Content

About seasonal adjustment

General information on seasonal adjustment

What is seasonal adjustment?

Monthly and quarterly time series are often characterised by considerable seasonal variations, which might complicate their interpretation. Such time series are therefore subjected to a process of seasonal adjustment in order to remove the effects of these seasonal fluctuations. Once data have been adjusted for seasonal effects by X-12-ARIMA or some other seasonal adjustment tool, a clearer picture of the time series emerges.

For more information on seasonal adjustment: metadata on methods: seasonal adjustment

Why seasonally adjust these statistics?

Why do we seasonally adjust statistics on quarterly investments in oil and gas, manufacturing, mining and electricity supply?

The statistics on quarterly investments in oil and gas, manufacturing, mining and electricity supply is part of a system of short-term statistics compiled to monitor the economy. The primary goal of the survey is to monitor the development in actual and estimated investments as they are important indicators on the demand for capital goods in the economy.

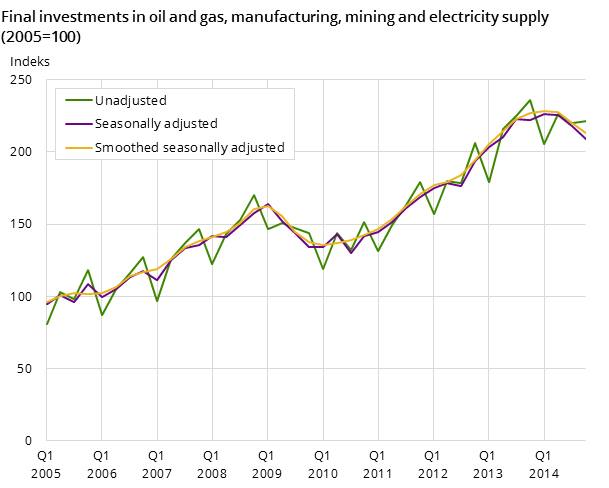

Historical data reveal that time series on quarterly investments in oil and gas, manufacturing, mining and electricity supply have a clear seasonal pattern (see chart), and this might complicate the interpretation of the time series from quarter to quarter.

However, it is possible to adjust for this type of seasonal variations (see chart).

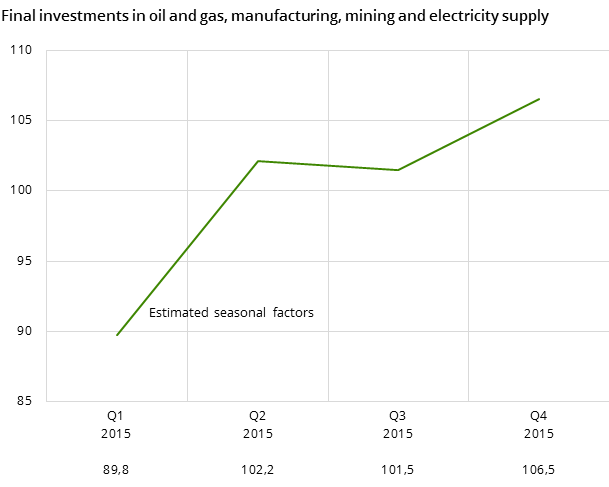

The seasonal factors (chart 1) show that quarterly investments seem to be low in the first quarter and high in the fourth quarter. The estimates for the second and the third quarter lie in between the two extremes and more or less share the same value. The stable seasonal pattern in the unadjusted series indicates a low degree of white noise. This conclusion is supported by the small gap between the seasonally adjusted time series and the smoothed seasonally adjusted time series (trend).

No empirical studies are conducted to explain the seasonal pattern for quarterly investments in oil and gas, manufacturing, mining and electricity supply. However, years of experience has shown that the following factors are possible sources of seasonal variations.

Seasonal variations

Temperatures and weather conditions seem to influence investment behaviour.

The nature of projects

Projects (particularly in manufacturing and electricity supply) often start at the beginning of the year and are scheduled to be finished within twelve months. Investments are most likely to be low in the initial phase of a project. The reason for this is that the groundwork often costs substantially less than new machinery and equipment.

Accounting principles

Some of the smaller establishments choose to report total investments in the fourth quarter of the year. This is against the guidelines, but can be explained by a lack of proper tools for making budgets and measure costs.

Seasonally adjusted time series

Seasonally adjusted time series are published for estimated and actual quarterly investments in:

- extraction of oil and gas, pipeline, mining, manuf. and electricity supply

- extraction of oil and gas and pipeline transport

- manufacturing, mining & quarrying and electricity supply

- manufacturing, mining & quarrying

- manufacturing

- mining & quarrying

- electricity supply

Pre-treatment

Pre-treatment routines/schemes

Pre-treatment is an adjustment for variations caused by calendar effects and outliers.

Automatic pre-treatment of raw data based on standard options in the seasonal adjustment tools.

Calendar adjustment

Calendar adjustment involves adjusting for the effects of working days/trading days and for moving holidays. Working days/trading days are adjustment for both the number of working days/trading days and for that the composition of days can vary from one month to another.

