Monthly updates of the National Accounts are postponed until November 2025. In the meantime, monthly data series will be published every three months together with quarterly national accounts.

Statistikk innhold

Statistics on

National accounts

The national accounts provide an overview of the state and development in the Norwegian economy. Key figures are gross domestic product (GDP), consumption, gross investment, exports and imports, employment and wages, profitability in industries and productivity. 1st to 3rd quarter is published with monthly national accounts in May, August and November. 4th quarter will be published February the following year, figures for t-2 in August.

Selected figures from these statistics

- Final expenditure and gross domestic product. Seasonally adjusted. Percentage change in volumeDownload table as ...Final expenditure and gross domestic product. Seasonally adjusted. Percentage change in volume1

2023 2024 2nd quarter 2025 April 2025 May 2025 June 2025 Gross domestic product 0.1 2.1 0.8 0.7 -0.2 0.4 Gross domestic product Mainland Norway 0.7 0.6 0.6 0.5 -0.1 0.3 Petroleum activities and ocean transport -1.0 4.9 1.4 1.1 -0.5 0.6 Final domestic use of goods and services -0.8 0.4 0.3 -1.5 -1.5 0.6 Final consumption expenditure of households and NPISH -1.2 1.4 0.2 -0.1 -0.1 1.1 Final consumption expenditure of general government 3.4 2.4 0.5 -0.3 0.3 0.2 Gross fixed capital formation (GFCF) -1.5 -1.4 4.6 4.1 -1.7 0.9 Total exports 0.4 5.2 0.8 3.2 -0.2 0.8 Total imports -1.5 4.3 -0.6 -0.1 -3.4 1.9 Employed persons 1.3 0.5 0.2 Total hours worked 0.6 0.3 0.1 1Figures from 2023 onwards are preliminary. Errors in seasonally adjusted figures were corrected on 29 November 2024, at 11:35 a.m Explanation of symbolsDownload table as ... - Final expenditure and gross domestic product. Monthly. Seasonally adjusted figures. Percentage change in volume from the previous periodDownload table as ...Final expenditure and gross domestic product. Monthly. Seasonally adjusted figures. Percentage change in volume from the previous period1

November 2024 December 2024 January 2025 February 2025 March 2025 April 2025 May 2025 June 2025 Final consumption expenditure of households and NPISHs 0.5 0.0 1.3 0.4 -0.2 -0.1 -0.1 1.1 ¬ Household final consumption expenditure 0.5 0.1 1.4 0.5 -0.3 -0.1 -0.1 1.1 ¬¬ Goods 0.8 -0.9 2.4 0.8 0.0 0.9 0.5 1.3 ¬¬ Services 0.0 0.2 0.2 0.1 0.1 -0.4 0.1 0.2 ¬¬ Direct purchases abroad by resident households 1.5 2.6 0.2 0.6 -2.0 -4.3 -2.6 2.5 ¬¬ Direct purchases by non-residents 0.9 -3.6 -3.4 -1.3 4.0 -0.8 4.1 -4.0 ¬ Final consumption expenditure of NPISHs 0.7 -0.8 0.0 -1.2 0.9 0.1 0.4 0.3 Final consumption expenditure of general governmen 0.3 -0.2 0.1 0.1 0.6 -0.3 0.3 0.2 ¬ Final consumption expenditure of central government 0.2 0.0 0.2 0.3 0.9 -0.6 0.4 0.3 ¬¬¬ Central government, civilian 0.2 -0.1 0.1 0.3 0.8 -0.8 0.3 0.2 ¬¬¬ Central government, defence 0.4 0.6 1.2 0.2 1.9 0.7 0.8 0.3 ¬ Final consumption expenditure of local government 0.4 -0.4 0.0 -0.2 0.3 0.1 0.2 0.2 Gross fixed capital formation (GFCF) -2.0 3.9 -9.7 4.8 -0.3 4.1 -1.7 0.9 ¬ Extraction and transport via pipelines (GFCF) -4.8 6.7 -10.0 -4.6 5.5 8.2 4.6 -4.3 ¬ Ocean transport (GFCF) -72.4 73.6 -98.2 -3.6 920.2 128.1 -28.6 23.3 ¬ Mainland Norway (GFCF) 1.6 2.3 -8.0 7.4 -2.1 2.6 -3.3 2.4 ¬¬ Mainland Norway excluding general government (GFCF) -0.5 -2.3 -1.5 1.2 6.4 -4.1 1.6 3.7 ¬¬¬ Industries (GFCF) -0.3 -2.9 -1.8 2.1 5.6 -5.0 2.5 4.3 ¬¬¬¬ Services activities incidential to extraction (GFCF) -6.2 5.0 -20.5 -4.1 6.5 35.3 3.1 -8.8 ¬¬¬¬ Other services (GFCF) -1.1 -5.2 -1.6 1.8 -0.9 1.2 -3.4 5.4 ¬¬¬¬ Manufacturing and mining (GFCF) -3.4 1.0 -3.6 -1.2 2.1 4.0 1.5 -0.6 ¬¬¬¬ Production of other goods (GFCF) 6.2 0.3 1.9 6.3 27.2 -28.2 22.3 7.0 ¬¬¬ Dwelling service (households) (GFCF) -1.1 -0.8 -0.6 -1.0 8.7 -1.5 -0.6 2.0 ¬¬¬ General government (GFCF) 6.4 11.8 -19.7 20.9 -17.6 18.3 -12.8 -0.5 Acquisitions less disposals of valuables -7.2 -7.5 7.3 -3.7 5.2 -2.1 6.5 -1.9 Changes in stocks and statistical discrepancies -40.5 -65.2 306.8 -35.5 310.3 -51.4 -47.6 -16.2 Gross capital formation -4.9 0.6 -4.5 2.0 13.4 -4.8 -5.5 0.1 Final domestic use of goods and services -1.1 0.1 -0.6 0.7 3.6 -1.5 -1.5 0.6 Final demand from Mainland Norway (excl. changes in stocks) 0.7 0.5 -1.0 1.7 -0.4 0.4 -0.7 1.1 Final demand from general government 1.4 2.2 -4.1 3.8 -3.1 3.0 -2.4 0.1 Total exports -0.1 0.0 -1.6 1.4 -4.4 3.2 -0.2 0.8 ¬ Traditional goods (export) 5.6 -6.0 2.8 -1.0 -0.4 2.8 -3.6 13.7 ¬ Crude oil and natural gas (export) -1.7 1.3 -1.9 1.0 -5.2 5.8 0.5 -1.6 ¬ Ships, oil platforms and aircraft (export) -41.3 481.6 -72.4 490.0 -83.9 36.8 67.6 -80.8 ¬ Services (export) -0.4 -1.0 -2.6 -0.2 -0.3 -5.4 0.8 -4.2 Total use of goods and services -0.6 0.1 -1.0 1.0 0.0 0.6 -0.9 0.7 Total imports -2.6 2.1 -4.6 2.0 0.7 -0.1 -3.4 1.9 ¬ Traditional goods (import) -1.3 -3.0 1.1 0.7 2.8 0.1 -2.8 2.7 ¬ Crude oil and natural gas (import) -53.5 56.2 14.1 14.8 3.4 -21.8 32.9 5.4 ¬ Ships, oil platforms and aircraft (import) -13.8 103.0 -84.8 152.5 -49.7 147.2 -62.1 -16.3 ¬ Services (import) -1.4 2.2 -2.6 0.2 0.0 -3.9 -1.4 0.6 Gross domestic product, market values2 -0.1 -0.5 0.0 0.8 -0.2 0.7 -0.2 0.4 Gross domestic product Mainland Norway, market values2 0.2 -0.4 1.4 0.1 -0.1 0.5 -0.1 0.3 Petroleum activities and ocean transport3 -0.5 -0.7 -2.6 2.1 -0.5 1.1 -0.5 0.6 Gross domestic product Mainland Norway, basic values 0.2 -0.2 1.2 0.1 -0.2 0.5 -0.1 0.2 ¬ Mainland Norway excluding general government (GDP) 0.1 -0.1 1.4 0.1 -0.4 0.8 -0.3 0.2 ¬¬ Manufacturing and mining (GDP) 1.2 2.4 -1.5 1.4 0.0 2.3 -0.4 -0.2 ¬¬ Production of other goods (GDP) -0.9 0.6 4.2 -0.4 -1.4 1.5 -1.1 -1.9 ¬¬ Service activities (GDP) 0.3 -0.8 1.0 0.0 -0.1 0.3 0.0 0.9 ¬ General government (GDP) 0.4 -0.4 0.4 0.3 0.4 -0.4 0.2 0.3 Taxes and subsidies products -0.2 -2.3 3.2 -0.6 0.9 0.7 0.5 0.9 1Figures from 2023 onwards are preliminary 2Gross domestic product is measured at market prices, while value added by industry is measured at basic prices 3Includes oil and gas extraction, transport via pipelines and ocean transport Errors in seasonally adjusted figures were corrected on 29 November 2024, at 11:35 a.m Explanation of symbolsDownload table as ... - Final expenditure and gross domestic product. Rolling three-month sum. Seasonally adjusted. Percentage change in volumeDownload table as ...Final expenditure and gross domestic product. Rolling three-month sum. Seasonally adjusted. Percentage change in volume1 2

