Content

Published:

This is an archived release.

Strong increase in property tax revenues

Municipalities had total revenues of NOK 11 billion from property tax in 2015; an increase of 16 per cent from 2014.

| 2015 | 2016 | Per cent | ||

|---|---|---|---|---|

| 2014 - 2015 | 2015 - 2016 | |||

| 1Figures for property tax accounts are published the year after the other figures concerning property tax. | ||||

| Municipalities with property tax | 355 | 365 | 4.1 | 2.8 |

| Municipalities with property tax on mills and factories | 88 | 78 | -8.3 | -11.4 |

| Municipalities with property tax on both mills and factories and areas built in | 11 | 7 | -8.3 | -36.4 |

| Municipalities with property tax in the municipalities as a whole | 221 | 239 | 11.1 | 8.1 |

| Property tax, total (NOK 1 000)1 | 11 164 966 | .. | 16.1 | .. |

| Property tax from commercial property (NOK 1 000)1 | 5 739 470 | .. | 5.1 | .. |

| Property tax from residential homes and holiday properties (NOK 1 000)1 | 5 425 496 | .. | 30.5 | .. |

| Property tax as a percentage of gross operating income1 | 2.8 | .. | 12.0 | .. |

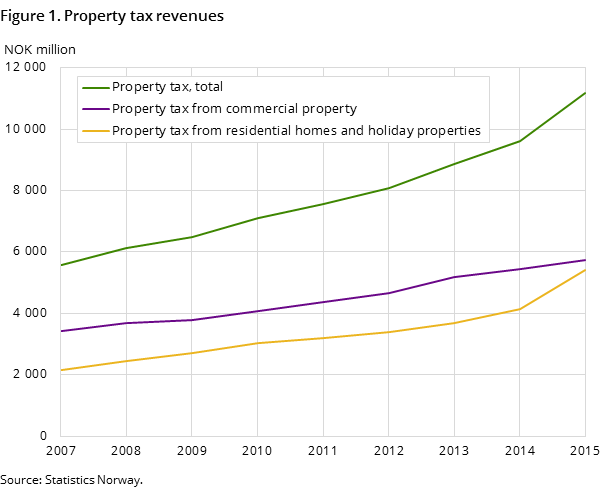

Revenues from property tax on residential homes and holiday properties (referred to henceforth as residential property) contributed the most to the total increase, see figure 1. Revenues from taxation of residential property increased by as much as 31 per cent from 2014 to 2015, while revenues from taxation of commercial property increased by 5 per cent. In 2015, tax from commercial property amounted to NOK 6 billion, while tax from residential property amounted to NOK 5 billion.

Property tax accounted for 2.8 per cent of the total gross operating revenues in 2015. This is a small contribution to the municipalities’ operating revenues, but has increased every year for the past five years.

More municipalities charging property tax

There are several elements explaining the increase in property tax revenues. First, a growing number of municipalities are introducing property tax; the number increased by 14 municipalities between 2014 and 2015, and by 10 municipalities between 2015 and 2016. Now, 365 of the total 428 municipalities in Norway have introduced property tax.

Most of the new municipalities introduce property tax both on commercial and residential property. Of the 14 new municipalities with property tax in 2015, only 2 introduced the tax only on commercial property. In 2016, 4 of the 10 new municipalities have introduced property tax only on commercial property.

Increased number of municipalities charging property tax on residential property

Some municipalities that have already introduced property tax are expanding the range of the property tax. This is also contributing to the increase in property tax revenues. Most of these municipalities have introduced property tax on residential property on top of the existing property tax on commercial property. In 2015, there were 21 more municipalities with tax on residential property than in 2014. This year, there are 20 more municipalities with residential property tax.

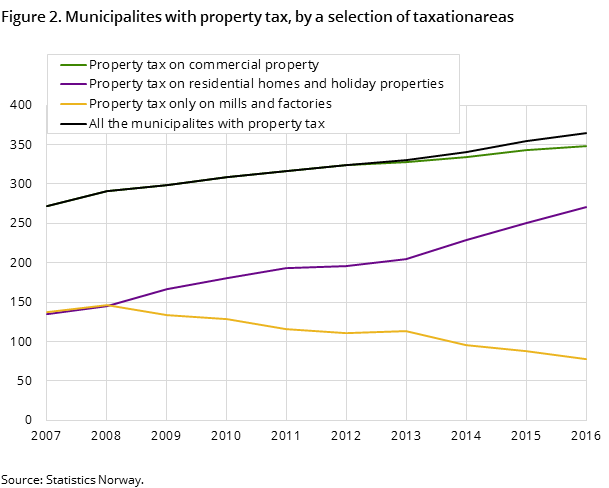

The number of municipalities with tax on residential property has increased considerably in the last three years, while the number of municipalities with tax on commercial property has had a relatively modest yearly increase, see figure 2. This is mainly because the number of municipalities with property tax only on mills and factories, which are classed as commercial property, has fallen considerably since 2008.

Revaluing of property and higher tax rates

As a main rule, the municipalities that charge property tax have to revalue the properties every ten years. This revaluation also contributes to higher revenues from property taxation. Nineteen municipalities revalued properties in 2015, effective from 1 January 2015.

Increasing the tax rate also pushes up revenues. Municipalities can determine the level of tax rate payable themselves, although the rate has to be between 2 and 7 per thousand of the property value. The municipalities may also use a differentiated, and usually lower, rate for tax on residential property than the general property tax rate for other property in the municipality. From 2014 to 2015, 42 municipalities increased the general tax rate and 16 municipalities increased the differentiated tax rate for residential properties. The general tax rate average increased by 1.7 per thousand of the property value and the differentiated tax rate average increased by 1 per thousand of the property value.

This effect on the increase in total property tax revenues from 2014 to 2015 was counteracted by the fact that 17 municipalities decreased the general tax and 13 municipalities decreased the differentiated tax. The taxes were reduced by 1.6 and 1.1 per thousand of the property value respectively.

122 municipalities with differentiated tax rate

Along with the increase in the number of municipalities with residential property tax, the number of municipalities with a differentiated tax rate for residential properties is increasing. There are now 122 municipalities with a differentiated tax rate, which is 21 more than in 2015.

There is also even growth in the number of municipalities with a basic tax deduction for residential property. One hundred municipalities now apply this tax deduction.

A third element that lessens the tax burden for residential property owners is that a growing number of municipalities are exempting new residential properties from taxation for a certain number of years from the year of construction. This relief is now given by 97 municipalities.

RevenuesOpen and readClose

Figures for property tax accounts are published the year after the other figures concerning property tax.

Contact

-

Else Helena Bredeli

E-mail: else.bredeli@ssb.no

tel.: (+47) 40 90 26 53

-

Anne Brit Thorud

E-mail: anne.brit.thorud@ssb.no

tel.: (+47) 40 90 26 59