Calendar adjustments are performed on all time series showing significant and plausible calendar effects within a statistically robust approach such as regression or RegARIMA (a regression model with an ARIMA structure for the residuals).

Methods for trading/working day adjustment

RegARIMA correction. The effect of trading days is estimated in a RegArima framework.

The effect of trading days is estimated by using a correction for the length of the month and for leap year before regressing the series on the number of working days. The residuals will have an ARIMA-structure.

Correction for moving holidays

Automatic correction. If performed by X-12-ARIMA, automatic correction of raw data will be based on US holidays.

National and EU/euro area calendars

Use of default calendars. The default in X-12-ARIMA is the US calendar.

Treatment of outliers

Outliers, or extreme values, are abnormal values of the series.

Outliers are detected automatically by the seasonal adjustment tool. The outliers are removed before seasonal adjustment is carried out and then reintroduced into the seasonally adjusted data.

Model selection

Pre-treatment requires choosing an ARIMA model, as well as deciding whether the data should be log-transformed or not.

Automatic model selection by established routines in the seasonal adjustment tool.

Decomposition scheme

The decomposition scheme specifies how the various components – basically trend-cycle, seasonal and irregular – combine to form the original series. The most frequently used decomposition schemes are the multiplicative, additive or log additive.

Manual decomposition scheme selection after graphical inspection of the time series.

Seasonal adjustment

Choice of seasonal adjustment approach

X-12-ARIMA

Consistency between raw and seasonally adjusted data

In some series, consistency between raw and seasonally adjusted series is imposed.

Do not apply any constraint.

Consistency between aggregate/definition of seasonally adjusted data

In some series, consistency between seasonally adjusted totals and the aggregate is imposed .For some series there is also a special relationship between the different series, e.g. GDP which equals production minus intermediate consumption.

Do not apply any constraint.

Direct versus indirect approach

Direct seasonal adjustment is performed if all time series, including aggregates, are seasonally adjusted on an individual basis. Indirect seasonal adjustment is performed if the seasonally adjusted estimate for a time series is derived by combining the estimates for two or more directly adjusted series.

Direct seasonal adjustment is performed on aggregates and components using the same approach and software. Any discrepancies across the aggregation structure are not removed.

Horizon for estimating the model and the correction factors

When performing seasonal adjustment of a time series, it is possible to choose the period to be used in estimating the model and the correction factors. Correction factors are the factors used in the pre-treatment and seasonal adjustment of the series.

The whole time series is used to estimate the model and the correction factors

Audit procedures

General revision policy

Seasonally adjusted data may change due to a revision of the unadjusted (raw) data or the addition of new data. Such changes are called revisions, and there are several ways to deal with the problem of revisions when publishing the seasonally adjusted statistics.

Seasonally adjusted data are revised in accordance with a well-defined and publicly available revision policy and release calendar.

Concurrent versus current adjustment

The model, filters, outliers and regression parameters are re-identified and re-estimated continuously as new or revised data become available.

Horizon for published revisions

The revision period for the seasonally adjusted results is limited to 3-4 years prior to the revision period of the unadjusted data, while older data are frozen.

Comment: The revision period for the seasonally adjusted figures is 4 years when new data are added. The whole time series may be revised when implementing new or improved methods.

Quality of seasonal adjustment

Evaluation of seasonally adjustment data

Continuous/periodical evaluation using standard measures proposed by different seasonal adjustment tools.

Quality measures for seasonal adjustment

For most of the series, a selected set of diagnostics and graphical facilities for bulk treatment of data is used.

A table containing selected quality indicators for the seasonal adjustment is available here .

For more information on the quality indicator in the table see: metadata on methods: seasonal adjustment

Special cases

Seasonal adjustment of short time series

All series are sufficiently long to perform an optimal seasonal adjustment.

Treatment of problematic series

None of the published series are viewed as problematic.

Posting procedures

Data availability

Unadjusted and seasonally adjusted data are available.

Press releases

In addition to unadjusted data, at least one of the following series is released: Calendar adjusted, seasonally adjusted, smoothed seasonally adjusted (trend).

Relevant documentation

- Metadata on methods: seasonal adjustment

- EUROSTAT: Seasonal Adjustment. Methods and Practices

- US census: X-12-ARIMA-manual.

- The Committee for Monetary, Financial and Balance of Payments statistics: ESS-Guidelines on seasonal adjustment

- Ole Klungsøyr: Sesongjustering av tidsserier. Spektralanalyse og filtrering, Notat 2001/54, Statistisk sentralbyrå

- Dinh Quang Pham: Innføring i tidsserier - sesongjustering og X-12-ARIMA, Notater 2001/2, Statistisk sentralbyrå

- Dinh Quang Pham: Nye US Census-baserte metoder for ukedageffekter for norske data, Notater 2008/58, Statistisk sentralbyrå

- Ny metode for påskekorrigering for norske data, Notater 2007/43, Statistisk sentralbyrå.

Find more figures

Fin detailed figures from Investments in oil and gas, manufacturing, mining and electricity supply