Content

Published:

This is an archived release.

The release on 24 August will include some changes to historical figures within Oil and gas extraction and pipeline transportation for the investment years 2001-2013.

Investment decline projected for 2017

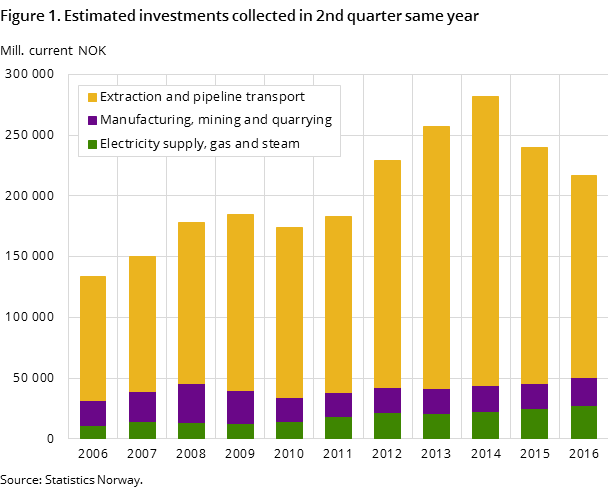

Estimates for total investments covering oil and gas, manufacturing, mining & quarrying and electricity supply are now showing a decline for 2017. The downturn is mainly due a decrease within oil and gas and manufacturing.

| Estimates collected in Q2 the same year | |||

|---|---|---|---|

| 2016 / 2015 | 2015 | 2016 | |

| 1Values at current prices | |||

| Extraction, pipeline, mining, manuf. and elec | -9.9 | 240 239 | 216 455 |

| Extraction and pipeline transport | -14.8 | 194 773 | 165 906 |

| Manufacturing | 13.9 | 19 780 | 22 524 |

| Mining and quarrying | -24.8 | 904 | 680 |

| Electricity, gas and steam | 10.3 | 24 783 | 27 345 |

| Estimates collected in Q2 the previous year | |||

| 2017 / 2016 | 2016 | 2017 | |

| Extraction, pipeline, mining, manuf. and elec | -14.6 | 234 798 | 200 633 |

| Extraction and pipeline transport | -18.7 | 188 436 | 153 218 |

| Manufacturing | -8.8 | 18 198 | 16 600 |

| Mining and quarrying | -34.3 | 630 | 414 |

| Electricity, gas and steam | 10.4 | 27 533 | 30 402 |

New figures for 2016 show that total investments covering oil and gas, manufacturing, mining & quarrying and electricity supply are expected to amount to NOK 216.5 billion measured in current value. The estimate is 9.9 per cent lower than the corresponding figure for 2015. The decline is mainly due to a significant fall of 14.8 per cent within oil and gas. The decrease is, however, partly offset by higher investments in electricity supply and manufacturing.

The first estimates for 2017 show that total investments are expected to amount to NOK 200.6 billion. This is 14.6 per cent lower than the corresponding figure for 2016. The decline is mainly due to a fall within oil and gas and manufacturing. The fall in total investments is moderated by higher expected investments within electricity supply.

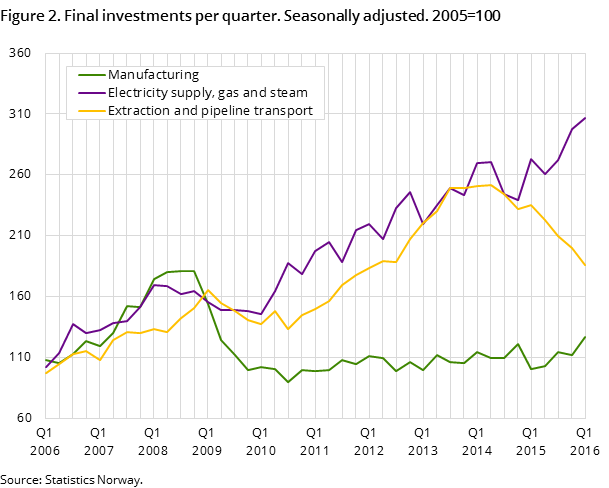

Quarterly final investments for extraction and pipeline transport saw a 7.0 per cent decrease in the first quarter of 2016 compared with the fourth quarter of 2015, according to seasonally-adjusted figures. Meanwhile, quarterly final investments for electricity supply and manufacturing saw an increase in the same period equivalent to 3.3 and 13.6 per cent respectively.

