Content

Published:

This is an archived release.

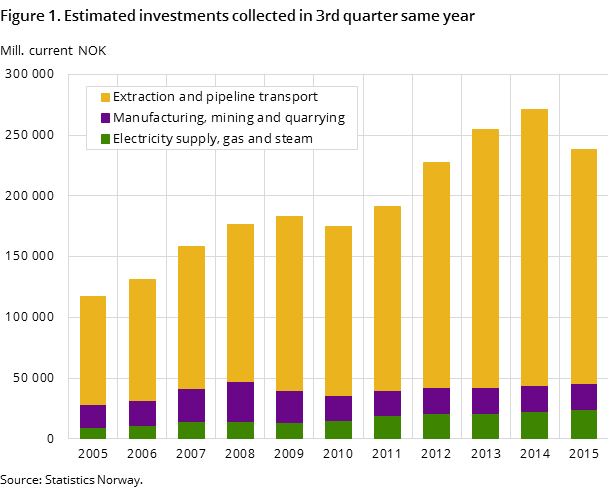

Investment decline in 2015

Estimates for total investments covering oil and gas, manufacturing, mining & quarrying and electricity supply show a strong decline in 2015. The downturn is mainly due to significantly lower investments within oil and gas. On the other hand, 2016 estimates indicate a sharp increase in export-related manufacturing.

| Estimates collected in Q3 the same year | |||

|---|---|---|---|

| 2015 / 2014 | 2014 | 2015 | |

| 1Values at current prices | |||

| Extraction, pipeline, mining, manuf. and elec | -12.1 | 271 095 | 238 411 |

| Extraction and pipeline transport | -15.1 | 227 267 | 193 021 |

| Manufacturing | 0.1 | 20 345 | 20 371 |

| Mining and quarrying | -32.1 | 1 301 | 883 |

| Electricity, gas and steam | 8.8 | 22 181 | 24 137 |

| Estimates collected in Q3 the previous year | |||

| 2016 / 2015 | 2015 | 2016 | |

| Extraction, pipeline, mining, manuf. and elec | 1.3 | 224 536 | 227 513 |

| Extraction and pipeline transport | -2.2 | 185 256 | 181 183 |

| Manufacturing | 34.7 | 14 365 | 19 355 |

| Mining and quarrying | -6.0 | 688 | 647 |

| Electricity, gas and steam | 8.7 | 24 227 | 26 328 |

New figures for 2015 show that total investments covering oil and gas, manufacturing, mining & quarrying and electricity supply are expected to amount to NOK 238.4 billion measured in current value. The estimate is 12.1 per cent lower than the corresponding figure for 2014. The decline is mainly due to a significant fall of 15.1 per cent within oil and gas. The decrease is, however, somewhat subdued by an investment increase in electricity supply, while manufacturing investments are more or less unchanged.

The latest estimates for 2016 show that total investments are expected to amount to NOK 227.5 billion; 1.3 per cent higher than the corresponding figure for 2015. Extraordinary high investment levels within manufacturing, together with further growth within electricity supply explain this rise. The growth is somewhat mitigated by lower investments within oil and gas.

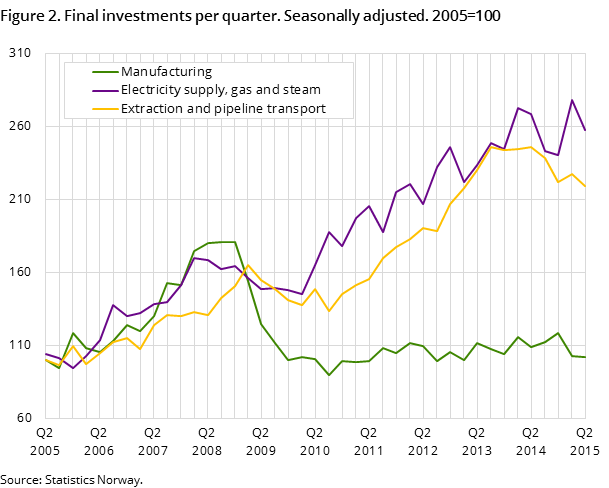

There was a 3.7 per cent decrease in quarterly final investments for extraction and pipeline transport in the second quarter of 2015 compared with the first quarter of 2015, according to seasonally-adjusted figures. Electricity supply also had a drop in quarterly final investments of 7.4 per cent in the same period. Manufacturing is more or less unchanged.

