Content

Published:

This is an archived release.

Good results in Norwegian banks

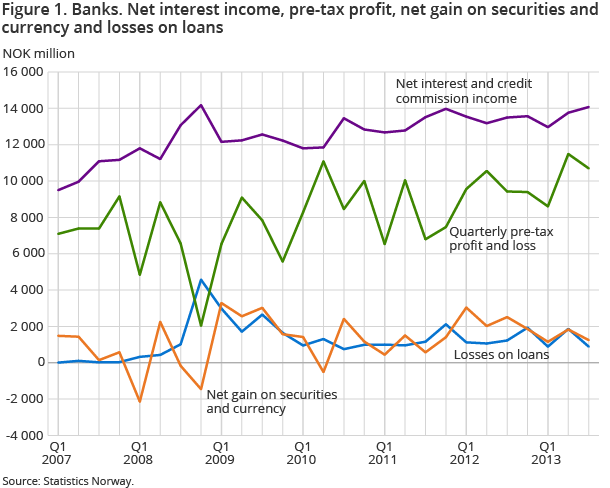

The Norwegian banks’ net profit before tax was NOK 10.7 billion in the 3rd quarter of 2013. This is an increase of NOK 1.3 billion compared to the corresponding quarter last year. Positive net interest income, increased commission income and lower losses on loans counteracted a lower net gain on securities and currency.

| 3rd quarter 2013 | 3rd quarter 2012 | |

|---|---|---|

| Banks | ||

| Net interest income | 40 800 | 40 224 |

| Loss on loans | 3 638 | 3 406 |

| Pre-tax profit | 30 791 | 29 538 |

| Mortgage companies | ||

| Net interest income | 14 540 | 9 172 |

| Loss on loans | 147 | 72 |

| Pre-tax profit | 1 419 | -15 454 |

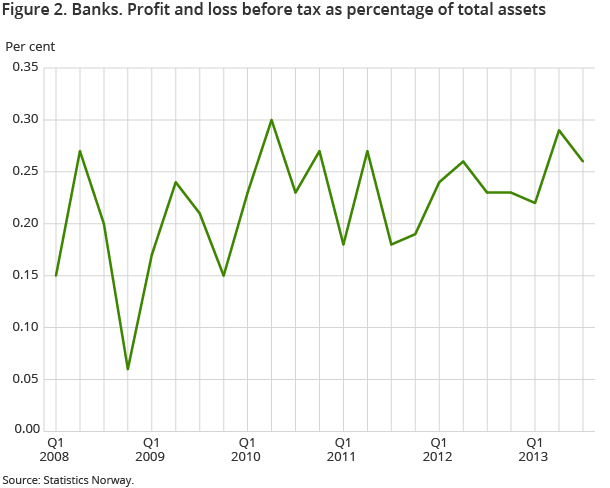

At the end of the 3rd quarter of 2013, Norwegian banks’ accumulated pre-tax profit amounted to NOK 30.8 billion. For comparison, the accumulated pre-tax profit was NOK 29.5 billion at the end of the same quarter last year. The pre-tax profit as a share of total assets was 0.26 per cent in the 3rd quarter this year. This is an increase from 0.23 per cent in the 3rd quarter last year, but a decrease from 0.29 per cent in the 2nd quarter this year.

Increased net interest income

Norwegian banks’ net interest income was NOK 14.1 billion in the 3rd quarter this year. This is the highest quarterly amount of net interest income during the last five quarters, and an increase of NOK 578 million from the same period last year. The net interest income as a share of total assets was 0.35 per cent; an increase from 0.33 per cent in the 3rd quarter last year.

The interest income amounted to NOK 32.1 billion, while the interest costs were nearly NOK 18 billion. This is a decrease from the 3rd quarter of 2012 of NOK 1.2 and NOK 1.8 billion respectively.

Lower gain on securities and currency

Norwegian banks’ net gains on securities and currency amounted to NOK 1.2 billion in the 3rd quarter of 2013. This is a decrease of NOK 583 million from the previous quarter and NOK 1.3 billion from the 3rd quarter last year.

The reduction in net gains from the 3rd quarter last year to the 3rd quarter this year mainly stems from the decrease in net gain on treasury bills, bonds and other interest-bearing capital securities of NOK 2.5 billion. This decrease was partly counteracted by increased net gains on shares and currency of NOK 600 and NOK 514 million respectively. These net gains and losses were affected by fluctuations in the fair value of assets and liabilities as well as exchange rates and the value of financial derivatives.

Lower losses on loans

Norwegian banks’ losses on loans amounted to NOK 886 million in the 3rd quarter of 2013, which is the lowest level of loan losses since the 3rd quarter of 2010. In comparison, the loan losses amounted to nearly NOK 1.9 billion in the previous quarter and NOK 1.2 billion in the 3rd quarter last year. As a percentage of total assets, the losses on loans were 0.02 per cent.

Positive quarterly results for mortgage companies

Norwegian mortgage companies’ quarterly pre-tax profit was nearly NOK 1.6 billion in the 3rd quarter this year; an increase of NOK 474 million from the previous quarter. The pre-tax profit as a percentage of total assets was 0.09 per cent.

The net interest income has gradually increased in recent quarters, and amounted to NOK 5.7 billion in the 3rd quarter this year. This is an increase from NOK 4.7 billion in the previous quarter and NOK 3.3 billion from the 3rd quarter last year. The net interest income as a share of total assets was 0.33 per cent, up from 0.19 per cent in the same quarter last year.

Mortgage companies had a net loss on securities and currency of NOK 1.7 billion in the 3rd quarter this year. This stems from a loss in treasury bills, bonds and other interest-bearing capital securities of NOK 3.5 billion, which was partly counteracted by a net gain on other financial assets and liabilities of NOK 2.1 billion.

Mortgage companies’ loans on losses are still very low. In the 3rd quarter this year, the losses amounted to NOK 48 million, down from NOK 55 million in the previous quarter.

Good results for finance companies

The quarterly pre-tax profit in finance companies amounted to NOK 943 million in the 3rd quarter this year, up from NOK 885 million in the previous quarter. Measured as a percentage of total assets, the pre-tax profit was 0.73 per cent.

Net interest income was NOK 1.7 billion in the 3rd quarter this year; an increase of NOK 43 million from the previous quarter and NOK 111 million from the 3rd quarter last year. The net interest income has remained stable between NOK 1.5 and NOK 1.7 billion during the last five quarters. The finance companies’ losses on loans amounted to NOK 129 million in the 3rd quarter. This is NOK 18 million lower than in the previous quarter, but NOK 36 million higher than in the 3rd quarter last year. Loans on losses measured as a percentage of total assets were 0.1 per cent.

The statistics is now published as Banks and mortgage companies.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42