance of NOK 11 billion in the 3rd quarter this year, up from a deficit of NOK 4 billion in the 2nd quarter. Compensation of employees and property income received from the rest of the world exceeded the corresponding payments to the rest of the world by NOK 18 billion. Net transfers to the rest of the world are estimated at almost NOK 8 billion.

Positive net financial transactions

The implementation of the new manual and revision of data gives rise to several changes in the financial account, where the figures are revised for the period 2005-2014. Direct investment has had the largest revision, where, in addition to a data revision, a new definition of group companies’ loans has been implemented.

The balance of payments during the period 2005-2014 has had an average positive net direct investment, i.e. Norwegian direct investment abroad has been larger then foreign direct investment in Norway. However, in the 3rd quarter of 2014 it amounted to a negative net direct investment of NOK -20 billion.

The portfolio investment has been quite stable in this period with positive net transactions, and has been little affected by the data revision. Net portfolio investment for the 3rd quarter of 2014 amounted to NOK 17 billion. The portfolio assets are dominated by the sector general government, which amounted to NOK 36 billion in the 3rd quarter of 2014. The general government has the largest investments in equity and long-term debt securities.

Other investments consist of trade credits, loans, currency and deposits and other claims. In the 3rd quarter of 2014 the deposits increased by NOK 22 billion, and loans decreased by NOK 88 billion. Deposit-taking corporations, except the central bank, have large fluctuations in deposits and loans between quarters.

Transactions fluctuate over time, and the balance is affected by the global market with changes in exchange rates and price changes.

Errors and omissions

Although the balance of payments accounts are, in principle, balanced, imbalances occur due to imperfections in source data and compilation. The implementation of the new manual and data revision have led to a smaller disparity between net lending in the current account and net lending in the financial account. The net errors and omissions in the balance of payment in the period 2009-2013 are adjusted from NOK 225 billion to NOK 59 billion. Data revisions in both the current and financial accounts have contributed to the reduction.

RevisionsOpen and readClose

Statistics Norway has implemented a main revision of the balance of payments statistics, as an adaption to new international recommendations (IMFs Balance of Payments Manual – BPM6). In addition, some new sources and new statistical data have been introduced. Read the article and the outcomes of the Main Revision.

In the current account, imports of goods are now presented at both FOB value (Free On Board) and CIF value (Cost, Insurance and Freight). Property income is split between income from direct investments and income from other investments. In the financial account, changes in the definition of direct investment and incorporation of IMF’s liability for special drawing rights (SDR) leads to a break in the time series. Please see further information in “About the statistics”.

As an illustration of the impact of the revision, the current account surplus of 2011 has been revised down from NOK 372 to NOK 342 billion. Both the trade balance and net income and current transfers have been revised down.

Additional information

For more information about price and volume growth of exports and imports, see the quarterly national accounts.

More details about exports and imports of goods and services are available in the statistics on external trade in goods and services.

Contact

-

Håvard Sjølie

E-mail: havard.sjolie@ssb.no

tel.: (+47) 40 90 26 05

-

Linda Wietfeldt

E-mail: linda.wietfeldt@ssb.no

tel.: (+47) 40 90 25 48