Content

Published:

This is an archived release.

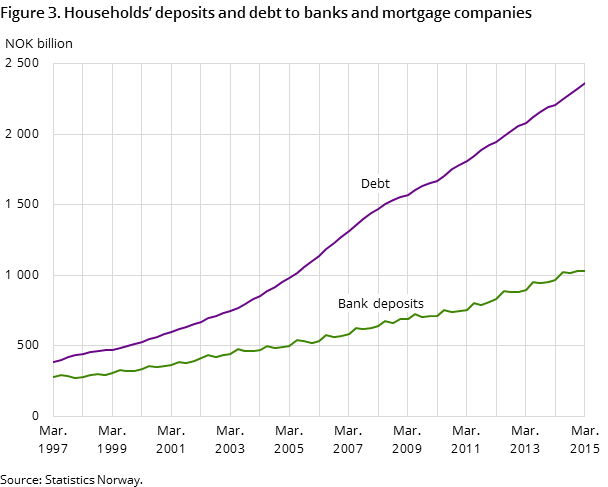

Household net debt to the banks increases

The increase in household deposits declined, while borrowing from the banking sector and investments in securities grew in the first quarter of 2015. This is a change from the previous quarter, when the increase in bank deposits was at a record high and debt developments were stable.

| 1st quarter 2014 | 2nd quarter 2014 | 3rd quarter 2014 | 4th quarter 2014 | 1st quarter 2015 | |

|---|---|---|---|---|---|

| 1Seasonal adjusted | |||||

| Assets | 3 616 581 | 3 718 266 | 3 749 246 | 3 827 101 | 3 885 196 |

| Liabilities | 2 772 577 | 2 840 509 | 2 864 513 | 2 935 655 | 2 958 020 |

| Net financial assets | 844 004 | 877 757 | 884 733 | 891 446 | 927 176 |

| Net lending | 26 119 | 1 966 | -3 907 | -8 164 | 10 760 |

| Other changes | 20 073 | 31 787 | 10 883 | 14 877 | 24 970 |

| Debt to income ratio1 | 224.5 | 225.2 | 225.4 | 227.2 | 228.8 |

| Debt growth (per cent)1 | 6.6 | 6.3 | 6.2 | 6.1 | 6.5 |

Households’ net purchase of shares in mutual funds amounted to NOK 9 billion in the last four-quarter period to the first quarter of 2015. There was also a modest net purchase of shares in the previous quarter, but overall there was a net sale of other securities from the household portfolio in the four-quarter period.

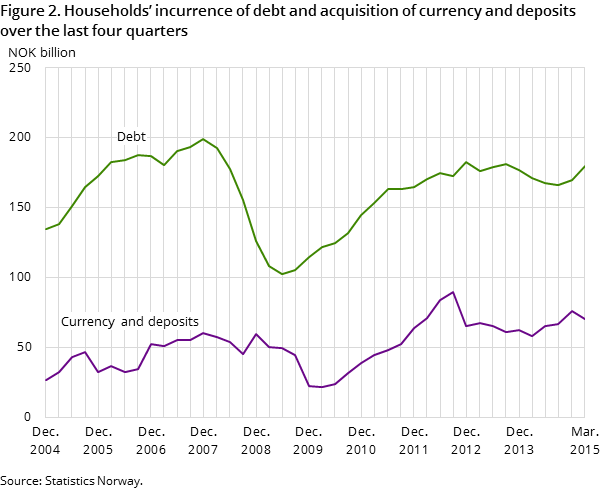

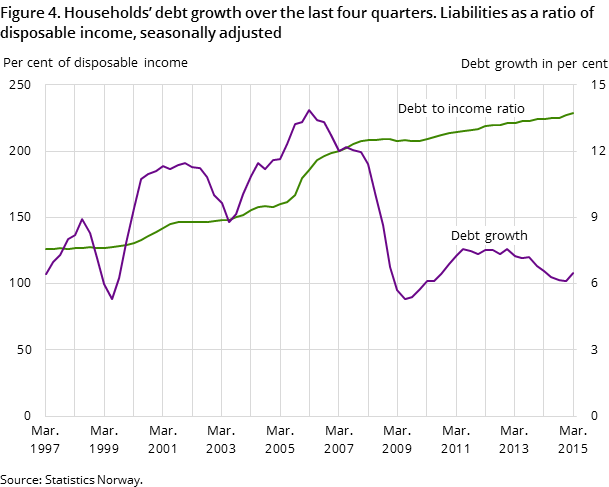

Increased debt growth

Households’ bank deposits increased by NOK 69 billion, which is a NOK 7 billion lower increase than in the previous four-quarter period. At the same time, households’ incurrence of debt is calculated at NOK 180 billion, which is up NOK 10 billion from the previous four-quarter period. Borrowing from banks and mortgage companies was NOK 148 billion after an increase in borrowing of NOK 19 billion in the first quarter of 2015.

The development is illustrated by the debt growth, which was 6.5 per cent last quarter compared to 6.1 per cent in the fourth quarter of last year. The seasonally-adjusted debt to income ratio was 228.8 per cent of disposable income at the end of the first quarter of 2015 compared to 227.2 per cent at the end of the previous quarter.

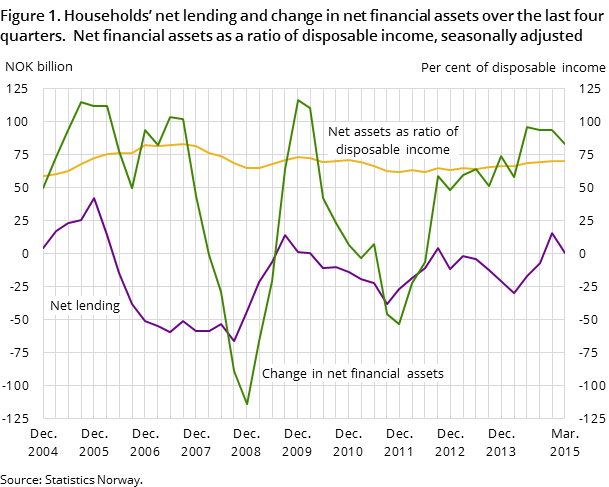

Lower net lending

Households’ net lending was NOK 1 billion in the last four-quarter period. Net lending was reduced by NOK 15 billion from the previous four-quarter period. Net holding gains contributed with NOK 82 billion and households’ net assets increased by NOK 83 billion in the last four-quarter period to the first quarter of 2015.

Contact

-

Torbjørn Cock Rønning

E-mail: torbjorn.cock.ronning@ssb.no

tel.: (+47) 97 75 28 57

-

Jon Ivar Røstadsand

E-mail: jon-ivar.rostadsand@ssb.no

tel.: (+47) 21 09 43 69

-

Marit Eline Sand

E-mail: marit.sand@ssb.no

tel.: (+47) 40 90 26 74