Content

Published:

This is an archived release.

Flattening debt growth for households

After falling from the end of 2012 up until the start of 2014, households’ debt growth is now estimated at 6.1 per cent in 2014. Corresponding figures for 2012 and 2013 were 7.6 and 6.8 per cent respectively. The development shows a flattening in debt growth in the last half of 2014.

| 4th quarter 2013 | 1st quarter 2014 | 2nd quarter 2014 | 3rd quarter 2014 | 4th quarter 2014 | |

|---|---|---|---|---|---|

| 1Seasonal adjusted | |||||

| Assets | 3 559 610 | 3 621 740 | 3 723 916 | 3 749 627 | 3 815 494 |

| Liabilities | 2 761 136 | 2 772 577 | 2 840 509 | 2 864 513 | 2 934 147 |

| Net financial assets | 798 474 | 849 163 | 883 407 | 885 114 | 881 347 |

| Net lending | -32 909 | 29 815 | 1 709 | -9 956 | -13 011 |

| Other changes | 37 925 | 20 874 | 32 535 | 11 663 | 9 244 |

| Debt to income ratio1 | 224.4 | 224.6 | 225.1 | 225.9 | 227.4 |

| Debt growth (per cent)1 | 6.8 | 6.6 | 6.3 | 6.2 | 6.1 |

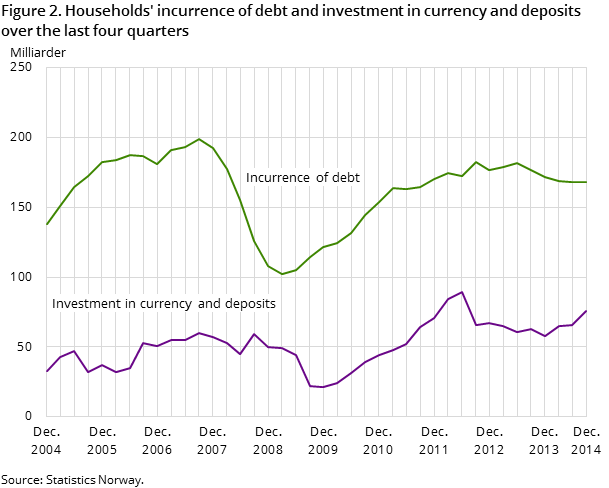

Households’ net incurrence of debt is estimated at NOK 168 billion in 2014. This is around the same level as in the last part of 2011. Simultaneous to the flattening of the debt development, the investment in currency and deposits also continues to increase. Investments in these assets have risen in the last three four-quarter periods, with households investing a total of NOK 76 billion in currency and deposits in 2014. The comparable amount invested in 2013 was NOK 63 billion.

The withdrawals of households’ investments in equity also continue. During the quarters of 2014, households’ net investments in these assets ended at minus NOK 4 billion. Listed shares account for the majority of this change, with a net sale of more than NOK 3 billion in 2014.

Positive net lending

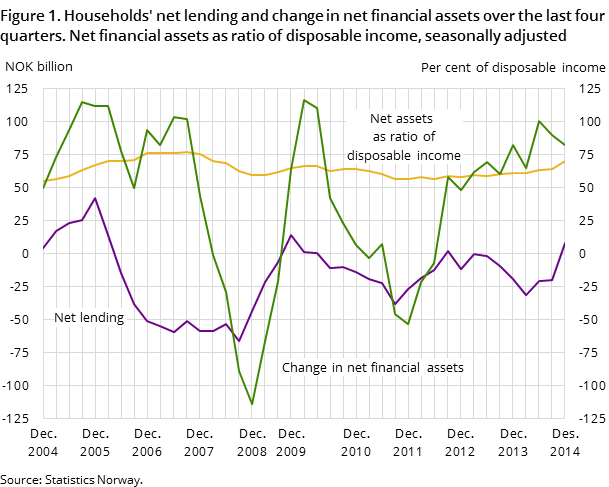

Net lending for households amounted to NOK 9 billion in 2014. This was the first time since the period from the 4th quarter of 2011 to the 3rd quarter of 2012 that net lending for the last four quarters ended on the plus side. Changes in net financial assets for 2014 were NOK 83 billion, and net gains ended at NOK 74 billion.

Contact

-

Torbjørn Cock Rønning

E-mail: torbjorn.cock.ronning@ssb.no

tel.: (+47) 97 75 28 57

-

Jon Ivar Røstadsand

E-mail: jon-ivar.rostadsand@ssb.no

tel.: (+47) 21 09 43 69

-

Marit Eline Sand

E-mail: marit.sand@ssb.no

tel.: (+47) 40 90 26 74