September 2024 - November 2024 October 2024 - December 2024 November 2024 - January 2025 December 2024 - February 2025 January 2025 - March 2025 February 2025 - April 2025 March 2025 - May 2025 April 2025 - June 2025 Final consumption expenditure of households and NPISHs -0.5 -0.2 0.7 1.2 1.7 1.1 0.4 0.2 ¬ Household final consumption expenditure -0.5 -0.2 0.7 1.3 1.9 1.3 0.4 0.2 ¬¬ Goods 1.0 1.3 1.2 1.4 2.6 2.4 2.1 1.9 ¬¬ Services -0.1 -0.1 0.6 0.5 0.5 0.3 0.1 -0.1 ¬¬ Direct purchases abroad by resident households 0.5 1.6 3.5 4.1 2.1 -1.2 -5.2 -6.2 ¬¬ Direct purchases by non-residents 22.3 20.2 8.8 -1.4 -5.0 -2.5 2.7 2.7 ¬ Final consumption expenditure of NPISHs -0.4 -0.8 0.2 -0.8 -0.7 -0.8 0.3 0.7 Final consumption expenditure of general governmen 0.6 0.5 0.4 0.2 0.3 0.4 0.6 0.5 ¬ Final consumption expenditure of central government 0.6 0.6 0.5 0.5 0.8 0.9 1.0 0.5 ¬¬¬ Central government, civilian 0.4 0.5 0.3 0.3 0.5 0.6 0.6 0.2 ¬¬¬ Central government, defence 1.8 1.6 1.8 2.0 2.6 2.8 3.2 2.7 ¬ Final consumption expenditure of local government 0.6 0.4 0.2 -0.1 -0.1 -0.1 0.3 0.4 Gross fixed capital formation (GFCF) 1.7 1.8 -1.8 -1.7 -5.2 0.2 1.4 4.6 ¬ Extraction and transport via pipelines (GFCF) 2.6 6.7 1.4 -1.8 -8.7 -3.2 5.6 12.1 ¬ Ocean transport (GFCF) 13.6 89.4 -57.5 -55.7 -94.0 -61.5 -13.9 393.2 ¬ Mainland Norway (GFCF) 1.3 -0.6 -1.4 -0.9 -2.2 1.8 0.4 2.1 ¬¬ Mainland Norway excluding general government (GFCF) 2.4 -0.7 -2.6 -3.7 -0.3 2.3 4.4 2.7 ¬¬¬ Industries (GFCF) 5.1 1.6 -1.9 -3.6 -0.7 1.8 3.7 2.2 ¬¬¬¬ Services activities incidential to extraction (GFCF) -5.5 -21.2 -21.1 -19.6 -20.1 -2.7 19.0 37.7 ¬¬¬¬ Other services (GFCF) 7.3 5.6 -0.6 -3.8 -4.5 -1.3 -0.6 0.6 ¬¬¬¬ Manufacturing and mining (GFCF) 0.8 3.2 -0.3 -2.0 -4.2 -0.6 3.3 5.9 ¬¬¬¬ Production of other goods (GFCF) 3.6 -7.7 -3.8 -1.7 18.5 14.3 15.2 0.4 ¬¬¬ Dwelling service (households) (GFCF) -4.3 -6.3 -4.4 -3.8 0.7 3.5 6.5 4.0 ¬¬¬ General government (GFCF) -0.9 -0.3 1.0 4.9 -5.8 0.8 -7.3 0.7 Acquisitions less disposals of valuables 12.1 6.9 -1.8 -6.9 -1.6 0.9 5.7 3.6 Changes in stocks and statistical discrepancies -71.9 -58.3 -49.5 -13.1 100.3 134.2 143.4 -41.2 Gross capital formation -9.8 -4.7 -5.8 -2.3 -0.2 6.1 7.6 0.3 Final domestic use of goods and services -2.9 -1.3 -1.2 0.0 0.8 2.3 2.3 0.3 Final demand from Mainland Norway (excl. changes in stocks) 0.2 -0.1 0.1 0.5 0.5 1.1 0.5 0.7 Final demand from general government 0.3 0.4 0.5 1.1 -0.9 0.5 -0.9 0.5 Total exports -2.5 -0.1 -0.3 -0.1 -2.2 -1.6 -2.0 0.8 ¬ Traditional goods (export) 4.2 3.1 2.8 -1.3 -0.3 -0.6 0.5 4.2 ¬ Crude oil and natural gas (export) -6.0 -1.3 -1.0 0.4 -2.7 -1.5 -1.4 2.1 ¬ Ships, oil platforms and aircraft (export) -13.7 71.8 41.6 215.3 47.9 55.3 -58.0 -50.4 ¬ Services (export) 2.9 -0.3 -1.8 -3.1 -3.6 -4.2 -4.6 -6.4 Total use of goods and services -2.7 -0.8 -0.8 0.0 -0.5 0.5 0.4 0.5 Total imports -0.4 -0.4 -2.5 -1.2 -2.6 0.0 -0.8 -0.6 ¬ Traditional goods (import) -1.0 -2.0 -3.1 -2.4 0.0 2.3 2.8 1.2 ¬ Crude oil and natural gas (import) -29.0 -34.0 -35.9 8.4 26.1 33.8 10.8 3.9 ¬ Ships, oil platforms and aircraft (import) 29.8 77.7 9.3 10.8 -64.7 -35.9 -44.6 11.0 ¬ Services (import) 0.4 -0.4 -0.7 -0.3 -1.4 -2.0 -3.7 -4.5 Gross domestic product, market values3 -3.4 -0.9 -0.3 0.3 0.1 0.7 0.7 0.8 Gross domestic product Mainland Norway, market values -0.1 -0.4 0.1 0.5 1.2 1.0 0.8 0.6 Petroleum activities and ocean transport4 -8.9 -1.6 -1.0 0.0 -2.0 0.2 0.6 1.4 Gross domestic product Mainland Norway, basic values 0.0 -0.2 0.3 0.7 1.1 0.9 0.6 0.4 ¬ Mainland Norway excluding general government (GDP) 0.0 -0.5 0.2 0.7 1.3 1.0 0.6 0.5 ¬¬ Manufacturing and mining (GDP) -1.4 -0.2 1.3 2.4 1.4 1.9 1.8 2.4 ¬¬ Production of other goods (GDP) -0.3 -2.2 -0.4 1.7 3.6 2.2 0.4 -0.9 ¬¬ Service activities (GDP) 0.3 0.0 0.2 0.1 0.6 0.5 0.5 0.6 ¬ General government (GDP) 0.0 0.5 0.6 0.5 0.6 0.6 0.5 0.2 Taxes and subsidies products -0.6 -2.2 -1.6 -0.9 1.5 1.6 2.2 1.7 1Figures from 2023 onwards are prelimanry 2Rolling three-month growth is calculated by comparing a three-month period with the previous three-month period, for example growth in May to July compared with February to April. Furthermore, March, June, September and December represent the quarters in a year. For example, March will represent the first quarter. 3Gross domestic product is measured at market prices, while value added by industry is measured at basic prices. 4Includes oil and gas extraction, transport via pipelines and ocean transport. Errors in seasonally adjusted figures were corrected on 29 November 2024, at 11:35 a.m Explanation of symbolsDownload table as ... - Final expenditure and gross domestic product. Quarter and year. At current prices. NOK millionDownload table as ...Final expenditure and gross domestic product. Quarter and year. At current prices. NOK million1

2023 2024 2nd quarter 2024 3rd quarter 2024 4th quarter 2024 1st quarter 2025 2nd quarter 2025 Final consumption expenditure of households and NPISHs 1 959 015 2 050 693 526 067 497 330 541 575 516 184 544 161 ¬ Household final consumption expenditure 1 841 203 1 928 115 494 478 469 533 508 621 483 815 511 940 ¬¬ Goods 833 641 860 429 221 748 205 884 235 455 210 580 235 685 ¬¬ Services 915 126 975 536 244 852 243 544 248 972 255 217 255 116 ¬¬ Direct purchases abroad by resident households 163 564 176 096 47 393 54 128 39 779 35 816 46 068 ¬¬ Direct purchases by non-residents -71 128 -83 947 -19 515 -34 024 -15 585 -17 798 -24 929 ¬ Final consumption expenditure of NPISHs 117 812 122 579 31 589 27 797 32 953 32 369 32 221 Final consumption expenditure of general governmen 1 116 464 1 183 912 302 213 294 574 300 311 301 913 319 122 ¬ Final consumption expenditure of central government 564 296 602 559 153 967 148 456 155 007 153 834 164 425 ¬¬¬ Central government, civilian 493 702 523 428 133 458 129 099 134 321 133 115 140 939 ¬¬¬ Central government, defence 70 594 79 132 20 509 19 357 20 686 20 719 23 486 ¬ Final consumption expenditure of local government 552 168 581 353 148 246 146 117 145 304 148 078 154 697 Gross fixed capital formation (GFCF) 1 104 630 1 142 620 279 552 283 477 325 853 267 293 299 422 ¬ Extraction and transport via pipelines (GFCF) 216 933 253 361 63 728 63 354 70 648 61 441 71 769 ¬ Ocean transport (GFCF) 2 478 9 147 879 2 654 5 501 318 1 652 ¬ Mainland Norway (GFCF) 885 219 880 112 214 944 217 469 249 704 205 534 226 001 ¬¬ Industries (GFCF) 418 820 424 224 107 259 103 579 115 531 105 990 114 027 ¬¬¬ Services activities incidential to extraction (GFCF) 8 022 12 293 2 780 3 934 3 319 2 349 3 630 ¬¬¬ Other services (GFCF) 260 036 257 903 64 171 61 916 70 125 65 847 66 933 ¬¬¬ Manufacturing and mining (GFCF) 67 331 69 317 16 800 15 853 20 707 15 705 17 757 ¬¬¬ Production of other goods (GFCF) 83 432 84 710 23 506 21 876 21 380 22 088 25 706 ¬¬ welling service (households) (GFCF) 202 535 170 209 43 362 41 678 39 895 40 451 42 584 ¬¬ General government (GFCF) 263 864 285 678 64 324 72 211 94 278 59 094 69 391 Acquisitions less disposals of valuables 686 789 203 176 218 218 218 Changes in stocks and statistical discrepancies 132 045 110 818 5 667 33 933 12 144 65 793 -5 293 Gross capital formation 1 237 361 1 254 227 285 423 317 586 338 215 333 304 294 347 Final domestic use of goods and services 4 312 840 4 488 832 1 113 703 1 109 490 1 180 101 1 151 400 1 157 630 Final demand from Mainland Norway (excl. changes in stocks) 3 960 698 4 114 717 1 043 224 1 009 372 1 091 589 1 023 631 1 089 284 Final demand from general government 1 380 328 1 469 590 366 537 366 785 394 589 361 007 388 513 Total exports 2 444 264 2 467 957 630 164 602 355 662 370 664 566 589 362 ¬ Traditional goods (export) 665 296 669 190 167 874 163 075 181 001 175 131 176 938 ¬ Crude oil and natural gas (export) 1 201 777 1 169 313 304 747 271 064 318 705 333 759 255 992 ¬ Ships, oil platforms and aircraft (export) 8 281 11 909 2 999 2 224 3 761 5 914 2 995 ¬ Services (export) 568 910 617 545 154 543 165 992 158 903 149 761 153 437 Total use of goods and services 6 757 104 6 956 790 1 743 867 1 711 845 1 842 472 1 815 966 1 746 992 Total imports 1 655 545 1 760 184 451 687 455 329 463 754 425 173 447 161 ¬ Traditional goods (import) 992 407 1 037 151 273 252 261 311 270 814 256 283 269 562 ¬ Crude oil and natural gas (import) 26 515 20 744 3 913 7 789 4 487 5 565 3 934 ¬ Ships, oil platforms and aircraft (import) 31 211 41 163 6 950 9 835 18 972 7 078 7 800 ¬ Services (import) 605 413 661 126 167 572 176 394 169 481 156 247 165 864 Gross domestic product, market values2 5 101 559 5 196 606 1 292 180 1 256 516 1 378 717 1 390 793 1 299 831 Gross domestic product Mainland Norway, market values2 3 878 698 4 050 136 1 016 116 987 162 1 054 473 1 056 943 1 055 009 Petroleum activities and ocean transport3 1 222 861 1 146 470 276 064 269 355 324 244 333 850 244 822 Gross domestic product Mainland Norway, basic values 3 424 887 3 574 017 895 330 869 451 926 389 943 205 930 616 ¬ Mainland Norway excluding general government (GDP) 2 583 888 2 676 525 664 340 645 937 699 392 714 606 685 395 ¬¬ Manufacturing and mining (GDP) 315 547 327 344 81 792 82 410 85 974 87 198 91 944 ¬¬ Production of other goods (GDP) 486 674 468 188 104 619 111 694 122 382 134 254 104 498 ¬¬ Service activities (GDP) 1 781 667 1 880 994 477 929 451 833 491 036 493 154 488 953 ¬ General government (GDP) 841 000 897 492 230 990 223 514 226 997 228 598 245 222 Taxes and subsidies products 453 811 476 119 120 786 117 711 128 084 113 738 124 393 1Figures from 2023 onwards are prelimanry 2Gross domestic product is measured at market prices, while value added by industry is measured at basic prices 3Includes oil and gas extraction, transport via pipelines and ocean transport. Explanation of symbolsDownload table as ... - Final expenditure and gross domestic product. Quarter and year. At constant 2022-prices. NOK millionDownload table as ...Final expenditure and gross domestic product. Quarter and year. At constant 2022-prices. NOK million1

