Content

Published:

This is an archived release.

Significant decline in net profit for public non-financial corporations

Public non-financial corporations achieved less profit in 2014 compared to 2013. The main contributor is still enterprises involved in mining and quarrying, however, mining and quarrying, as well as the water supply, sewerage, waste management and remediation activities had a deficit in 2014.

| 2014 | 2013 | 2012 | |

|---|---|---|---|

| Operating profit margin. Per cent | 16.26 | 22.75 | 24.92 |

| Operating margin. Per cent | 3.45 | 27.21 | 36.03 |

| Return on total assets. Per cent | 0.01 | 0.01 | 17.71 |

| Return on equity. Per cent | -0.01 | 0.01 | 18.17 |

| Equity ratio. Per cent | 47.73 | 51.21 | 45.65 |

| Current ratio | 1.07 | 1.00 | 0.87 |

| Ratio of fixed assets to long term capital | 0.98 | 1.00 | 1.04 |

| Debt-to-equity ratio | 1.09 | 0.95 | 1.19 |

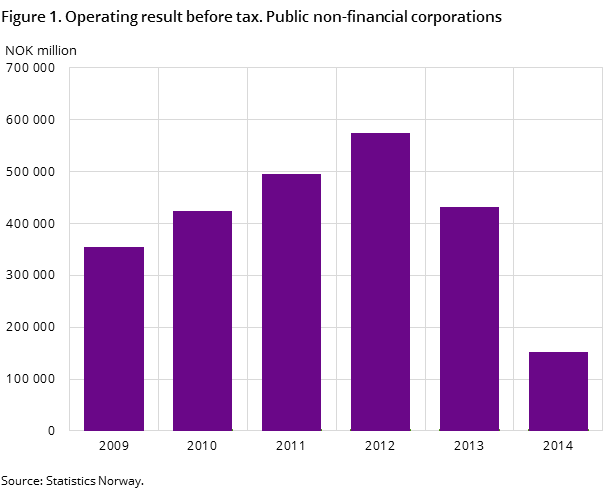

Public non-financial corporations achieved NOK 152 billion in profit before tax in 2014. This is about 12 per cent of the operating income. The corresponding figures for 2013 were NOK 432 billion and 33 per cent respectively.

The decrease in the profit is mainly the result of the reduction in profit in mining and quarrying, and also the water supply, sewerage, waste management and remediation activities. State's Direct Financial Interest (SDFI) and Statoil ASA and BIR AS dominate these industries.

Electricity, gas, steam and air conditioning supply had a total decline of NOK 3 billion in operating results compared to the previous year.

The information and communication industry achieved a profit before tax of NOK 2 billion and a deficit of NOK 614 billion. Transportation and storage achieved a profit before tax of NOK 10 billion, and a net profit of just under NOK 3.8 billion. The major corporations in this industry include Telenor ASA, Posten Norge AS and Norges Statsbaner AS.

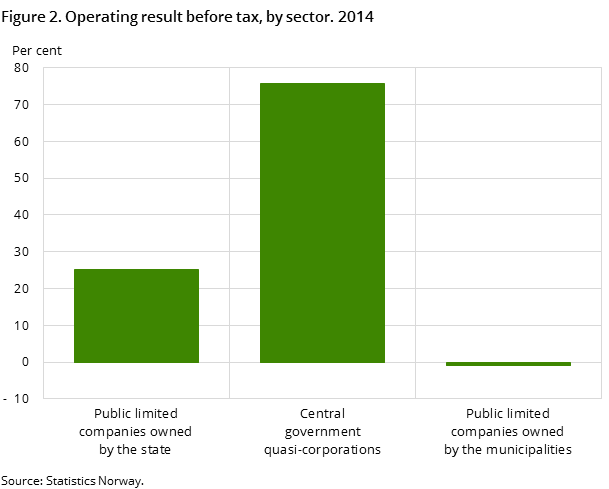

Central government corporations had major deficit

While central government quasi-corporations achieved a profit of just less than NOK 115 billion, the central government corporations had a total deficit of almost NOK 92 billion. The decrease in the net profit for the year is a result of an increase in financial expenses from the previous year. Some of the foreign subsidiary companies had a reduction in the asset value. The central government corporations and the central government quasi-corporations accounted for about 94 per cent of the total operating profit. SDFI had a deficit of slightly more than NOK 9 billion. The deficit for the local government-owned enterprises was almost NOK 8 billion in 2014.

Increase in assets

Public non-financial corporations’ total assets amounted to NOK 3 473 billion at the end of 2014. This was an increase of about NOK 300 bill50ion from the previous year. The value of the fixed assets increased by 6.1 per cent, while the value of the current assets increased by 24.8 per cent.

However, most of the capital is located in a small number of companies. Approximately 50 corporations contributed more than three quarters of the total assets. Each of these corporations has an asset value of more than NOK 7 billion. Eleven of these capital-intensive enterprises are owned by local government and these are all located in the electricity, gas, steam and air conditioning supply industry.

The financial situation

The public non-financial corporations had a relatively stable financial structure in the period 2009 to 2014. The equity ratio was about 48 per cent in 2014.

Furthermore, the ratio of fixed assets to long-term capital has been relatively stable at around 1, but nevertheless had a slight decrease in the period 2009-2014. The fixed assets have mainly been financed by long-term capital.

The current ratio increased from 0.98 in 2013 to 1.05 in 2014. This means that the current assets have gone from being less than the current liabilities to being higher than the current liabilities. The figures do not necessarily illustrate the enterprises’ liquidity and therefore require careful consideration.

Central government quasi-corporations have been excluded here because the equity in these corporations cannot be compared with other public corporations.

1 The accounting figures are taken from Petoros AS Annual Accounting Report for 2014.

Public ownershipOpen and readClose

Both the central and the local government have a significant ownership interest in Norwegian business and industry. The public companies vary with regard to economic activity. The level of ownership varies from holdings in large listed corporations to small fully-owned enterprises. The corporations are involved in activities such as mining and quarrying, energy supply, transport, real estate operations and rehabilitation. Mining and quarrying is the dominating business area and includes the State’s Direct Finance Investment (SDFI) and Statoil ASA among others. Corporations in the transportation and storage industry are the largest employers. These industries include Posten Norge AS and Norges Statsbaner AS.

DevelopmentOpen and readClose

All in all, there were slightly more than 3 150 public non-financial corporations for which Statistics Norway could obtain accounting data for in 2012. Furthermore, Statistics Norway could not obtain accounting data for just over 100 public corporations. The changes could be attributed to various reasons.

Some central government and local government business units are also reclassified as management. As this continues from one year to another, many public corporations may reclassify and as a result no longer be included in the statistics for the public non-financial corporations.

Contact

-

Francis Kwamena Acquah

E-mail: francis.kwamena.acquah@ssb.no

tel.: (+47) 40 90 26 62