Content

Published:

This is an archived release.

Pessimism in petroleum-related manufacturing

Norwegian industrial managers report a downturn in the total output in the third quarter of 2016. It is especially suppliers to the oil and gas sector that are reporting a decline. However, there is certain optimism in the general expectations for the fourth quarter among most of the industry leaders.

| 3rd quarter 2016 | ||

|---|---|---|

| Changes from previous quarter | Expected changes in next quarter | |

| 1A diffusion index is compiled using the estimated percentages on "ups" and "same" according to the formula: (ups + 0,5 * same). The diffusion index has a turning point at 50. An index value above 50 indicates growth in the variable, and opposite for a value below 50. | ||

| Total volume of production | 48.9 | 50.3 |

| Average capacity utilisation | 47.6 | 51.6 |

| Average employment | 42.4 | 42.4 |

| New orders received from home markets | 47.0 | 51.6 |

| New orders received from export markets | 41.5 | 48.0 |

| Total stock of orders | 43.9 | 48.4 |

| Prices on products at home markets | 49.9 | 50.8 |

| Prices on products at export markets | 47.5 | 47.2 |

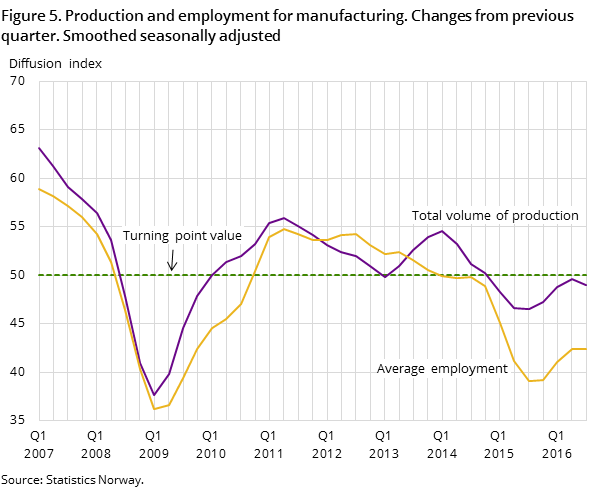

The business tendency survey for the third quarter of 2016 shows a downturn in total production compared with the second quarter of 2016. This decline comes after signs of a leveling off in production volumes in the second quarter. Manufacturers of capital goods are experiencing a further decline in production, where low activity among suppliers to the oil and gas sector continues to contribute the most to the decline. This is particularly related to the following industries:

- Machinery and equipment

- Building of ships, boats and oil platforms

- Repair and installation of machinery

Producers of intermediate goods reported increased production in the last quarter. There was an increase in industries such as rubber, plastic and mineral products, and in wood and wood products, while manufacturers of basic chemicals had reduced production. At the same time there was increased production within consumer goods, especially for manufacturers of food. The increased output in these two industrial groupings mitigates the fall in the overall industrial production.

The overall employment declined in the third quarter of 2016. The decline comes from producers in all the three main industrial groupings. The fall is most significant among producers of capital goods which are particularly linked to the oil and gas sector.

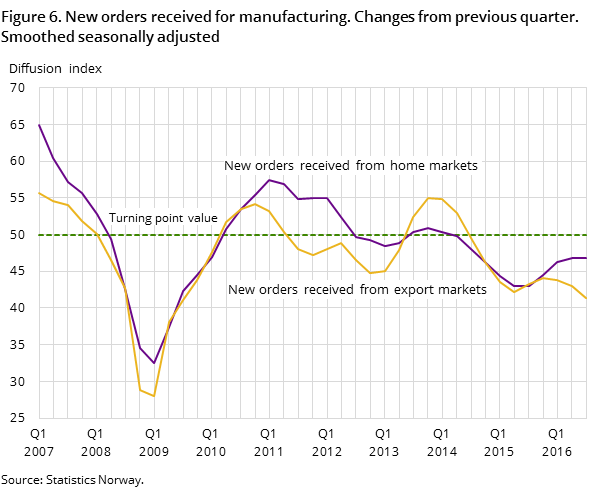

Decline in new orders and in the total stock of orders

There was a decline in the total stock of orders in the third quarter. New orders from both the domestic and export markets also fell from the pervious quarter. Producers of capital goods saw a clear decline in new orders and the stock of orders. These producers continue to be affected by the low investment activity in the oil and gas industry. Producers of intermediate goods saw a slight decline in orders from the export market, while the home market was somewhat unchanged. The total stock of orders was slightly up for these manufacturers. Producers of consumer goods experienced an increase in orders from both the domestic and export market, and an increased stock of orders.