Slightly lower estimates for 2016 in oil and gas

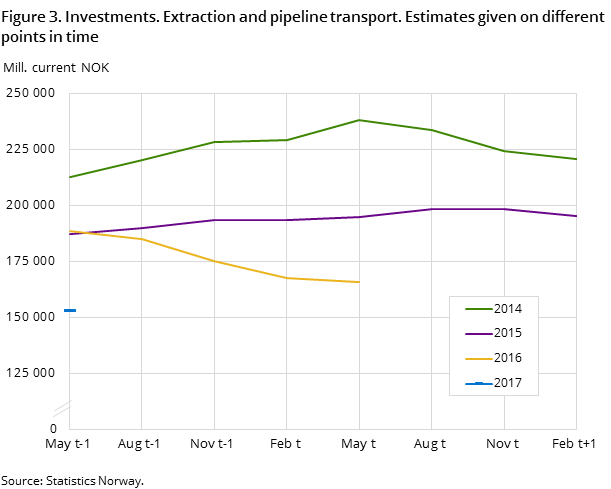

The investments in oil and gas extraction and pipeline transport for 2016 are now estimated at NOK 165.9 billion. This is 14.8 per cent lower than the corresponding estimate for 2015, given in the 2nd quarter of 2015. The decrease is due to lower investments in all categories. The fall is dominated by the decreases within exploration and fields on stream.

Investments for fields on stream in 2016 are now estimated at NOK 70.6 billion. This is 12.6 per cent lower than the corresponding estimate given for 2015.

Investments in the exploration activity in 2016 are estimated at NOK 22.3 billion. The estimate is 30.1 per cent lower than the corresponding figure for 2015, presented in the 2nd quarter of 2015. As from this survey, the delimitation in the exploration activity is changed.

First estimates for 2017 indicate further fall in oil and gas investments

The investments in oil and gas extraction and pipeline transport for 2017 are estimated at NOK 153.2 billion. This is 18.7 per cent lower than the corresponding estimate given for 2016 in the 2nd quarter of 2015.

The sharp decrease indicated from 2016 to 2017 should be interpreted with caution. From the survey in the 2nd quarter of 2015 to the present survey, the estimates for 2016 have decreased gradually from NOK 188.4 billion to NOK 165.9 billion. Almost all of the decrease was within exploration. Historical figures show that the estimates in the first three quarters in the estimate cycle in the statistics tend to underestimate final investments to a diminishing degree. Further, the investments in the first three estimates in the investment year tend to overestimate final investments to an increasing degree, while the estimate given in the fourth quarter of the investment year typically shows a decrease. The estimate development for 2016 so far differs considerably from the development in a normal year (see figure 3). This is probably due to the decrease in crude prices during autumn 2015 and winter 2016. The estimate development for 2017 is expected to be more similar to a normal year than the development for 2016 so far. Therefore, it is not unlikely that the decrease from 2016 to 2017 will be less than indicated in this survey.

The decrease from 2016 to 2017 is due to lower investments in all categories. The fall is dominated by decreases within exploration, field development and fields on stream.

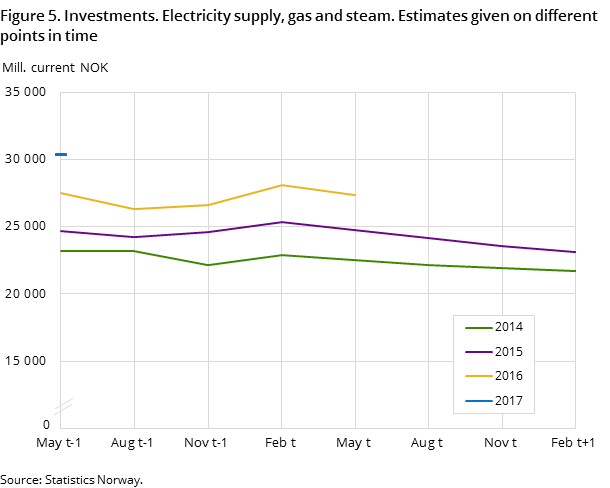

Growth investment in electricity supply in 2016 and 2017

The new investment estimates for 2016 show that total investments in electricity supply amount to NOK 27.4 billion measured in current value. The estimate is 10 per cent above the corresponding estimate for 2015. The largest contribution to growth was from the higher level of investments in the transmission and distribution sector. This increase is particularly related to power grid upgrades in addition to the installation of new power meters (AMS). In addition, a few major projects within production of electricity contributed to the growth of investment for electricity supply in 2016.

The first estimates for 2017 indicate further growth in investment in electricity supply. The estimate for 2017 is 10 per cent above the estimates for 2016, published at the same time last year. Strong investment growth in the transmission and distribution of electricity is one of the major contributors to the rise, while electricity production showed a small decline.