2023 2024 2nd quarter 2024 3rd quarter 2024 4th quarter 2024 1st quarter 2025 2nd quarter 2025 Final consumption expenditure of households and NPISHs 1 833 619 1 854 873 474 633 453 440 489 917 458 649 481 106 ¬ Household final consumption expenditure 1 722 706 1 744 264 446 575 428 154 460 731 429 867 453 511 ¬¬ Goods 789 237 795 708 205 043 190 500 217 639 194 390 214 702 ¬¬ Services 860 089 873 261 219 749 220 505 222 373 220 054 221 136 ¬¬ Direct purchases abroad by resident households 139 944 151 261 39 428 47 709 34 730 31 387 39 758 ¬¬ Direct purchases by non-residents -66 564 -75 966 -17 645 -30 561 -14 010 -15 965 -22 085 ¬ Final consumption expenditure of NPISHs 110 914 110 609 28 059 25 285 29 186 28 782 27 595 Final consumption expenditure of general governmen 1 069 465 1 095 563 272 182 274 174 278 066 275 536 277 462 ¬ Final consumption expenditure of central government 536 363 553 521 137 357 137 152 140 661 140 277 140 580 ¬¬¬ Central government, civilian 469 856 481 945 119 705 119 030 122 327 121 272 121 223 ¬¬¬ Central government, defence 66 508 71 576 17 652 18 122 18 334 19 005 19 358 ¬ Final consumption expenditure of local government 533 102 542 042 134 826 137 022 137 405 135 258 136 881 Gross fixed capital formation (GFCF) 1 037 174 1 017 333 249 463 254 529 286 988 233 130 258 407 ¬ Extraction and transport via pipelines (GFCF) 196 487 215 355 53 831 54 653 58 795 51 274 59 175 ¬ Ocean transport (GFCF) 2 426 5 180 644 2 459 4 637 269 1 375 ¬ Mainland Norway (GFCF) 838 260 796 799 194 987 197 417 223 557 181 588 197 857 ¬¬Næringer (bruttoinvestering) 394 416 381 252 96 514 93 714 102 845 93 296 99 928 ¬¬¬ Services activities incidential to extraction (GFCF) 7 379 11 083 2 417 3 449 2 828 2 011 3 029 ¬¬¬ Other services (GFCF) 246 162 232 513 58 072 56 400 62 641 58 228 58 900 ¬¬¬ Manufacturing and mining (GFCF) 62 776 61 985 15 035 14 231 18 388 13 808 15 441 ¬¬¬ Production of other goods (GFCF) 78 100 75 671 20 989 19 634 18 988 19 249 22 558 ¬¬ Dwelling service (households) (GFCF) 193 926 156 802 39 808 38 073 36 344 36 360 37 462 ¬¬ General government (GFCF) 249 918 258 744 58 666 65 630 84 368 51 932 60 467 Acquisitions less disposals of valuables 625 663 172 147 182 179 178 Changes in stocks and statistical discrepancies 130 873 99 259 5 223 32 583 12 468 58 681 -13 217 Gross capital formation 1 168 671 1 117 255 254 858 287 258 299 638 291 991 245 368 Final domestic use of goods and services 4 071 756 4 067 691 1 001 673 1 014 872 1 067 621 1 026 176 1 003 936 Final demand from Mainland Norway (excl. changes in stocks) 3 741 345 3 747 235 941 803 925 030 991 540 915 773 956 425 Final demand from general government 1 319 383 1 354 308 330 848 339 803 362 434 327 467 337 928 Total exports 3 195 748 3 376 354 852 024 826 557 856 913 819 265 813 160 ¬ Traditional goods (export) 665 047 677 796 166 747 171 003 182 729 169 094 177 518 ¬ Crude oil and natural gas (export) 1 979 595 2 127 198 543 553 489 903 533 088 520 500 502 029 ¬ Ships, oil platforms and aircraft (export) 7 131 9 180 2 617 1 843 3 167 4 683 2 322 ¬ Services (export) 543 974 562 179 139 106 163 808 137 929 124 988 131 291 Total use of goods and services 7 267 504 7 444 045 1 853 697 1 841 429 1 924 534 1 845 441 1 817 095 Total imports 1 530 464 1 586 503 405 994 419 342 412 472 374 583 399 327 ¬ Traditional goods (import) 941 065 974 573 256 377 247 505 250 150 234 599 252 009 ¬ Crude oil and natural gas (import) 26 769 22 459 4 256 8 467 5 030 6 310 5 095 ¬ Ships, oil platforms and aircraft (import) 27 710 31 235 5 667 8 483 15 077 5 320 5 905 ¬ Services (import) 534 919 558 235 139 693 154 887 142 215 128 354 136 318 Gross domestic product, market values2 5 737 040 5 857 542 1 447 703 1 422 087 1 512 061 1 470 858 1 417 768 Gross domestic product Mainland Norway, market values2 3 702 837 3 723 855 922 484 915 722 967 785 946 027 927 447 Petroleum activities and ocean transport 2 034 203 2 133 688 525 218 506 365 544 277 524 832 490 321 Gross domestic product Mainland Norway, basic values 3 287 580 3 314 965 817 659 812 291 860 048 850 983 821 394 ¬ Mainland Norway excluding general government (GDP) 2 487 932 2 498 715 613 745 609 193 654 539 645 768 614 946 ¬¬ Manufacturing and mining (GDP) 286 615 291 345 73 172 70 974 75 781 75 940 75 796 ¬¬ Production of other goods (GDP) 537 019 530 874 118 003 132 848 141 667 144 549 118 318 ¬¬ Service activities (GDP) 1 664 298 1 676 497 422 571 405 371 437 091 425 279 420 831 ¬ General government (GDP) 799 648 816 250 203 914 203 097 205 510 205 215 206 448 Taxes and subsidies products 415 256 408 890 104 825 103 431 107 736 95 044 106 053 1Figures from 2023 onwards are preliminary 2Gross domestic product is measured at market prices, while value added by industry is measured at basic prices Explanation of symbolsDownload table as ... - Final expenditure and gross domestic product. Quarter and year. Percentage change in volume from the same period in the previous yearDownload table as ...Final expenditure and gross domestic product. Quarter and year. Percentage change in volume from the same period in the previous year1