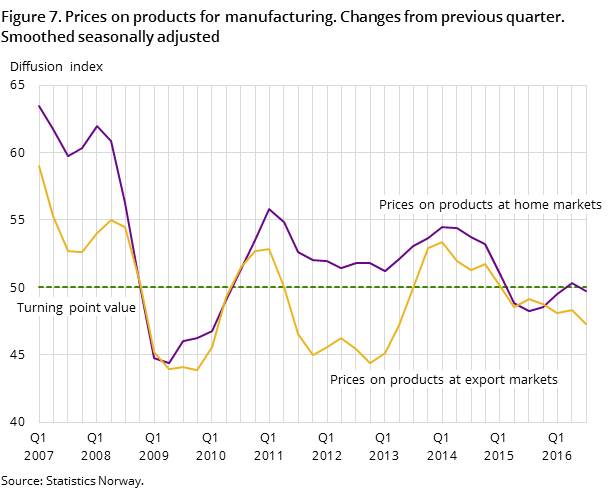

Prices in manufacturing went slightly down in the export market, while it was unchanged in the domestic market. Export prices are to be assessed in Norwegian kroner, and the appreciation of the Norwegian krone against the currencies of the major trading partners could explain some of the decline in the export market for some industries. For manufacturers of capital goods there was a decrease in prices in both markets, while producers of intermediate goods had a decrease in the export market and an unchanged development in the domestic market. The export-oriented industry, non-ferrous metals, has experienced falling prices in the previous five quarters, but saw increased prices in both markets in the third quarter of 2016. For consumer goods there was an increase in prices in both markets, which can especially be attributed to the increase in prices in food products.

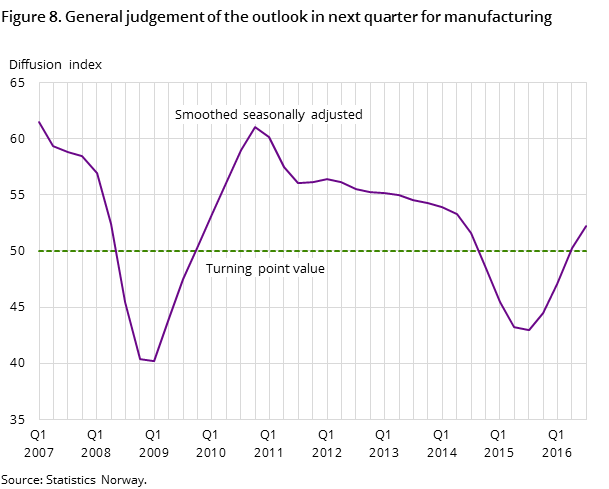

Positive expectations for the fourth quarter of 2016

The general outlook for the fourth quarter of 2016 is positive, which is the first positive assessment in eighth quarters. However, business leaders report that investment plans are adjusted downwards and that employment will see a further drop. New orders from the domestic market are expected to increase, while new orders from the export market and the total stock of orders are expected to decline. Producers of capital goods are in general negative in their expectations for the fourth quarter, while manufacturers of intermediate goods and consumer goods are more optimistic.

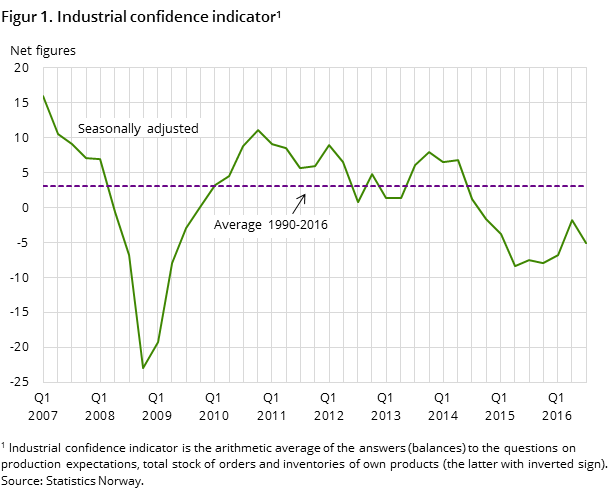

The industrial confidence indicator in the third quarter was at -5.0 (seasonally-adjusted net figures), down from -1.8 in the previous quarter. This is below the historical average of 3.0. Values above zero indicate that total output will grow, while values below zero indicate that total output will fall. International comparisons of the industrial confidence indicator are available from Eurostat (EU), The Swedish National Institute of Economic Research and Statistics Denmark.

