Content

Published:

This is an archived release.

Decrease in household net lending

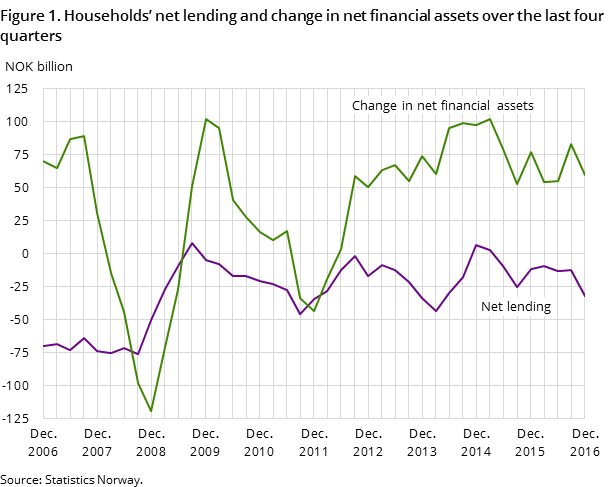

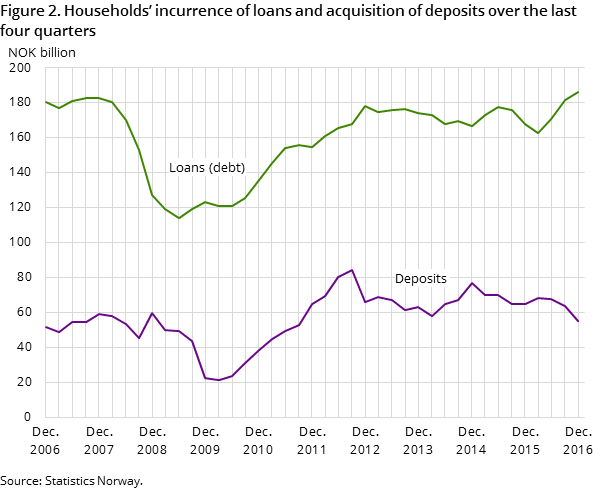

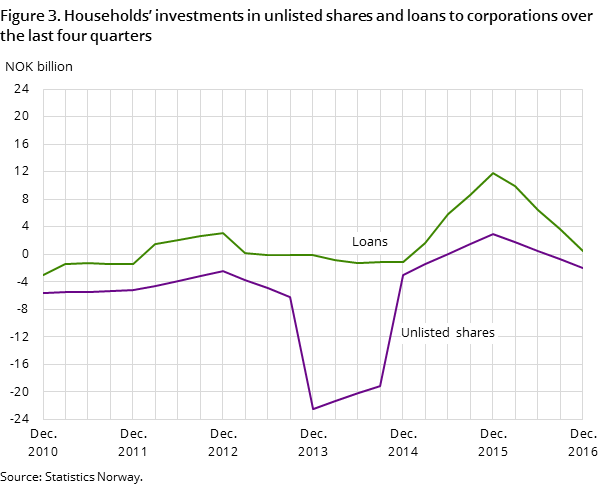

Households’ net lending in 2016 amounted to NOK -32 billion, compared to NOK -12 billion in 2015. The decrease can be explained by higher borrowing and lower investments in deposits, but also lower investments in unlisted shares and loans to corporations.

| 4th quarter 2015 | 1st quarter 2016 | 2nd quarter 2016 | 3rd quarter 2016 | 4th quarter 2016 | |

|---|---|---|---|---|---|

| 1Seasonal adjusted | |||||

| Assets | 4 054 618 | 4 089 196 | 4 184 569 | 4 219 149 | 4 290 784 |

| Liabilities | 3 119 966 | 3 126 737 | 3 203 939 | 3 229 344 | 3 296 648 |

| Net financial assets | 934 652 | 962 459 | 980 630 | 989 805 | 994 136 |

| Net lending | 1 272 | 18 427 | -6 310 | -25 281 | -18 976 |

| Other changes | 26 739 | 9 380 | 24 481 | 34 456 | 23 307 |

| Debt to income ratio1 | 229.7 | 230.7 | 233.3 | 234.0 | 234.8 |

| Debt growth (per cent)1 | 6.1 | 5.6 | 5.5 | 5.7 | 5.6 |

Households’ net lending is estimated at NOK -32 billion in 2016, which means that net borrowing has been higher than net investments in financial assets. The year 2016 was primarily characterised by higher borrowing and lower investments in deposits than in 2015. Net incurrence of loans increased from NOK 167 billion to NOK 186 billion, while net investments in deposits decreased from NOK 65 billion to NOK 55 billion.

The accounts also show that household lending to and investments in unlisted shares in corporations were lower in 2016 than in 2015. These high investments in 2015 were due to higher reinvested dividends in loans and shares, and must be seen in conjunction with an increase in dividends in 2015 caused by higher tax on dividends from 2016. In 2016, the level of dividends and reinvestments are assumed to be lower and at more normal levels. It should be noted that these estimates are based on preliminary sources, both for 2015 and 2016.

The household accounts have been revised since the last publication for the period first quarter 2014 to third quarter 2016. Investments in fund shares, other liabilities and pension entitlements in particular have been revised. There have also been large revisions for the non-financial corporations and the rest of the world accounts.

Contact

-

Torbjørn Cock Rønning

E-mail: torbjorn.cock.ronning@ssb.no

tel.: (+47) 97 75 28 57

-

Jon Ivar Røstadsand

E-mail: jon-ivar.rostadsand@ssb.no

tel.: (+47) 21 09 43 69

-

Marit Eline Sand

E-mail: marit.sand@ssb.no

tel.: (+47) 40 90 26 74