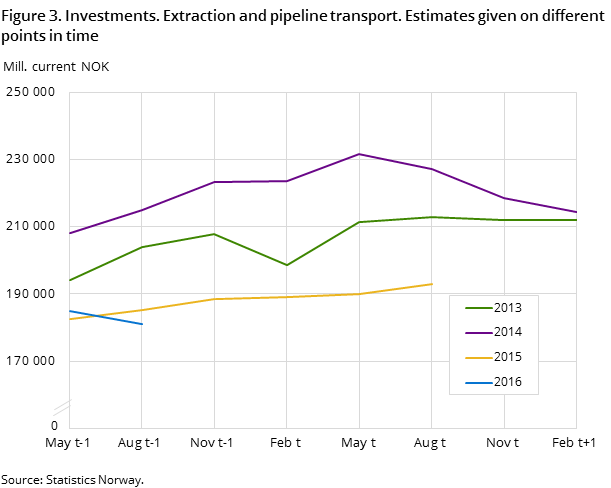

Lower estimates in oil and gas for 2016

The investments in oil and gas extraction and pipeline transport for 2016 are estimated at NOK 181.2 billion. This is 2.0 per cent lower than the previous estimate for 2016. The decrease is mainly due to lower estimates for exploration.

The estimate for 2016 is 2.2 per cent lower than the corresponding estimate for 2015, given in the 3rd quarter of 2014. The decrease is due to lower investments in fields on stream and pipeline transport, while field development, exploration and shutdown and removal seem to increase the investment level compared to 2015.

Higher estimates for 2015

The investments in oil and gas extraction and pipeline transport for 2015 are estimated at NOK 193 billion. This is 1.5 per cent higher than the previous estimate for 2015. The increase is mainly due to higher estimates for exploration. Some exploration wells previously planned for 2016 are now planned to be drilled in 2015.

The estimate for 2015 is 15.1 per cent lower than the corresponding estimate for 2014, given in the 3rd quarter of 2014. The decrease that is now indicated is lower than in the previous survey. In the previous quarter, the estimate was 18 per cent lower than the corresponding estimate for 2014.

It is particularly investments within field development, fields on stream, exploration and pipeline transport that show a decrease compared to corresponding estimates for 2014, while the estimates indicate an increase within onshore activities and shutdown and removal.

While the accrued investment costs came to NOK 47.8 billion in the 1st quarter, the accrued costs increased to NOK 50.4 billion in the 2nd quarter. The accrued investments in the first two quarters in 2015 totalled NOK 98.2 billion. Realisation of the current estimate for 2015 assumes investments of NOK 94.8 billion in the second half of 2015.

Sharp decrease in the investments in fields on stream after 2013

After several years with high investment activity within fields on stream, this investment category reached its peak in 2013 and has fallen since. Final investments fell from NOK 105.1 billion in 2013 to NOK 93.4 billion in 2014. The decrease appears to continue in 2015 and 2016; estimates in the present survey are NOK 81.7 and NOK 69.4 billion respectively. The decrease is particularly sharp within the subcategory services. While the final investments came to NOK 39.8 billion in 2013 the estimates are now only NOK 22.5 and NOK 15.4 billion for 2015 and 2016 respectively. The share of the investments within services accrued abroad is usually very low. The investment level within this subcategory is therefore important for Norwegian suppliers to oil and gas extraction. The sharp fall that is indicated within services therefore contributes to the challenges the Norwegian suppliers to the oil industry now face.

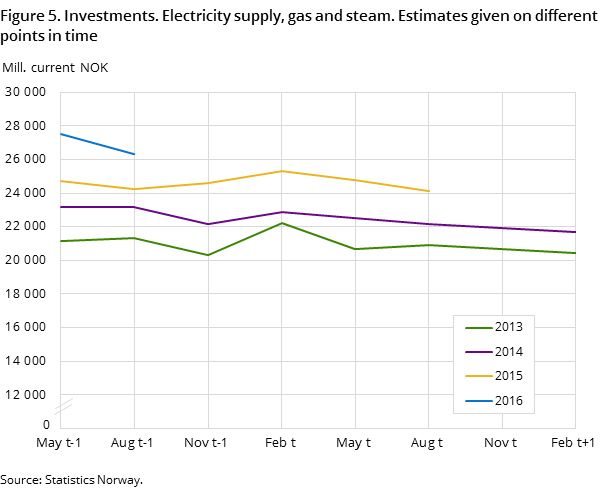

Growth in electricity supply in 2015 - continues in 2016

New estimates for 2015 show that total investments within electricity supply are expected to amount to NOK 24.1 billion; 9 per cent higher than the corresponding figure for 2014. High estimates within transmission and distribution of electricity explain this rise. The growth is particularly related to power grid upgrades and installation of new automatic electricity meters (AMR) .

Preliminary estimates for 2016 indicate a further investment growth within electricity supply; 9 per cent higher than the corresponding figure for 2015. Higher investments within production of electricity, and a further increase in transmission and distribution of electricity, explain this development. The investment increase within production of electricity is due to upgrades of old power stations.

