Content

Published:

This is an archived release.

Improved quarterly results for banks

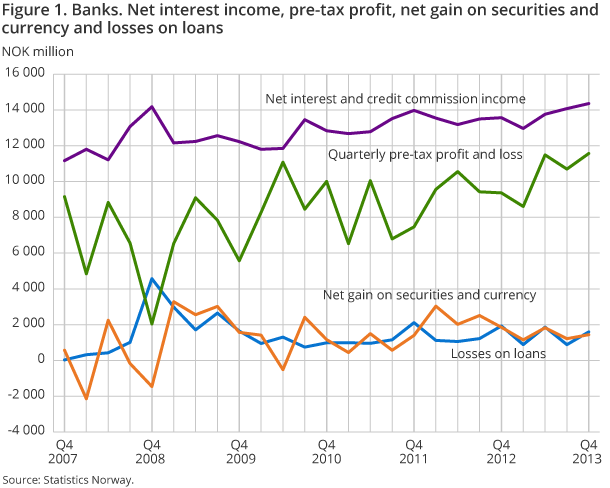

The banks' quarterly profit before tax amounted to NOK 11.6 billion in the 4th quarter of 2013. This is an increase of NOK 2.2 billion compared to the same quarter in 2012. Increased net interest income and net commission income counteracted a lower net gain on securities and currency.

| 4th quarter 2013 | 4th quarter 2012 | |

|---|---|---|

| Banks | ||

| Net interest income | 55 156 | 53 793 |

| Loss on loans | 5 236 | 5 335 |

| Pre-tax profit | 42 357 | 38 934 |

| Mortgage companies | ||

| Net interest income | 20 368 | 12 906 |

| Loss on loans | 195 | 147 |

| Pre-tax profit | 1 078 | -20 209 |

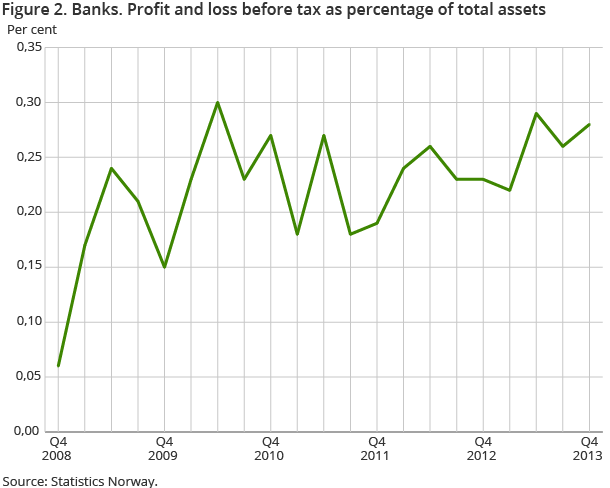

Norwegian banks’ profit before tax amounted to 0.28 per cent of banks' total assets at the end of the 4th quarter of 2013 and was slightly above the average for the last five quarters. The accumulated pre-tax profit amounted to NOK 42.4 billion, or 1.02 per cent of total assets. This is a decrease from a pre-tax profit equal to 0.96 per cent of total assets in 2012.

Stable growth in net interest income

Norwegians banks’ net interest income as the difference between interest income and interest expenses amounted to NOK 14.4 billion in the 4th quarter of 2013. This is an increase of NOK 790 million compared to the same period in 2012. Lower interest costs and higher interest income contributed to this growth in 2013. As a share of total assets, the net interest income was 0.35 per cent, unchanged from the previous quarter. Compared to the 4th quarter of 2012, this is an increase from 0.33 per cent of total assets.

In the 4th quarter of 2013, the net interest income amounted to NOK 32.4 billion, while the interest expenses were NOK 18.1 billion. The interest income thus was NOK 646 million higher and interest costs were NOK 143 million lower than in the 4th quarter of 2012.

Decrease in gain on securities and currency

Norwegian banks' net gains on securities and currency amounted to NOK 1.4 billion in the 4th quarter of 2013. This is a decrease of NOK 413 million from the same quarter the year before and an increase of NOK 223 million from the 3rd quarter of 2013. As a share of total assets, the net gains on securities and currency were 0.03 per cent in the 4th quarter of 2013. The net gains on securities and currency have fluctuated between 0.03 and 0.05 per cent over the last five quarters.