2023 2024 2nd quarter 2024 3rd quarter 2024 4th quarter 2024 1st quarter 2025 2nd quarter 2025 Final consumption expenditure of households and NPISHs -1.2 1.4 2.9 2.1 1.8 3.8 1.4 ¬ Household final consumption expenditure -1.4 1.5 2.8 2.2 1.9 3.9 1.6 ¬¬ Goods -5.8 1.2 2.2 1.9 2.1 4.9 4.7 ¬¬ Services 2.2 1.8 3.2 2.3 2.1 3.5 0.6 ¬¬ Direct purchases abroad by resident households 14.3 8.1 5.8 7.6 8.9 6.7 0.8 ¬¬ Direct purchases by non-residents 21.2 14.1 6.0 8.9 32.0 16.1 25.2 ¬ Final consumption expenditure of NPISHs 1.0 -0.3 3.5 0.9 0.0 2.5 -1.7 Final consumption expenditure of general governmen 3.4 2.4 2.4 2.1 2.0 1.9 1.9 ¬ Final consumption expenditure of central government 3.1 2.9 3.3 2.8 2.3 2.5 2.3 ¬¬¬ Central government, civilian 2.8 2.2 2.6 2.1 1.5 1.6 1.3 ¬¬¬ Central government, defence 5.6 7.6 7.8 7.8 7.7 8.8 9.7 ¬ Final consumption expenditure of local government 3.6 1.8 1.5 1.5 1.8 1.3 1.5 Gross fixed capital formation (GFCF) -1.5 -1.4 -1.5 2.1 0.0 0.5 3.6 ¬ Extraction and transport via pipelines (GFCF) 10.2 9.8 15.5 4.5 7.0 5.9 9.9 ¬ Ocean transport (GFCF) -83.2 222.2 63.8 79.4 6 404.8 251.0 113.5 ¬ Mainland Norway (GFCF) -2.6 -4.6 -5.5 0.9 -3.6 -1.0 1.5 ¬¬ Industries (GFCF) 2.9 -2.9 -2.8 2.0 -1.6 3.7 3.5 ¬¬¬ Services activities incidential to extraction (GFCF) 45.5 45.0 25.4 105.0 28.4 0.3 25.3 ¬¬¬ Other services (GFCF) -2.7 -4.9 -7.6 -1.1 1.7 2.1 1.4 ¬¬¬ Manufacturing and mining (GFCF) 18.2 -1.0 1.5 -0.3 -4.7 -4.7 2.7 ¬¬¬ Production of other goods (GFCF) 7.9 -2.6 6.5 4.0 -11.4 17.2 7.5 ¬¬ Dwelling service (households) (GFCF) -18.3 -19.1 -18.2 -17.1 -19.0 -14.6 -5.9 ¬¬ General government (GFCF) 4.1 3.9 0.4 13.6 2.3 1.8 3.1 Acquisitions less disposals of valuables 8.7 6.1 12.5 10.1 5.6 9.8 3.7 Changes in stocks and statistical discrepancies -18.2 -14.6 -75.5 240.7 -20.2 -4.5 .. Gross capital formation -3.7 -2.8 -7.3 10.9 -1.0 -0.6 -3.7 Final domestic use of goods and services -0.8 0.4 0.0 4.5 1.0 2.0 0.2 Final demand from Mainland Norway (excl. changes in stocks) -0.3 0.3 0.9 1.9 0.6 2.3 1.6 Final demand from general government 3.5 2.7 2.0 4.2 2.1 1.9 2.1 Total exports 0.4 5.2 11.3 5.9 1.3 -1.0 -4.6 ¬ Traditional goods (export) 5.3 2.1 4.2 2.2 4.4 6.6 6.5 ¬ Crude oil and natural gas (export) -1.8 6.7 16.9 6.9 -1.2 -4.5 -7.6 ¬ Ships, oil platforms and aircraft (export) -40.6 45.8 61.7 -53.1 280.3 69.2 -11.3 ¬ Services (export) 4.2 3.3 0.2 8.7 5.4 3.0 -5.6 Total use of goods and services -0.3 2.6 4.9 5.1 1.1 0.7 -2.0 Total imports -1.5 4.3 3.3 10.1 6.8 4.7 -1.6 ¬ Traditional goods (import) -6.2 3.8 6.4 10.3 5.1 5.2 -1.7 ¬ Crude oil and natural gas (import) 3.1 -15.0 -21.9 23.3 -22.3 26.0 19.7 ¬ Ships, oil platforms and aircraft (import) -0.3 22.9 -42.7 23.0 151.8 10.0 4.2 ¬ Services (import) 7.7 5.0 2.2 8.4 4.8 2.6 -2.4 Gross domestic product, market values2 0.1 2.1 5.3 3.8 -0.3 -0.3 -2.1 Gross domestic product Mainland Norway, market values2 0.7 0.6 2.7 1.5 0.4 3.1 0.5 Petroleum activities and ocean transport3 -1.0 4.9 10.2 8.0 -1.6 -5.9 -6.6 Gross domestic product Mainland Norway, basic values 1.0 0.8 3.0 1.7 0.7 3.3 0.5 ¬ Mainland Norway excluding general government (GDP) 0.8 0.5 3.3 1.6 0.4 3.8 0.2 ¬¬ Manufacturing and mining (GDP) 0.0 1.6 4.1 3.8 2.5 6.3 3.6 ¬¬ Production of other goods (GDP) -0.3 -1.1 0.7 -0.4 -2.1 4.2 0.3 ¬¬ Service activities (GDP) 1.2 0.7 3.9 1.9 0.9 3.3 -0.4 ¬ General government (GDP) 1.9 1.8 2.1 1.8 1.5 1.7 1.2 Taxes and subsidies products -2.3 -1.3 0.3 0.5 -1.2 1.1 1.2 1Figures from 2023 onwards are prelimanry 2Gross domestic product is measured at market prices, while value added by industry is measured at basic prices. 3Includes oil and gas extraction, transport via pipelines and ocean transport. Explanation of symbolsDownload table as ... - Final expenditure and gross domestic product. Quarter and year. Percentage change in prices from the same period in the previous yearDownload table as ...Final expenditure and gross domestic product. Quarter and year. Percentage change in prices from the same period in the previous year1

2023 2024 2nd quarter 2024 3rd quarter 2024 4th quarter 2024 1st quarter 2025 2nd quarter 2025 Final consumption expenditure of households and NPISHs 6.8 3.2 3.4 2.6 2.0 2.4 2.0 ¬ Household final consumption expenditure 6.9 3.1 3.3 2.6 2.0 2.2 1.9 ¬¬ Goods 5.6 2.0 2.0 1.8 1.2 1.7 1.5 ¬¬ Services 6.4 4.7 4.9 4.4 3.9 3.6 3.5 ¬¬ Direct purchases abroad by resident households 16.9 -0.4 1.2 -2.5 -4.5 -3.5 -3.6 ¬¬ Direct purchases by non-residents 6.9 3.4 4.1 3.0 2.6 3.4 2.1 ¬ Final consumption expenditure of NPISHs 6.2 4.3 5.8 3.6 1.9 4.4 3.7 Final consumption expenditure of general governmen 4.4 3.6 4.3 3.9 1.5 3.3 3.6 ¬ Final consumption expenditure of central government 5.2 3.8 4.9 4.5 1.4 3.4 4.3 ¬¬¬ Central government, civilian 5.1 3.7 4.7 4.6 1.3 3.5 4.3 ¬¬¬ Central government, defence 6.1 4.2 6.0 3.5 1.8 2.5 4.4 ¬ Final consumption expenditure of local government 3.6 3.4 3.7 3.2 1.6 3.2 2.8 Gross fixed capital formation (GFCF) 6.5 4.9 5.3 4.6 4.6 4.8 3.4 ¬ Extraction and transport via pipelines (GFCF) 10.4 6.4 7.0 6.6 5.1 4.3 2.4 ¬ Ocean transport (GFCF) 2.2 14.5 16.4 2.7 8.6 -18.8 -12.0 ¬ Mainland Norway (GFCF) 5.6 4.2 4.5 4.1 4.2 4.9 3.6 ¬¬ Industries (GFCF) 6.2 4.3 4.8 4.0 4.0 4.4 2.7 ¬¬¬ Services activities incidential to extraction (GFCF) 8.7 5.7 5.7 5.7 5.9 3.7 4.2 ¬¬¬ Other services (GFCF) 5.6 4.3 4.7 3.8 4.3 4.5 2.8 ¬¬¬ Manufacturing and mining (GFCF) 7.3 4.0 4.3 3.7 3.4 3.3 2.9 ¬¬¬ Production of other goods (GFCF) 6.8 4.3 5.0 4.2 3.7 5.0 1.8 ¬¬ Dwelling service (households) (GFCF) 4.4 3.9 4.2 4.2 3.8 4.6 4.4 ¬¬ General government (GFCF) 5.6 4.2 4.0 4.1 4.5 5.8 4.7 Acquisitions less disposals of valuables 9.8 8.4 8.7 8.2 8.1 3.6 3.2 Changes in stocks and statistical discrepancies 0.9 -1.7 11.8 3.3 -3.1 16.7 -63.1 Gross capital formation 5.9 4.3 5.9 4.1 4.4 7.1 7.1 Final domestic use of goods and services 5.9 3.6 4.3 3.4 2.5 4.0 3.7 Final demand from Mainland Norway (excl. changes in stocks) 5.9 3.5 3.9 3.3 2.4 3.1 2.8 Final demand from general government 4.6 3.7 4.3 3.9 2.2 3.7 3.8 Total exports -23.5 -4.1 -1.3 -2.4 1.9 17.2 -2.0 ¬ Traditional goods (export) 0.0 -1.5 -2.7 0.1 0.2 4.5 -1.0 ¬ Crude oil and natural gas (export) -39.3 -8.8 -1.5 -4.6 -0.1 27.2 -9.1 ¬ Ships, oil platforms and aircraft (export) 16.1 -1.3 0.7 13.9 -15.9 19.5 12.6 ¬ Services (export) 4.6 5.0 9.1 -0.4 4.2 5.2 5.2 Total use of goods and services -7.0 0.4 1.3 1.1 2.3 8.8 2.2 Total imports 8.2 2.0 2.4 1.2 2.0 4.3 0.7 ¬ Traditional goods (import) 5.5 0.7 0.6 1.1 1.2 5.1 0.4 ¬ Crude oil and natural gas (import) -1.0 -8.0 -9.5 -7.5 -13.4 -3.0 -16.0 ¬ Ships, oil platforms and aircraft (import) 12.6 7.3 9.2 5.7 9.5 19.0 7.7 ¬ Services (import) 13.2 4.0 5.7 1.6 2.7 3.1 1.4 Gross domestic product, market values2 -11.1 -0.2 1.0 0.8 2.1 9.9 2.7 Gross domestic product Mainland Norway, market values2 4.7 3.8 4.0 4.0 2.8 3.3 3.3 Petroleum activities and ocean transport3 -39.9 -10.6 -4.9 -6.2 -1.1 28.2 -5.0 Gross domestic product Mainland Norway, basic values 4.2 3.5 3.7 3.8 2.4 3.4 3.5 ¬ Mainland Norway excluding general government (GDP) 3.9 3.1 3.1 3.5 2.5 3.2 3.0 ¬¬ Manufacturing and mining (GDP) 10.1 2.1 1.8 0.6 4.6 6.3 8.5 ¬¬ Production of other goods (GDP) -9.4 -2.8 -4.9 1.5 -3.6 -0.5 -0.4 ¬¬ Service activities (GDP) 7.1 4.8 5.2 4.3 3.7 3.7 2.7 ¬ General government (GDP) 5.2 4.8 5.5 5.0 2.1 4.1 4.9 Taxes and subsidies products 9.3 6.3 6.3 4.8 5.2 2.7 1.8 1Figures from 2023 onwards are prelimanry 2Gross domestic product is measured at market prices, while value added by industry is measured at basic prices. 3Includes oil and gas extraction, transport via pipelines and ocean transport. Explanation of symbolsDownload table as ... - Final expenditure and gross domestic product. Quarter and year. Seasonally adjusted figures. At current prices. NOK millionDownload table as ...Final expenditure and gross domestic product. Quarter and year. Seasonally adjusted figures. At current prices. NOK million1

