Content

Published:

This is an archived release.

Households’ debt growth levels off

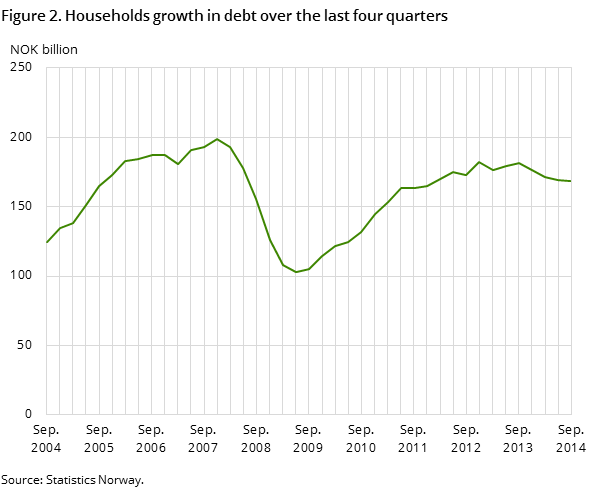

Households’ borrowing over the last four quarters to the third quarter of 2014 amounted to NOK 168 billion, compared to NOK 169 billion in the previous four-quarter period. This is the fourth quarter in a row with a fall in borrowing.

| 3rd quarter 2013 | 4th quarter 2013 | 1st quarter 2014 | 2nd quarter 2014 | 3rd quarter 2014 | |

|---|---|---|---|---|---|

| 1Seasonal adjusted | |||||

| Assets | 3 498 480 | 3 570 247 | 3 629 174 | 3 731 335 | 3 756 485 |

| Liabilities | 2 699 638 | 2 764 533 | 2 775 526 | 2 843 518 | 2 867 591 |

| Net financial assets | 798 842 | 805 714 | 853 648 | 887 817 | 888 894 |

| Net lending | -12 973 | -32 438 | 24 975 | -344 | -12 227 |

| Other changes | 24 953 | 39 310 | 22 959 | 34 513 | 13 304 |

| Debt to income ratio1 | 203.7 | 204.8 | 204.9 | 206.2 | 207.9 |

| Debt growth (per cent)1 | 7.2 | 6.8 | 6.6 | 6.3 | 6.3 |

Banks and mortgage companies are households’ most important credit sources. Households borrowed NOK 121 billion from these sources in the last four-quarter period, compared to NOK 118 billion in the previous period. Borrowing from the central government went down from NOK 21 billion to NOK 17 billion in last four-quarter period.

Steady development in households’ net lending

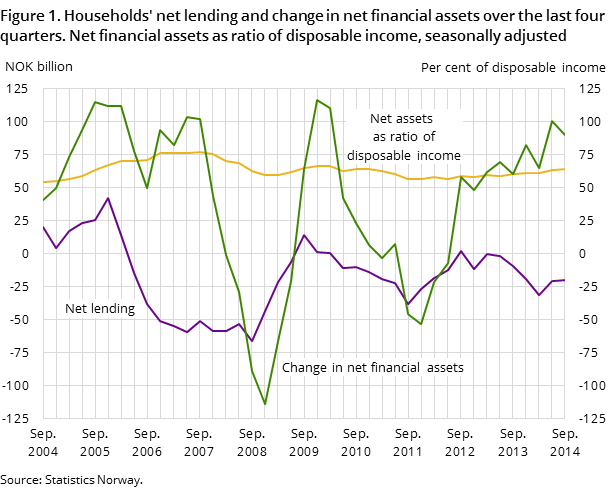

Households’ net lending is estimated at NOK -20 billion over the last four quarters, compared to NOK -21 billion in the previous four-quarter period. The increase in net financial assets is estimated at NOK 90 billion in the last period and net holding gains at NOK 110 billion. The revaluation of unlisted shares made a major contribution to total holding gains, but is estimated and uncertain.

Contact

-

Torbjørn Cock Rønning

E-mail: torbjorn.cock.ronning@ssb.no

tel.: (+47) 97 75 28 57

-

Jon Ivar Røstadsand

E-mail: jon-ivar.rostadsand@ssb.no

tel.: (+47) 21 09 43 69

-

Marit Eline Sand

E-mail: marit.sand@ssb.no

tel.: (+47) 40 90 26 74