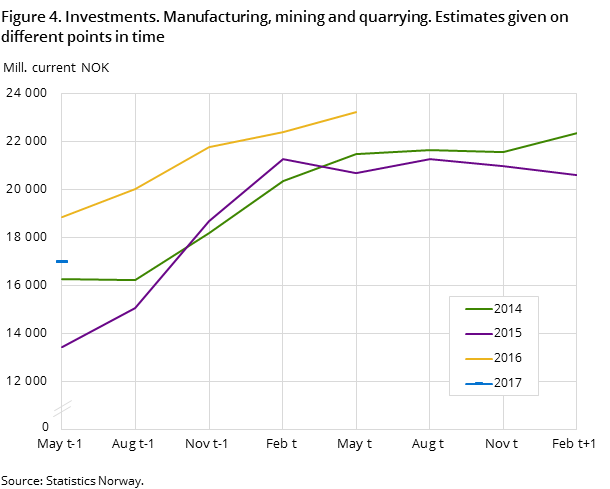

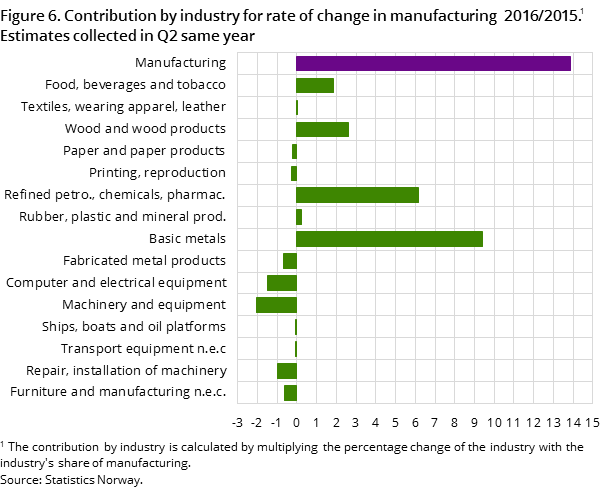

Oil-related industries contributed to investment growth in manufacturing in 2016

Manufacturing investments for 2016 are now estimated at NOK 22.5 billion measured in current value. The 2016 estimate is 14 per cent higher than the estimate for 2015 given in the 2nd quarter of last year. There are however large differences between the various industrial sectors. Export-oriented manufacturing sectors such as oil refining, chemical and pharmaceutical industries, and metals, account for much of the manufacturing investment growth. Growth in these sectors is partly due to capacity expansion and modernisation. Wood and wood products also contributed to the higher investment in the industry. The industry sectors that dampen growth include fabricated metal products, computer industry and electrical equipment, machinery and equipment and repair and installation. The decline in some of these industries can be attributed to lower investment activity in the oil and gas industry.

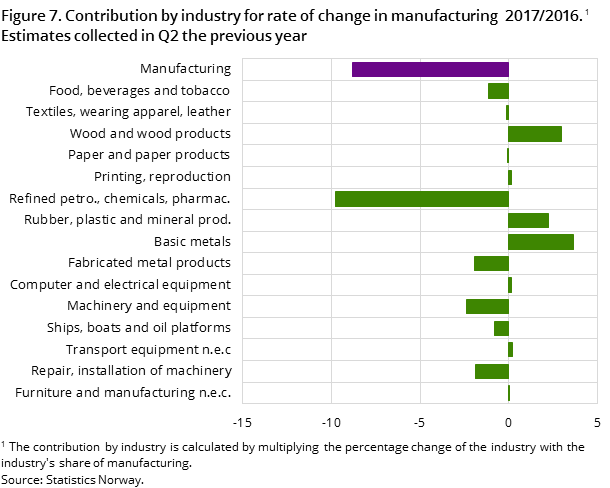

Negative forecasts for manufacturing in 2017

The industry's first estimate for 2017 suggests a decline in investment. Compared with the corresponding estimate for 2016, the decline is likely to be about 9 per cent. The decrease in 2017 is largely due to the 35 per cent investment decline in the development sector of oil refining, chemical and pharmaceutical industries. The low forecast for 2017 for this industrial sector is characterised by the fact that a few large investment projects, which have contributed to growth in 2016, are now entering their final phase. Some industries with strong ties to the oil and gas industry also show low estimates for 2017. It is important to point out that early estimates for the following year can often entail a degree of uncertainty.

Sharp fall in mining and quarrying in 2016 and 2017

Measured in current value, the estimate of the total investment in mining and quarrying in 2016 amounted to NOK 680 million. This represents a sharp decline of almost 25 per cent compared with corresponding estimates from the previous year. The estimate for 2017 suggests a further decline.

Changed delimitation in the exploration activityOpen and readClose

From the survey in the 2nd quarter of 2016 the delimitation within the exploration activity has been changed. So far this activity has comprised only exploration costs regarding the production licences. From now on the exploration activity shall also comprise the licensees` exploration costs beyond licence costs. To be included are own costs related to licences where others are operators, own studies, ”sole risk” costs and costs related to applications for new licences. Accrued costs and estimates are changed according to a new delimitation from 2013 and will in a later survey be changed back to 2007.

The survey is merged with oil and gas activities, investments, starting with the next quarterly publicationOpen and readClose

As from the Q3 publication in 2015, the statistics on investments in manufacturing, mining and quarrying and electricity supply (KIS) were merged with the statistics on oil and gas activities, investments (OLJEINV). The combined statistics will provide a more comprehensive presentation of final and planned investments for oil and gas, manufacturing, mining and quarrying and electricity supply.

Find more figures

Fin detailed figures from Investments in oil and gas, manufacturing, mining and electricity supply

Contact

-

Ståle Mæland

E-mail: stale.maeland@ssb.no

tel.: (+47) 95 05 98 88

-

Edvard Andreassen

E-mail: edvard.andreassen@ssb.no

tel.: (+47) 40 90 23 32