2023 2024 2nd quarter 2024 3rd quarter 2024 4th quarter 2024 1st quarter 2025 2nd quarter 2025 Final consumption expenditure of households and NPISHs 1 959 015 2 050 693 515 354 515 484 519 350 532 721 535 731 ¬ Household final consumption expenditure 1 841 203 1 928 115 484 669 484 400 488 363 501 035 503 705 ¬¬ Goods 833 641 860 429 218 153 214 029 219 794 226 822 231 805 ¬¬ Services 915 126 975 536 242 194 247 017 249 657 252 985 254 592 ¬¬ Direct purchases abroad by resident households 163 564 176 096 44 027 44 121 44 622 45 443 42 211 ¬¬ Direct purchases by non-residents -71 128 -83 947 -19 705 -20 767 -25 709 -24 215 -24 904 ¬ Final consumption expenditure of NPISHs 117 812 122 579 30 685 31 085 30 987 31 686 32 026 Final consumption expenditure of general governmen 1 116 464 1 183 912 293 950 298 696 300 249 306 395 310 414 ¬ Final consumption expenditure of central government 564 296 602 559 150 096 152 110 152 620 156 618 160 205 ¬¬¬ Central government, civilian 493 702 523 428 130 437 132 067 132 355 135 235 137 726 ¬¬¬ Central government, defence 70 594 79 132 19 659 20 043 20 266 21 383 22 479 ¬ Final consumption expenditure of local government 552 168 581 353 143 854 146 586 147 628 149 777 150 209 Gross fixed capital formation (GFCF) 1 104 630 1 142 620 281 945 288 516 299 977 285 837 301 782 ¬ Extraction and transport via pipelines (GFCF) 216 933 253 361 63 666 63 273 69 240 62 975 71 708 ¬ Ocean transport (GFCF) 2 478 9 147 866 2 647 5 513 328 1 640 ¬ Mainland Norway (GFCF) 885 219 880 112 217 413 222 596 225 225 222 534 228 434 ¬¬ Industries (GFCF) 418 820 424 224 106 179 106 554 109 619 110 045 112 807 ¬¬¬ Services activities incidential to extraction (GFCF) 8 022 12 293 2 740 3 879 3 221 2 549 3 602 ¬¬¬ Other services (GFCF) 260 036 257 903 63 871 63 796 68 239 66 167 66 594 ¬¬¬ Manufacturing and mining (GFCF) 67 331 69 317 17 268 17 017 17 784 16 984 18 237 ¬¬¬ Production of other goods (GFCF) 83 432 84 710 22 301 21 861 20 375 24 345 24 374 ¬¬ Dwelling service (households) (GFCF) 202 535 170 209 43 415 41 832 39 572 40 607 42 557 ¬¬ General government (GFCF) 263 864 285 678 67 819 74 210 76 034 71 882 73 070 Acquisitions less disposals of valuables 686 789 202 195 210 208 216 Changes in stocks and statistical discrepancies 132 045 110 818 12 093 50 528 13 856 25 900 11 823 Gross capital formation 1 237 361 1 254 227 294 240 339 240 314 043 311 945 313 821 Final domestic use of goods and services 4 312 840 4 488 832 1 103 545 1 153 420 1 133 641 1 151 060 1 159 967 Final demand from Mainland Norway (excl. changes in stocks) 3 960 698 4 114 717 1 026 718 1 036 776 1 044 823 1 061 650 1 074 580 Final demand from general government 1 380 328 1 469 590 361 769 372 906 376 282 378 277 383 484 Total exports 2 444 264 2 467 957 658 195 589 920 636 672 674 916 618 603 ¬ Traditional goods (export) 665 296 669 190 167 487 166 261 173 896 176 911 178 725 ¬ Crude oil and natural gas (export) 1 201 777 1 169 313 333 357 267 103 295 859 331 382 283 815 ¬ Ships, oil platforms and aircraft (export) 8 281 11 909 2 999 2 224 3 761 5 914 2 995 ¬ Services (export) 568 910 617 545 154 352 154 332 163 155 160 709 153 069 Total use of goods and services 6 757 104 6 956 790 1 761 740 1 743 340 1 770 313 1 825 976 1 778 570 Total imports 1 655 545 1 760 184 441 245 447 352 456 970 447 995 439 652 ¬ Traditional goods (import) 992 407 1 037 151 264 814 263 263 263 352 266 824 264 719 ¬ Crude oil and natural gas (import) 26 515 20 744 5 406 6 817 4 225 5 297 5 145 ¬ Ships, oil platforms and aircraft (import) 31 211 41 163 6 950 9 835 18 972 7 078 7 800 ¬ Services (import) 605 413 661 126 164 075 167 437 170 421 168 797 161 988 Gross domestic product, market values 5 101 559 5 196 606 1 320 495 1 295 988 1 313 343 1 377 981 1 338 918 Gross domestic product Mainland Norway, market values 3 878 698 4 050 136 1 007 090 1 021 935 1 025 721 1 050 432 1 061 557 Petroleum activities and ocean transport2 1 222 861 1 146 470 313 405 274 053 287 622 327 549 277 361 Gross domestic product Mainland Norway, basic values 3 424 887 3 574 017 888 380 902 616 904 688 928 851 938 851 ¬ Mainland Norway excluding general government (GDP) 2 583 888 2 676 525 665 598 676 012 677 000 695 507 702 347 ¬¬ Manufacturing and mining (GDP) 315 547 327 344 80 803 84 597 84 899 87 722 93 479 ¬¬ Production of other goods (GDP) 486 674 468 188 115 770 115 534 114 449 123 288 118 790 ¬¬ Service activities (GDP) 1 781 667 1 880 994 469 025 475 880 477 653 484 497 490 078 ¬ General government (GDP) 841 000 897 492 222 782 226 605 227 687 233 345 236 504 Taxes and subsidies products 453 811 476 119 118 710 119 318 121 034 121 581 122 706 1Figures from 2023 onwards are prelimanry 2Includes oil and gas extraction, transport via pipelines and ocean transport. Errors in seasonally adjusted figures were corrected on 29 November 2024, at 11:35 a.m Explanation of symbolsDownload table as ... - Final expenditure and gross domestic product. Quarter and year. Seasonally adjusted figures. Percentage change in volume from the previous period.Download table as ...Final expenditure and gross domestic product. Quarter and year. Seasonally adjusted figures. Percentage change in volume from the previous period.1

2023 2024 2nd quarter 2024 3rd quarter 2024 4th quarter 2024 1st quarter 2025 2nd quarter 2025 Final consumption expenditure of households and NPISHs -1.2 1.4 2.4 0.2 -0.2 1.7 0.2 ¬ Household final consumption expenditure -1.4 1.5 2.6 0.1 -0.2 1.9 0.2 ¬¬ Goods -5.8 1.2 4.2 -1.2 1.3 2.6 1.9 ¬¬ Services 2.2 1.8 0.5 1.5 -0.1 0.5 -0.1 ¬¬ Direct purchases abroad by resident households 14.3 8.1 3.9 2.1 1.6 2.1 -6.2 ¬¬ Direct purchases by non-residents 21.2 14.1 -2.3 5.6 20.2 -5.0 2.7 ¬ Final consumption expenditure of NPISHs 1.0 -0.3 -0.2 1.7 -0.8 -0.7 0.7 Final consumption expenditure of general governmen 3.4 2.4 0.4 0.6 0.5 0.3 0.5 ¬ Final consumption expenditure of central government 3.1 2.9 0.7 0.4 0.6 0.8 0.5 ¬¬¬ Central government, civilian 2.8 2.2 0.5 0.1 0.5 0.5 0.2 ¬¬¬ Central government, defence 5.6 7.6 2.0 2.3 1.6 2.6 2.7 ¬ Final consumption expenditure of local government 3.6 1.8 0.2 0.8 0.4 -0.1 0.4 Gross fixed capital formation (GFCF) -1.5 -1.4 1.6 2.6 1.8 -5.2 4.6 ¬ Extraction and transport via pipelines (GFCF) 10.2 9.8 7.9 0.6 6.7 -8.7 12.1 ¬ Ocean transport (GFCF) -83.2 222.2 637.7 287.5 89.4 -94.0 393.2 ¬ Mainland Norway (GFCF) -2.6 -4.6 -0.2 2.2 -0.6 -2.2 2.1 ¬¬ Industries (GFCF) 2.9 -2.9 2.4 0.4 1.6 -0.7 2.2 ¬¬¬ Services activities incidential to extraction (GFCF) 45.5 45.0 9.9 46.9 -21.2 -20.1 37.7 ¬¬¬ Other services (GFCF) -2.7 -4.9 1.4 0.0 5.6 -4.5 0.6 ¬¬¬ Manufacturing and mining (GFCF) 18.2 -1.0 -1.5 -1.9 3.2 -4.2 5.9 ¬¬¬ Production of other goods (GFCF) 7.9 -2.6 7.7 -2.3 -7.7 18.5 0.4 ¬¬ Dwelling service (households) (GFCF) -18.3 -19.1 -5.5 -4.2 -6.3 0.7 4.0 ¬¬ General government (GFCF) 4.1 3.9 -0.5 9.1 -0.3 -5.8 0.7 Acquisitions less disposals of valuables 8.7 6.1 10.4 -5.0 6.9 -1.6 3.6 Changes in stocks and statistical discrepancies -18.2 -14.6 -39.8 25.5 -58.3 100.3 -41.2 Gross capital formation -3.7 -2.8 -4.3 4.6 -4.7 -0.2 0.3 Final domestic use of goods and services -0.8 0.4 0.0 1.5 -1.3 0.8 0.3 Final demand from Mainland Norway (excl. changes in stocks) -0.3 0.3 1.3 0.8 -0.1 0.5 0.7 Final demand from general government 3.5 2.7 0.3 2.2 0.4 -0.9 0.5 Total exports 0.4 5.2 4.7 -2.8 -0.1 -2.2 0.8 ¬ Traditional goods (export) 5.3 2.1 3.2 -0.7 3.1 -0.3 4.2 ¬ Crude oil and natural gas (export) -1.8 6.7 6.0 -5.3 -1.3 -2.7 2.1 ¬ Ships, oil platforms and aircraft (export) -40.6 45.8 -5.4 -29.6 71.8 47.9 -50.4 ¬ Services (export) 4.2 3.3 2.0 5.4 -0.3 -3.6 -6.4 Total use of goods and services -0.3 2.6 2.1 -0.4 -0.8 -0.5 0.5 Total imports -1.5 4.3 3.9 3.0 -0.4 -2.6 -0.6 ¬ Traditional goods (import) -6.2 3.8 4.4 1.0 -2.0 0.0 1.2 ¬ Crude oil and natural gas (import) 3.1 -15.0 26.7 23.9 -34.0 26.1 3.9 ¬ Ships, oil platforms and aircraft (import) -0.3 22.9 17.2 49.7 77.7 -64.7 11.0 ¬ Services (import) 7.7 5.0 1.9 3.8 -0.4 -1.4 -4.5 Gross domestic product, market values2 0.1 2.1 1.6 -1.4 -0.9 0.1 0.8 Gross domestic product Mainland Norway, market values2 0.7 0.6 0.3 0.7 -0.4 1.2 0.6 Petroleum activities and ocean transport3 -1.0 4.9 3.9 -4.8 -1.6 -2.0 1.4 Gross domestic product Mainland Norway, basic values 1.0 0.8 0.2 0.7 -0.2 1.1 0.4 ¬ Mainland Norway excluding general government (GDP) 0.8 0.5 0.1 0.9 -0.5 1.3 0.5 ¬¬ Manufacturing and mining (GDP) 0.0 1.6 -0.2 2.8 -0.2 1.4 2.4 ¬¬ Production of other goods (GDP) -0.3 -1.1 -0.1 1.6 -2.2 3.6 -0.9 ¬¬ Service activities (GDP) 1.2 0.7 0.3 0.4 0.0 0.6 0.6 ¬ General government (GDP) 1.9 1.8 0.5 0.0 0.5 0.6 0.2 Taxes and subsidies products -2.3 -1.3 1.2 0.7 -2.2 1.5 1.7 1Figures from 2023 onwards are prelimanry 2Gross domestic product is measured at market prices, while value added by industry is measured at basic prices. 3Includes oil and gas extraction, transport via pipelines and ocean transport. Errors in seasonally adjusted figures were corrected on 29 November 2024, at 11:35 a.m Explanation of symbolsDownload table as ...

