Content

Published:

This is an archived release.

Revised financial accounts for 2015

Household lending and investments in unlisted shares in 2015 are revised upwards. At the same time, tax debt is revised upward and investment in pension entitlements downward.

| 2nd quarter 2015 | 3rd quarter 2015 | 4th quarter 2015 | 1st quarter 2016 | 2nd quarter 2016 | |

|---|---|---|---|---|---|

| 1Seasonal adjusted | |||||

| Assets | 3 928 033 | 3 925 882 | 4 014 435 | 4 050 971 | 4 147 717 |

| Liabilities | 3 034 664 | 3 053 955 | 3 119 971 | 3 132 376 | 3 213 166 |

| Net financial assets | 893 369 | 871 927 | 894 464 | 918 595 | 934 551 |

| Net lending | -6 006 | -26 977 | -318 | 12 527 | -6 844 |

| Other changes | 22 793 | 5 535 | 22 855 | 11 604 | 22 800 |

| Debt to income ratio1 | 224.3 | 226.8 | 230.7 | 233.3 | 236.7 |

| Debt growth (per cent)1 | 6.6 | 6.4 | 6.1 | 5.8 | 5.8 |

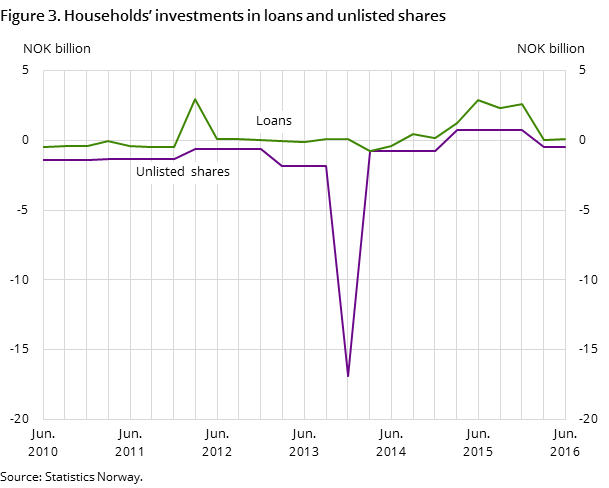

Updated sources for the financial accounts have led to larger revisions in 2015 than normal. The revised accounts show that household lending and investments in unlisted shares was higher than in previous versions. These investments are revised upwards by a total of NOK 16 billion. The revision is due to updated sources that show higher dividends, loans and shares in 2015. This increase must be seen in connection with higher dividends caused by higher tax on this income from 2016. The preliminary sources indicate that some of the extra dividends received have been reinvested in loans and shares in the companies.

At the same time, tax debt is revised upward and investment in pension entitlements downward. Net lending for the households is therefore not so affected, with just a NOK 5 billion upward revision.

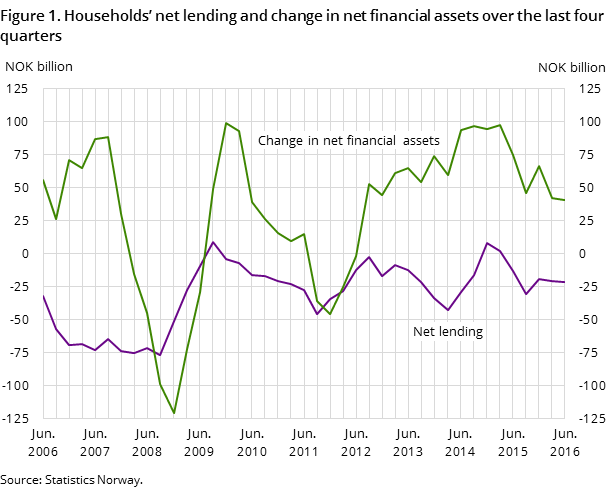

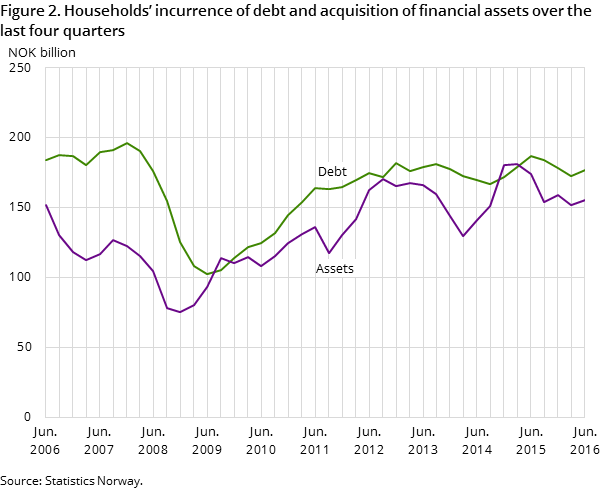

Net lending in the last four-quarter period for the household sector amounted to NOK -22 billion in the second quarter of 2016. This is the same amount as in the first quarter of 2016. The first two quarters of 2016 are characterised by higher borrowing and lower investments in loans and unlisted shares.

Contact

-

Torbjørn Cock Rønning

E-mail: torbjorn.cock.ronning@ssb.no

tel.: (+47) 97 75 28 57

-

Jon Ivar Røstadsand

E-mail: jon-ivar.rostadsand@ssb.no

tel.: (+47) 21 09 43 69

-

Marit Eline Sand

E-mail: marit.sand@ssb.no

tel.: (+47) 40 90 26 74