In the 4th quarter of 2013, the Norwegian banks' net gains on shares and other securities with variable income amounted to NOK 572 million. The net gains on currency were NOK 961 million, while the net gains on treasury bills, bonds and other interest-bearing capital securities fell to a modest NOK 2 million in the 4th quarter.

Lower net gains on securities and currency in the 4th quarter of 2013 compared to the 4th quarter of 2012 were primarily due to a decrease in net gains on treasury bills, bonds and interest-bearing capital securities. This net gain fell from NOK 1 billion in the 4th quarter of 2012 to NOK 2 million in the 4th quarter of 2013. In the same period, losses on other financial instruments were lower; NOK 383 million in the 4th quarter of 2012 compared to NOK 92 million in the corresponding quarter of 2013. Net gains and losses are affected by fluctuations in the fair value of assets and liabilities, as well as fluctuations in exchange rates and the value of financial derivatives.

Lower losses on loans

Norwegians banks’ losses on loans amounted to NOK 1.6 billion in the 4th quarter of 2013. This was a decrease from NOK 1.9 billion in the corresponding quarter in 2012. Losses on loans were slightly lower in the 3rd quarter of 2013, and amounted to NOK 886 million. As a share of total assets, losses on loans were only 0.04 per cent in the 4th quarter of 2013; the same level as in the other quarters in 2013.

Negative quarterly result, positive accumulated annual profit for mortgage companies

Norwegian mortgage companies' quarterly pre-tax profit fell from NOK 1.5 billion in the 3rd quarter to NOK -341 million in the 4th quarter of 2013. The results for the last quarter of 2013 were still higher than in the same quarter of 2012. As a share of total assets, the quarterly pre-tax profit amounted to -0.02 per cent in the 4th quarter of 2013, up from -0.28 per cent of total assets in the corresponding quarter in 2012. In 2013, the accumulated annual pre-tax profit for mortgage companies was positive and amounted to NOK 1.1 billion.

The trend in net interest income to mortgage companies has been positive in recent quarters and was NOK 5.8 billion in the 4th quarter of 2013. This is an increase from NOK 3.7 billion in the 4th quarter of the previous year. As a share of total assets, the net interest income for Norwegian mortgage companies increased from 0.22 per cent in the 4th quarter of 2012 to 0.34 per cent in the corresponding quarter in 2013.

The Norwegian mortgage companies’ losses on loans remained very low. In the 4th quarter of 2013 they amounted to NOK 48 million, down from NOK 75 million in the corresponding quarter in 2012. In 2013, the Norwegian mortgage companies’ losses on loans were lowest in the 1st quarter when they amounted to NOK 44 million.

In the 4th quarter of 2013, Norwegian mortgage companies had a net loss on securities and currency of NOK 3.4 billion. This stems from a loss on treasury bills, bonds and other interest-bearing capital securities of NOK 2.9 billion and losses on other financial instruments of NOK 2.3 billion. These losses were partly counteracted by gains on foreign exchange currency of NOK 1.8 billion in the same period. Compared to the 4th quarter of 2012, the net loss on securities and currency was NOK 3.2 billion lower in the corresponding quarter of 2013. The net loss as a share of total assets fluctuated between -0.38 per cent in the 4th quarter of 2012 to -0.19 per cent in the 4th quarter of 2013.

Good quarterly results for the finance companies

The quarterly pre-tax profit for the finance companies amounted to NOK 828 million in the 4th quarter of 2013, up from NOK 668 million in the corresponding quarter of 2012. As a share of total assets, the quarterly pre-tax profit for finance companies increased from 0.54 per cent in the 4th quarter of 2012 to 0.63 per cent in the 4th quarter of 2013. In the 3rd quarter of 2013, the quarterly pre-tax profit was even higher at NOK 943 million, or 0.73 per cent of total assets.

Finance companies’ net interest income was stable and amounted to NOK 1.7 billion in the 4th quarter of 2013. Net interest income was thus NOK 153 million higher than in the 4th quarter of 2012. Net interest income has fluctuated between NOK 1.6 billion and NOK 1.7 billion over the last five quarters. Losses on loans for finance companies increased from NOK 174 million in the 4th quarter of 2012 to NOK 211 million in the 4th quarter of 2013. During the same period, losses on loans increased from 0.14 per cent to 0.16 per cent as a share of total assets.

The statistics is now published as Banks and mortgage companies.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42