About the statistics

The information under «About the statistics» was last updated 23 February 2023.

See Concepts and definitions in national accounts for explanations.

Valuation

Registration of values: A transaction may be registered at different values, depending on under which circumstances it is registered. Different concepts regarding valuation are also relevant for the general aspect of registration (cf. cash values or accruals values, and other principles for the recording of statistical data). The transactions of variables in the national accounts follow the accrual principle. Thus, taxes and subsidies on production should be registered as accrued values and not as cash values as recorded in the government accounts.

In the description of the transaction of goods and services several price concepts are used. Output is valued at basic prices. Basic price is the price the seller receives, after corresponding taxes on the product are deducted (and subsidies added). The use categories, both intermediate consumption and final use, are valued at purchaser prices, that is the price the purchaser must pay. Exports are valued at fob (free on board), while imports are valued at cif (cost-insurance-freight).

The value added of an industry is "valued" at basic prices (calculated as output at basic prices less intermediate consumption at purchaser prices). The total value added of all the industries is also "valued" at basic prices.

GDP is "valued" at market prices, which means that taxes on products, including VAT, less subsidies on products are added to the total value added of the industries at basic prices.

The accounting system of the Norwegian national accounts is based on the international standards for national accounts, i.e. 2008 SNA and ESA 2010. The accounting system outlines the framework and contents for production of national accounts statistics. The level of detail in the classifications used for compilation of quarterly and preliminary annual national accounts are more aggregated than in that used for calculation of the annual national accounts.

In addition to accounting structure, the international standards give recommendations of groupings or classifications to be used in the national accounts:

Activity classification

The classification of Industries in the National Accounts follows the Norwegian Standard Industrial Classification (SN2007), which is based on NACE Rev.2. Several levels of aggregation have been introduced for publication and reporting purposes.

Classification of non-financial assets and gross fixed capital formation

Non-financial assets are classified by type of aggregates defined in 2008 SNA, such as fixed assets, inventories, valuables, and non-produced assets, including both tangible assets such as land, subsoil-assets, water resources etc., and intangible assets such as transferable contracts etc. Gross fixed capital formation is grouped by main type within building and construction, machinery and equipment and transportation equipment.

Product classification

The product classification used in the national accounts is based on the EU's standard product classification CPA - Statistical Classification of Products by Activity in the European Community. The CPA groups products by activities, i.e. it defines characteristic products within each activity and connects them to the activity classification NACE Rev.2. The annual accounts supply and use tables contain about 700 products, in addition to which some products are also incorporated purely for technical reasons. The system to elaborate preliminary annual and quarterly accounts contains about 90 products. The separation on products might to large extent be considered as a tool to balance the national account system and to undertake calculations in constants prices.

Classification of individual consumption by purpose

The classification of Consumption expenditure groups in the National Accounts is based on the international classification COICOP - Classification of Individual Consumption by Purpose, published by the UN.

Classification of the functions of government

The classification of the functions of government by purpose applies to all types of general government expenses, such as government final consumption expenditure, gross fixed capital formation, subsidies, property rents (i.e. expenses), capital transfers and other transfers for use in government financial accounts and in the national accounts. This classification is based on the international classification COFOG - Classification of the Functions of Government, published by the UN.

Classification of the purpose of non-profit institutions serving households (NPISH)

This is a minor purpose classification which applies to expenses of NPISHs. It is based on the international classification COPNI - Classification of the Purposes of the Non-Profit Institutions Serving Households, published by the UN.

Name: National accounts

Topic: National accounts and business cycles

Division for National Accounts

National level

The monthly national accounts (MNA) are published about 40 days after the end of the given month.

The quarterly national accounts (QNA) are published about 40 days after the end of the given quarter. Quarterly figures are calculated as the sum of three months (from monthly national accounts).

The first estimates of the preliminary year is published about 40 days after the end of the year.

Published figures are reported to Eurostat, the International Monetary Fund (IMF) and the Organisation for Economic Co-operation and Development (OECD).

Not relevant

The national accounts (NA) statistics are designed to provide a consistent and comprehensive survey of the overall national economy. The national accounts give both a summarised description of the economy as a whole and a detailed description of transactions between different parts of the Norwegian economy, and between Norway and the rest of the world. The national accounts also provide information on capital stocks and employment.

The first Norwegian national accounts based on modern principles were published by Statistics Norway in 1952. Annual series national accounts were calculated back to 1865 during the 1950th.

Final annual national accounts figures are based on all available final economic statistics and therefore take time to produce. The purpose of the quarterly national accounts is to provide updated information about short-term developments in the Norwegian economy based on an overall, consistent accounting system. Statistics Norway has produced and released quarterly national accounts (QNA) on a regular basis from 1953 but were not published at fixed intervals from the 1970s to the beginning of the 1980s. A new model for a QNA system was developed at the beginning of the 1980s and has been used since 1985, with some modifications.

National accounts are used as a tool to compare the economic situation in different countries, and therefore it is important that the national accounts in various countries are based on a common template. Staff involved in elaborating national accounts in Statistics Norway participated actively in developing international recommendations and concepts regarding national accounts. The first international standard for national accounts, 1953 System of National Accounts (1953 SNA), was published by UN in 1953.

From time to time adaptations or changes are made to the common international recommendations for national accounts. This requires corresponding changes in the construction of the Norwegian national accounts. At different time intervals, new source statistics are produced and indicate that parts of the national accounts figures need to be revised. Since one objective of the national accounts is to provide a picture of the development over time which is as correct as possible, it is not possible to introduce such changes from one year to another. With different time intervals, it will therefore be necessary to carry out major revisions of the national accounts figures, so-called main revisions, in order to introduce adaptations due to new international recommendations or introduce new levels based on new statistical sources. As part of these main revisions the time series are also revised so that the revised national accounts can give a consistent picture of the economic development over time.

In recent decades, Statistics Norway has carried out main revisions published in 1995, 2002, 2006, 2011 and 2014. The main purpose of main revision published in November 2014, was to incorporate updated international recommendations in 2008 SNA andESA 2010. Changes due to this main revision are described, among else, in the article Main revision 2014. Planned changes in the national accounts statistics. The publication History of national accounts in Norway. From free research to statistics regulated by law also provides more information about the history of national accounts in Norway, including main revisions. In the future main revisions of the national accounts normally will be carried out every five years.

Since the QNA are completely harmonised with the annual national accounts, it is also necessary to revise the QNA figures once the annual national accounts figures have been revised.

The quarterly figures are mostly used for observation and analysis of the current economic cycle. The QNA figures also serve as a basis for making forecasts of the future economic development, the government’s work with the national budget and other economic planning. In addition, the QNA contribute with material for research and development. Annual and quarterly national accounts are a useful tool for analyses of the economic development and structures in Norway. The national accounts are also used to compare the economy in different countries.

The annual and quarterly national accounts therefore have a wide group of users, from school pupils and students to public and private institutions that actively use the statistics in their analyses and investigation of economic structure and development. Active users include the Research Department in Statistics Norway, the Ministry of Finance, Norges Bank, international organisations such as the IMF, the OECD, the World Bank, the UN and Eurostat, resident and non-resident financial sector analysts, and the media.

No external users have access to the statistics and analyses before they are published and accessible simultaneously for all users on ssb.no at 08.00 am. Prior to this, a minimum of three months' advance notice is given in the Statistics Release Calendar. This is one of Statistics Norway’s key principles for ensuring that all users are treated equally.

The monthly figures are the basis for quarterly figures, quarterly figures are calculated as the sum of three months. Quarterly figures will be updated when publishing the third month in the quarter. This means that there may be deviations between the monthly and quarterly figures in the two months before the new quarter is calculated. The deviations will mainly apply to seasonally adjusted figures. In addition, the monthly publication includes a table showing rolling numbers for three and three months. The three-month growth is calculated by comparing a three-month period with the previous three-month period. For example, the volume change in the rolling table for July is given by comparing the period May-July with February-April. Figures for March, June, September and December will correspond to growth for a quarter.

All historical figures are consistent with both preliminary and final annual national accounts figures in fixed and current prices

The Norwegian Balance of Payments (BOP) is an integrated part of the Norwegian system of national accounts, and the BOP figures are fully consistent with other preliminary and final quarterly and annual national accounts figures. Furthermore, quarterly and annual national accounts figures are fully consistent and compatible with the institutional sector accounts. The regional national accounts, and various satellite accounts (environment, tourism, health, non-profit institutions, education) are consistent with the above mentioned national accounts statistics. Previous published figures from the regional accounts and various satellite accounts are, however, not revised as a part of main revision of the national accounts, so figures for previous years may not necessarily be compatible with updated NA time series.

As mentioned in the chapter "Production: Data sources and sampling", the national accounts are based on various statistical sources. The source statistics may not use the same definitions or groupings as used in the national accounts. As a result, figures in the source statistics may be adapted or corrected before being used in the national accounts. Published figures in the source statistics of certain industries may therefore not correspond to published figures in the national accounts.

Not relevant

Regulation (EU) No 549/2013 (ESA 2010).

The European Parliament and of the council of 21 May 2013 on the European system of national and regional accounts in the European Union (text with EEA relevance).

The coverage of the national accounts is defined by international guidelines in the 2008 System of National Accounts (2008 SNA), published by the UN, the OECD, the IMF, the World Bank, and the Commission of the European Communities, and theEuropean System of National and Regional Accounts (ESA 2010).

The total national economy, and the distinction between the national economy and foreign countries, is defined in terms of resident units. A unit is defined as a resident unit of the country when it has a centre of economic interest in the economic territory of the country - i.e. when it is involved in economic activities on this territory for an extended period of time (one year or more).

Two basic types of information are recorded in the national accounts: flows and stocks. Flows refer to actions and effects of events that take place within a given period of time, for example the output of an industry in one year. Stocks refer to positions at a certain point of time, for example the value of capital stock or the number of employed persons.

The national accounts consist of two main sets of tables; supply and use tables (SUT), also described as the real accounts, and the institutional sector accounts. The real accounts are based on local kind-of-activity units (KAUs), while the institutional sector accounts are based on institutional units. Institutional units are economic entities that are capable of owning goods and assets, of incurring liabilities and of engaging in economic activities and transactions with other units in their own right. An institutional unit contains one or more local kind-of-activity units (local KAUs). The local KAUs are classified by type of activity. An activity is characterised by an input of products, a production process and an output of products. All local KAUs engaged in the same or similar kind-of-activity constitute an industry.