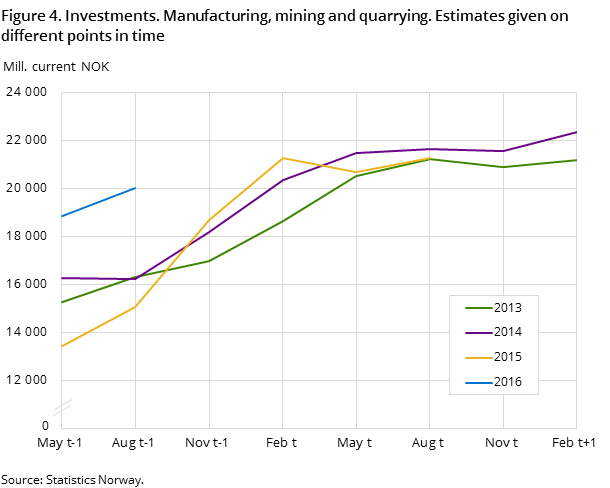

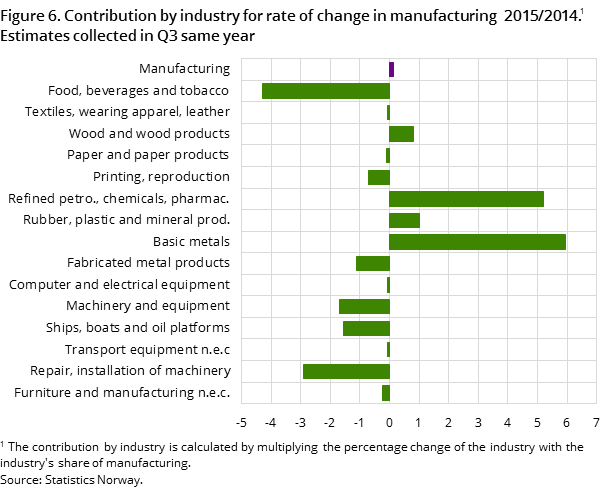

Strong growth in export-related manufacturing, decline in oil-related manufacturing

Estimates for 2015 show that total investments within manufacturing are expected to amount to NOK 20.4 billion; more or less unchanged compared with corresponding figures for 2014. However, there are large disparities between the different industries. Industries such as food and food products, machinery and equipment together with repair and installation of machinery are seeing a decline in investments. The downturn for machinery and equipment and repair and installation of machinery can be linked to lower investment activity in the oil and gas sector, while the fall in food and food products is related to completion of several large projects in the previous year. On the other hand, export-related industries such as the industry group refined petroleum, basic chemicals and the pharmaceutical industry together with basic metals are seeing high investment levels. The growth in these industries is related to capacity upgrades and modernisation, and some of the projects will go on for several years.

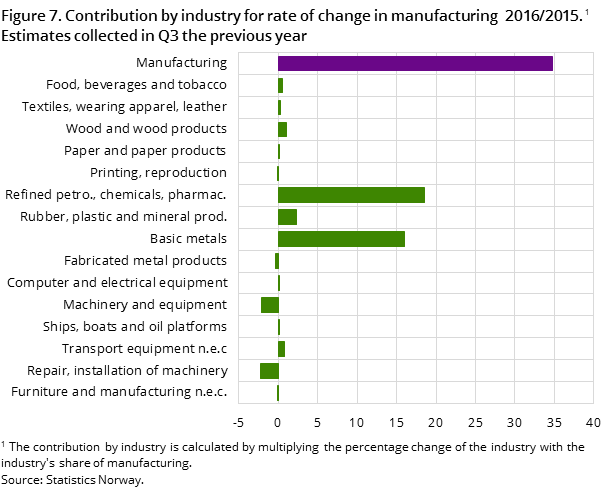

The latest estimates for manufacturing investments in 2016 indicate a sharp increase of 35 per cent, compared with the corresponding figure for 2015. This remarkable growth is due to the fact that the industry group refined petroleum, basic chemicals and pharmaceutical industry, and basic metals have growth rates equivalent to 100 and 89 per cent respectively. However, early estimates for next year entail a degree of uncertainty. In addition, the high figures for 2016 are strongly influenced by some large projects. Revision of these projects may affect the coming 2016 estimates.

Strong decline in mining and quarrying

Estimates for mining and quarrying in 2015 are expected to amount to NOK 883 million; a strong decline of 32 per cent compared with the corresponding figures for 2014.

The survey is merged with oil and gas activities, investments.Open and readClose

From the Q3 publication in 2015, the statistics on investments in manufacturing, mining and quarrying and electricity supply (KIS) are merged with the statistics on oil and gas activities, investments (OLJEINV). The combined statistics provide a more comprehensive presentation of final and planned investments for oil and gas, manufacturing, mining and quarrying and electricity supply.

From the Q3 publication in 2015, seasonally-adjusted figures for oil and gas are released. In addition, new and more informative Statbank tables are provided.

Find more figures

Fin detailed figures from Investments in oil and gas, manufacturing, mining and electricity supply

Contact

-

Ståle Mæland

E-mail: stale.maeland@ssb.no

tel.: (+47) 95 05 98 88

-

Edvard Andreassen

E-mail: edvard.andreassen@ssb.no

tel.: (+47) 40 90 23 32