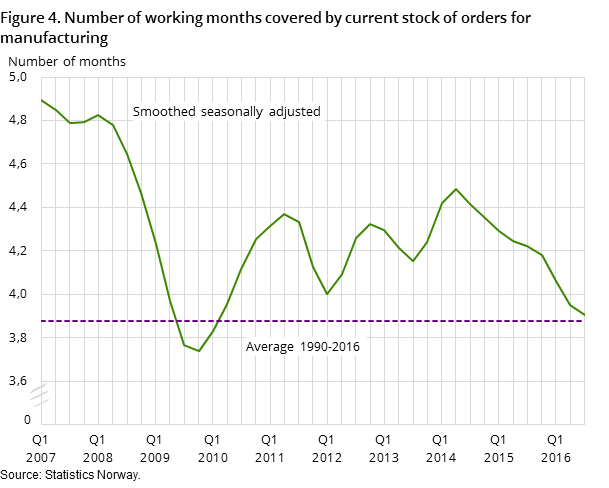

The number of working months covered by the current stock of orders declines

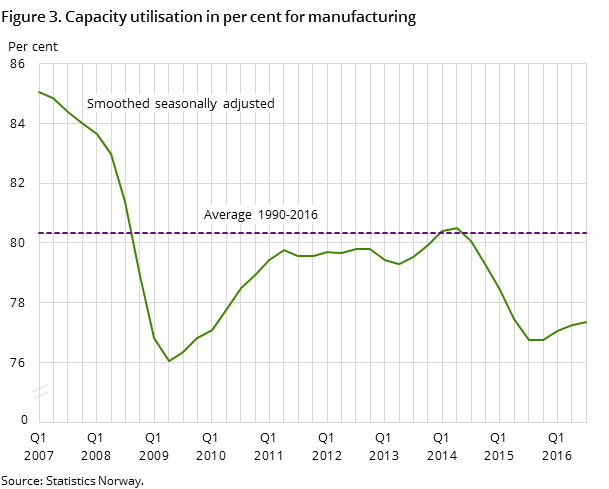

Average capacity utilisation for Norwegian manufacturing had a marginal increase and was calculated to 77.3 per cent at the end of the third quarter of 2016, compared with 77.2 in the second quarter of 2016. This is below the historical average of 80.4 per cent. International comparisons of average capacity utilisation are available from Eurostat (EU).

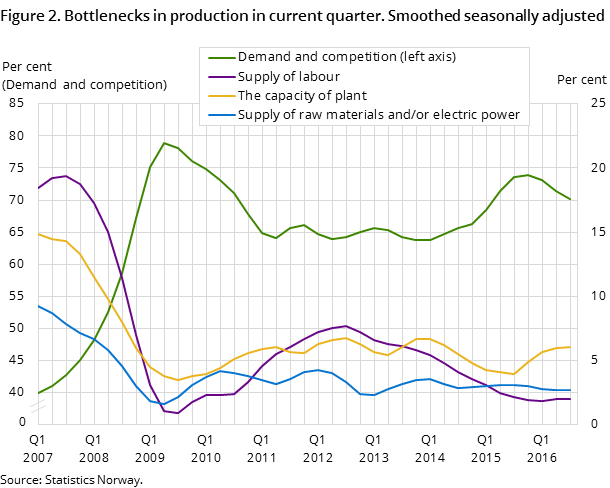

The average number of working months covered by the current stock of orders was 3.9 in the third quarter of 2016, as can be seen in figure 4. This is slightly below the level of the previous quarter and at the lowest level since the first quarter of 2010, but it is on the historical average for the indicator. The indicator on resource shortage is about the same as in the previous quarter. There is still little shortage of labour, good access to raw materials and electrical power, and few industry leaders are reporting full capacity utilisation.

Timeliness

The survey data was collected in the period from 8 September 2016 to 26 October 2016.

Assessment of Q3 2016 and the short-term outlook¹

1 An overall evaluation of the present situation and expected short-term developments. 2 Very good: ++, Good: +, Stable: ~, Poor: -, Very poor: --, Good, but with certain negative indications: +(-), A situation where the + and - factors even out: +/-, Poor, but with certain positive indications: -(+) | |

| Industry | Evaluation 2 |

| Food, beverages and tobacco | + |

| Wood and wood products | + |

| Paper and paper products | + |

| Basic chemicals | -(+) |

| Non-ferrous metals | +(-) |

| Fabricated metal products | -(+) |

| Computer and electrical equipment | - |

| Machinery and equipment | -- |

| Ships, boats and oil platforms | -- |

| Repair, installation of machinery | - |

Additional information

The statistics provide current data on the business cycle for manufacturing, mining and quarrying by collecting business leaders’ assessments of the economic situation and the short term outlook.

Contact

-

Edvard Andreassen

E-mail: edvard.andreassen@ssb.no

tel.: (+47) 40 90 23 32

-

Ståle Mæland

E-mail: stale.maeland@ssb.no

tel.: (+47) 95 05 98 88