The SUT at current and constant prices gives a structured overview of the supply (output and import) and use (final consumption, gross fixed capital formation, changes in inventories, export and intermediate consumption) of products (goods and services) in the economy. For each industry the value added is calculated as the difference between output and intermediate consumption. The value added in an industry can also be decomposed into compensation of employees, consumption of fixed capital, other taxes on production (net of subsidies) and operating surplus. The real accounts also give information on fixed assets, as well as wages, hours worked, full-time equivalent persons and employed persons by industry. Monthly national accounts does not include figures for employment etc..

Furthermore, the real accounts provide the basis for the calculation of the Gross Domestic Product (GDP) and other central macroeconomic measures. The annual growth in volume and price are calculated for most variables.

The non-financial sector accounts are based on institutional units. Institutional units are capable of providing a full set of accounts. The non-financial sector accounts describe all economic transactions in the various sectors. The accounts also provide information on the stocks financial and non-financial capital. Financial sector accounts are also based on institutional units. The institutional units are grouped in institutional sectors on the basis of their principal economic functions, behavior and objectives. The non-financial sector accounts are consistent with the real accounts. The further description of the national accounts covers the part of the national accounts that is based on the annual SUT (the real accounts).

The coverage of the preliminary annual and quarterly real accounts is the same as the final annual SUT

The accounting structure in the system that produces monthly, quarterly and preliminary annual figures (MNA) is, however, more aggregated than in the system that produces the final annual SUT. While the SUT in the annual accounts consists of about 130 industry groups and 700 product groups, the SUT in the MNA consists of about 80 industry groups and 120 product groups. The MNA and QNA system produces tables with seasonal adjusted figures for industries' value added, household consumption for aggregated consumption groups and for central macroeconomic measures. However, only tables for final expenditure and gross domestic product are published on a monthly basis, while the QNA contain more details.

The calculations of the annual real accounts are based on statistics from several different sources, such as the structural business statistics for manufacturing and other industries, accounting statistics for general government and enterprises, statistics for wages and earnings, external trade statistics, household consumer surveys and employment statistics. Some parts of the national accounts are compiled more or less directly from the source statistics, while other parts are based on calculations and estimates.

Monthly information is used for compiling monthly national accounts, such as the production index of industrial production, the index for retail sales, consumer price index, building statistics, producer price indices and much more. For some service industries where we lack explicit production indicators, monthly information about jobs, working days and absence is obtained from the A-ordning. For investments where we only have quarterly information, such as oil investments, quarterly figures are conventionally distributed by month. In the months before we get the so-called oil census, the development is used in the planned investment figures reported together with those performed for a quarter. In connection with the work on the QNA, quarterly information is incorporated and an update of the previous months is made. Quarterly national accounts will appear as the sum of the three months in the quarter.

The source statistics used to calculate national accounts are with a few exceptions produced by Statistics Norway.

Having the reporting responsibility to Eurostat, the Division for National Accounts occasionally documents the calculations for the final annual national accounts, see Norwegian National Accounts - GNI Inventory for ESA95.

In addition, there are a number of reports giving more detailed documentation of calculation of figures for various specific industry groups or other parts of the national accounts (mostly in Norwegian only).

The documentation report for the Quarterly national accounts gives an overview of central sources and methods used for quarterly accounts compilation. This will be updated in the autumn of 2018 to include monthly national accounts.

Compilation of the final annual real accounts

The annual national accounts are mainly based on statistics collected by other divisions in Statistics Norway. To some extent data produced by external suppliers are also used.

The process of compiling the final annual national accounts starts with the calculation of independent supply and use estimates for all goods and services at current prices. To some extent, source data are extracted directly from the databases and converted into national accounts codes and format. Other parts of the economy are based on more complex calculations, by means of different statistical sources and/or assessments.

The source data are critically evaluated and compared with alternative sources (for some parts of the economy). In some areas, the statistics have to be adjusted in order to satisfy the requirements of the national accounts. In areas where the statistics are incomplete, evaluations are essential. In the process of estimating national accounts data, estimated national accounts figures are critically evaluated and controlled in several steps.

Finally, supply and use for each of these goods and services are balanced using supplementary information and quality assessments of the various statistical sources. This results in integrated supply and use tables at current prices.

The figure below gives an outline of the calculation system for final annual national accounts figures. First, detailed figures are calculated and balanced in current prices. Then the system calculates figures in constant prices, based on the detailed current price figures and corresponding price indices. The deflation (current values being divided by price indices) takes place at the most detailed product level: A price index is allocated to each detailed product. The individual products are as price homogeneous as possible. Constant price figures in the annual national accounts are calculated using the price level of the previous year, which means that the base year is changed every

year.

The deflation approach has in fact two dimensions, (i) differentiated by main categories of supply and use (deflating output, imports, exports and implicitly for domestic use), and (ii) differentiated through valuation (deflating current values at basic prices by price indices and implicitly determining the other value components, including adjustments against values at purchaser prices). The method used to calculate constant figures is called double deflation, i.e. a separate deflation of output and intermediate consumption is carried out in order to arrive at value added at constant prices as a balancing item, based on a detailed input-output framework (supply and use tables).

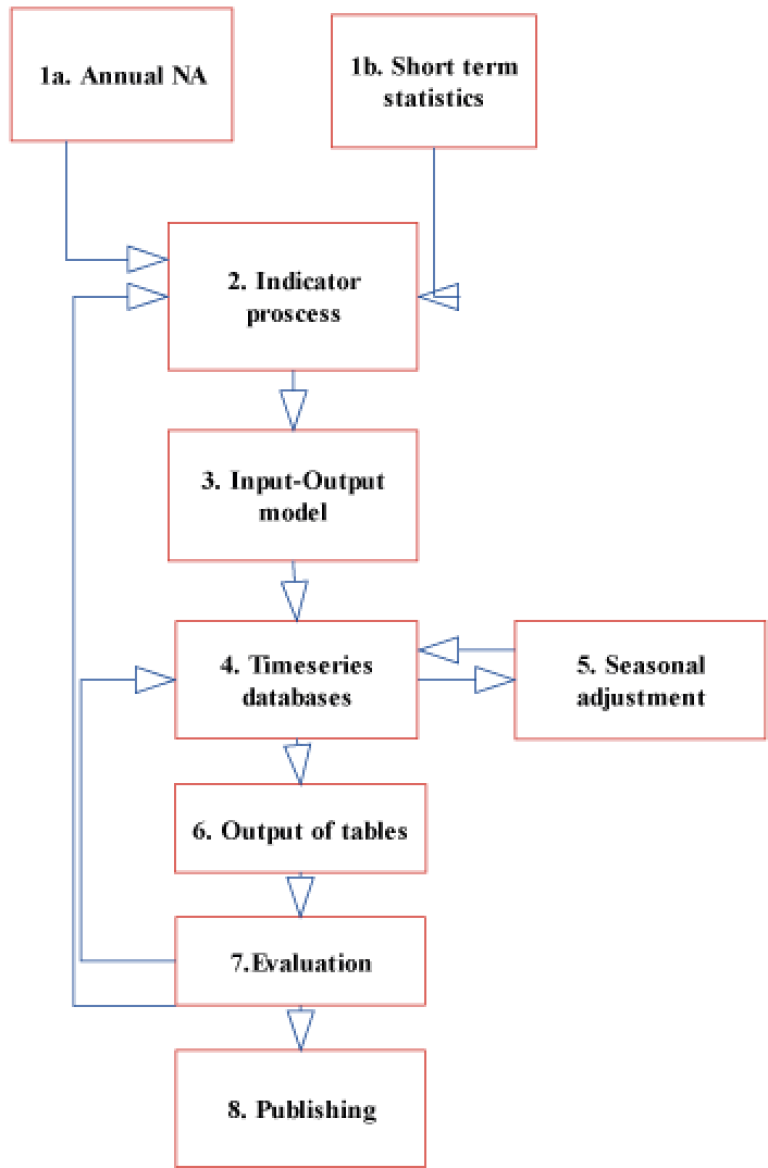

Figure 1. The calculation system for final annual NA figures (Click)

For a more detailed documentation, see Norwegian National Accounts - GNI Inventory for ESA95.

Compilation of the MNA and QNA

The majority of the short-term statistics produced by Statistics Norway are transferred to the MNA system by use of a direct link to the relevant databases. The information in the data sources about growth is used more or less directly in the MNA system. Some other input data series in the MNA system, however, are based more or less on calculations and estimations, using various types of information from Statistics Norway and other sources. Quarterly figures are calculated as the sum of three months

The national accounts data for a specific month, quarter or year are revised in accordance with an ordinary publication and revision cycle. The quarterly figures within a specific year t become final 21 months later after the end of the year t. In addition, periodical main revisions generate revised figures.

In the process of calculating MNA or QNA figures for a specific month or quarter, the short-term statistics source data are critically evaluated and compared with alternative sources (for some parts of the economy). In some cases, the information in the source statistics must be adjusted in order to satisfy the requirements of the quarterly national accounts. In the process to estimate MNA data estimated MNA figures are critically evaluated and controlled in many steps.

Monthly process

The figure below gives an overview of the Norwegian MNA and QNA estimation process. The figure shows that the MNA system is based on two main pillars: a) The SUT for the (final) annual national accounts and b) short-term statistics.

Figure 2. The computing system in the Norwegian MNA/QNA

The main principle in the MNA system is that the national accounts figures for the current quarter are computed based on the development of short-term indicators and the current-price figures from the base year. The base year (t-2) is the latest calculated final version of the annual national accounts. The method is the same for most common variables: The value in the base year is given the same growth rate (percentage change) as in the appropriate indicator, or a grouping of different relevant indicators.

A simple projection method, based on the development in previous periods, is used if an indicator does not cover the whole period from the base year to the current quarter.

The indicator compilations are made in the indicator process (box 2 in the figure).

However, the indicator process alone does not give a complete harmonised account at current and constant prices. To calculate values for variables that are not calculated in the indicator compilations, and to harmonise the accounts, we use an input-output model (box 3 in the figure).

The input-output model includes a commodity-flow balance, a price input-output system and a set of equations for summaries and definitions. It now comprises over 12 000 equations in total. The input-output coefficients are calculated from the SUT in the base year. The variables calculated in the indicator compilations are transferred to the input-output model as exogenous variables. To calculate balanced accounts at current prices we need price indices on all supply and use categories. These are computed in the model by weighting together product price indices with the input-output coefficients as weights. Each product gets three different price indices, one for resident output delivered to the home market (to resident users), a second for import and a third for export.

The price index for an industry’s total output is then calculated as a weighted average of the price indices for the home and export market using the input-output coefficients as weights. The price indices of intermediate consumption, final consumption expenditure and gross fixed capital formation are calculated in a similar way, using the import and home market price indices and the input-output coefficients.

The model also calculates variables which are not covered by short-term statistics or other information and therefore not calculated in the indicator process. These calculations are based on simple assumptions. For instance, intermediate consumption for most industries at constant prices (the total except FISIM) is assumed to be a fixed proportion of total output for the relevant industry. The distribution of intermediate consumption (except FISIM) on different products at constant prices is also assumed to be the same as in the base year. The industries’ use of FISIM as intermediate consumption is supposed to equal the growth in total output of FISIM services. Output in the retail and wholesale trade activities in constant prices is assumed to follow the development of the use of the various goods in constant prices, such as household consumption, intermediate consumption and gross fixed capital formation of the various specific goods (that means supposed fixed margins).

Changes in stock of separate products are (for most products) calculated as the difference between the total supply and use of the product. As in the annual NA, the changes in stock may be adjusted if that seems reasonable after an evaluation of the figures.

The results are stored in the time series database (box 4 in the figure), which, among other things, provides the basis for different sets of tables (box 6). At the moment there are two different sets of tables (with seasonal unadjusted figures), sets for internal checks and analyses of data and more aggregated sets of data for publishing.

Process 1-4 describes how the quarterly seasonally unadjusted figures are estimated. The unadjusted figures are seasonally adjusted (box 5) using a seasonal adjustment program.

The method adopted to compile the MNA is highly mechanical. This applies to the update of variables in the national accounts based on short-term statistics as well as the balancing of commodities, the computation of indirect taxes and factor incomes and the overall balancing of the GDP and main aggregates. Technically, the data systems are programmed in FAME and TROLL (the latter is used for the input-output model only).

Checks and/or the evaluation of data are, however, performed in several steps. The MNA system offers a unique opportunity to compare different types of input data. The evaluation of the different sources is done in close contact with the relevant statistics divisions in Statistics Norway. A more thorough evaluation is being done when processing and publishing quarterly figures, while the monthly process is more automated and less profound. Therefore, only final expenditure and gross domestic product are published on a monthly basis while the quarterly accounts offer more details.

Quarterly figures are calculated as the total of three months at quarterly releases. Quarterly figures will be updated only when publishing the third month in the quarter. This means that there may be a mismatch between the monthly and quarterly figures in the interim months. This applies mainly to seasonally adjusted numbers. That is, when you get a new observation (new month), it will normally affect the seasonally adjusted figures back in time. We do not update the QNA numbers that have also been sent to international organizations before the next quarters release. At the same time, we show figures for three-month growth. This is calculated by comparing a three-month period with the previous three-month period. For example, the volume change in July is given by comparing the period May-July with February-April. Figures for March, June, September and December will correspond to growth for a quarter. This means that users may get a continuous update of the quarterly figures by looking at the monthly publication.

Annual process and alignment

The MNA system is updated with a new base year every year (i.e. the latest final version of the annual accounts). The database for the annual accounts (box 1a), as well as the base data and coefficients in the harmonisation model (box 3) are updated. At the same time, it is possible to implement new indicators, carry out changes in the input series and in the model, etc. Such changes are not carried out in an ordinary monthly or quarterly process.

The recalculation of the monthly accounts is carried out by distributing the annual figures between the months using the original monthly figures as keys. The recalculated monthly accounts will then add up to the annual accounts at constant and current prices.

The harmonisation is based on the principle that the differences between the monthly changes to the original and harmonised series shall be as small as possible. The monthly accounts should add up to the figures in the annual accounts.

When the base year is updated the MNA for that year is aligned automatically.

Reference year

All figures are published at current prices and (for most sizes) constant prices (i.e. the accounts also specify volume and price changes). Constant-price estimates in the national accounts are calculated based on the previous year's prices; i.e. the base year is changed every year. Subsequently, data on volume changes are constructed in terms of growth rates and corresponding implicit data on changes in prices. In parallel, time series of volume figures are constructed by using prices from a reference year. The constant-price estimates are consistent with the data on changes in volume in the series of growth rates. Since the chaining is carried out separately for all items, the table components do not, however, necessarily add up to the totals of the same table.

The publication Quarterly national accounts gives more information about sources, methods and the processes used to calculate quaterly NA figures. This will be updated in the autumn of 2018 to include monthly national accounts.

The methods and routines used to produce seasonally adjusted figures are described in the chapter About seasonal adjustment.

§ 2-6 of the Statistics Act states that data under no circumstances shall be published in such a way that they may be traced back to the supplier. This means that the general rule is not to publish data if there are fewer than three enterprises in an industry. In practice, this means that for some detailed industry categories, figures must be aggregated up to a more aggregated industry group before they can be published.

Consistent monthly time series will exist back to 2016. Consistent quarterly time series will exist back to 1978 and annual time series back to 1970. Annual NA figures for the years 1865-1970 are based on the previous standards used for the national accounts and are not compatible with the up to date figures after the latest main revision of the NA.

Quarterly figures are calculated as the sum of three months. Quarterly figures will be updated only when publishing the third month in the quarter. This means that there may be mismatch between the monthly and quarterly figures in the interim months, see the description of the monthly process above.

Monthly figures, and thus quarterly figures, are aligned with the final annual national accounts figures, both in fixed and current prices. The other parts of the national accounts, such as income and capital accounts, and foreign accounts are also consistent and consistent with MNA.

The national accounts are based on various statistical sources. The sources are either survey data from establishments, enterprises or households, or data from registers. National accounts statistics reflect the inaccuracy in the statistical sources and the methods of compilation. Weaknesses and inaccuracy in the statistical sources are normally described in the documentation of the relevant sources.

Since the national accounts are an integrated system with balancing methods and consistency checks, the national accounts may reduce some of the inaccuracies in the statistical sources. On the other hand, national accounts require the compilation of statistics in areas where the sources are unsatisfactory, and the inaccuracy in such areas may therefore be significant. Some of the figures in the national accounts are estimated as residuals, and the uncertainty may be substantial in these areas. Examples are the compilation of changes in inventories and operating surplus by activity.

The EU Commission and Eurostat have completed a quality evaluation of the national accounts in all EEA countries. The conclusion was that "The Norwegian national accounts are of a high quality, soundly based on reliable and exhaustive sources, integrated in a system with a detailed product breakdown". (Report on the sources and methods used in compiling GNP in Norway, Eurostat/B1/CPNB/237/EN, 9 December 1997, Luxembourg.)

The International Monetary Fund (IMF) completed an evaluation of central parts of Norwegian macroeconomic statistics in autumn 2002, including the Norwegian national accounts. In the report IMF (2003), the Norwegian macroeconomic statistics, including the national accounts, got positive reviews: "In summary, Norway's macroeconomic statistics are of generally high quality." About the national accounts, the IMF also expressed that: "The source data for both the annual and the quarterly national accounts are generally sound and timely, and sufficiently portray reality."

The production of several of the sources that are used in the national accounts takes a considerable amount of time. Consequently, preliminary figures are more inaccurate than final figures.

In 2003, Statistics Norway carried out a project to evaluate the quality of the Norwegian QNA. The task of the project was to describe and evaluate the different processes in the system, and set up a plan for further work to improve quality. A project report was released in April 2004 (in Norwegian only). The report lists a variety of measures to increase quality, such as changes in the organisation of the QNA process, technical changes in the data system, an increase and improvement of the documentation related to the QNA system etc.

Another way of measuring the general quality of the QNA figures is to compare the preliminary annual figures from the first version of the annual accounts (by adding up the quarters in the QNA) with the final version. This was done in 2004. The article (in Norwegian only) looks at the growth rates of the main aggregates: GDP, GDP for mainland Norway, household consumption, government consumption, gross fixed capital formation, exports, imports and compensation of employees. For most variables, the study covers the years 1972-2002, while for some variables it covers the years 1993-2002. The study concludes that the preliminary figures generally had underestimated the growth rate in relation to the final figures, but that the overall picture did not differ too much.

The national accounts data for a specific month, quarter or year are revised in accordance with an ordinary publication and revision cycle. The monthly and quarterly figures within a specific year t have the status final 21 months after the end of the year. See Administrative information, Frequency and timeliness. In addition, periodical main revisions give revised figures. See Background and purpose. The table below shows the publication cycle for yearly and quarterly national accounts figures. In addition to what is stated in the table, monthly data will be published about 40 days after the end of the month. In May, year t (which coincides with the QNR for the first quarter), all months, also in year t-1, can be revised. After May year t, only the monthly figures for the current year are subject to revision.

| Publication cycle for quarterly and yearly national accounts figures | ||||

| Release date in: | 1st quarter year t | 2nd quarter year t | 3rd quarter year t | 4th quarter year t |

| May, year t | First preliminary version | Revised 3 for year t-1 | Revised 2 for year t-1 | Revised 1 for year t-1 |

| August, year t | Revised 1 Revised 5 for year t-1 Final for year t-2 | First preliminary version Revised 4 for year t-1 Final for year t-2 | Revised 3 for year t-1 Final for year t-2 | Revised 2 for year t-1 Final for year t-2 |

| November, year t | Revised 2 | Revised 1 | First preliminary version | Revised 3 for year t-1 |

| February, year t | Revised 3 for year t-1 | Revised 2 for year t-1 | Revised 1 | First preliminary version for year t-1 |

Goods sent abroad for processing and merchanting in the Norwegian national accounts. Notater (2015/02)

Process tables in the Norwegian national accounts. Notater (2015/03)

Improved treatment of insurance in the Norwegian national accounts. Notater (2015/04)

Changes in inventories in the Norwegian National Accounts - Accounting data as a source for changes in inventories. Notater (2017/13)

Quarterly national accounts - methods and sources of the quarterly national accounts compilations for Norway December 2013. Notater (2014/02)

Revised national accounts figures 1970-2010

History of national accounts in Norway - from free research to statistics regulated by law. Notater (113)

Norwegian National Accounts - GNI Inventory for ESA95

Norwegian methodology for supply and use tables and input-output tables. Notater (2009/8)

What is seasonal adjustment?

Monthly and quarterly time series are often characterised by considerable seasonal variations, which might complicate inter-period comparability. Such time series are therefore subjected to a process of seasonal adjustment in order to remove the effects of seasonal fluctuations. Once data have been adjusted for seasonal effects by X-12-ARIMA or some other seasonal adjustment tool, a clearer picture of the time series emerge.