Content

Published:

This is an archived release.

Households’ debt growth levels off

Households’ debt growth in 2013 was lower than in 2012. As a consequence, households’ net lending was higher in 2013 than in 2012, but still negative.

| Non financial corp. etc. | Financial corporations | General government | Households and NPISH | Rest of the world | |

|---|---|---|---|---|---|

| 4th quarter 2013 | |||||

| Net financial assets, start of period | -2 941 794 | 406 404 | 5 821 097 | 474 385 | -3 760 091 |

| Net lending | 61 580 | -19 745 | 59 281 | -20 937 | -80 180 |

| Other changes | -126 836 | 2 036 | 278 931 | 46 128 | -200 261 |

| Net financial assets, end of period | -3 007 049 | 388 695 | 6 159 309 | 499 577 | -4 040 531 |

| 1st quarter 2013 - 4th quarter 2013 | |||||

| Net lending (sum) | -49 252 | 43 289 | 348 151 | -24 147 | -318 043 |

| Other changes (sum) | -241 764 | 21 749 | 934 096 | 94 268 | -808 352 |

| Growth in debt (per cent) | 1.5 | 2.5 | 7.3 | 6.6 | 7.0 |

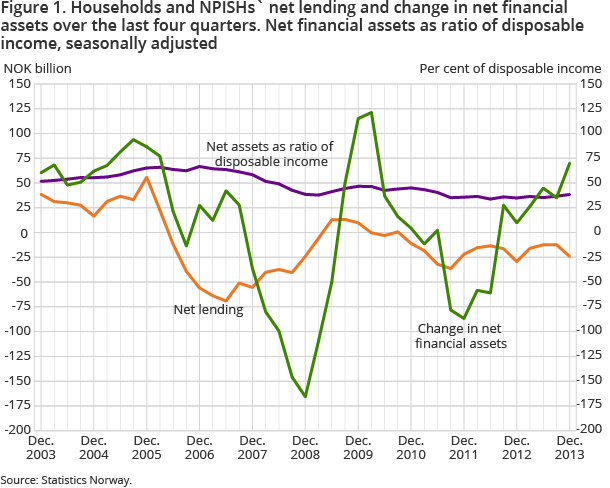

Households’ net lending is calculated to NOK -24 billion in 2013 compared to NOK -29 billion in 2014. Household borrowing is calculated to NOK 174 billion in 2013 compared to NOK 188 billion in 2012. Borrowing from the financial sector decreased, but some of this reduction was counteracted by an increase in borrowing from the government sector.

Households’ investments in financial assets also decreased from NOK 159 billion in 2012 to NOK 149 billion in 2013. This reduction is strongly influenced by a capital transfer of unquoted shares from the household sector to the non-financial corporation sector in the fourth quarter of 2013. This transaction alone accounts for NOK 15 billion of the reduction in 2013.

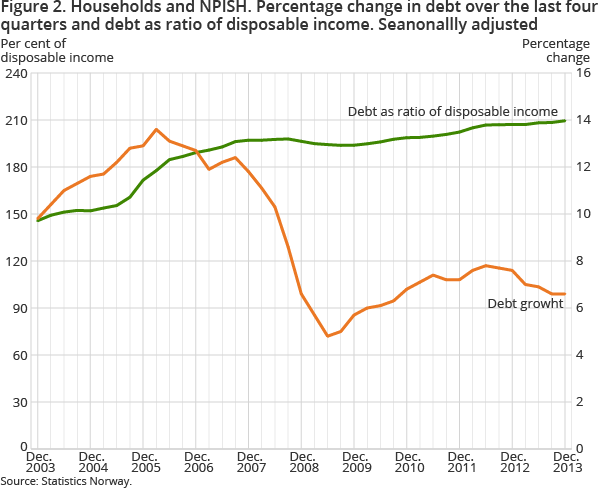

Debt growth levels off, but debt to income ratio sees further increase

The estimated annual growth rate for households’ debt levelled off in 2013 and the seasonally-adjusted growth rate is calculated to 6.6 per cent, compared to 7.6 per cent in 2012. The debt to income ratio continued to increase from 207.1 per cent in the fourth quarter of 2012 to 209.5 per cent in the fourth quarter of 2013.

Increase in households’ net financial assets

Households’ net financial assets increased from NOK 429 billion at the end of 2012 to NOK 500 billion at the end of 2013. Net holding gains in 2013 amounted to NOK 94 billion, while net lending amounted to NOK -24 billion.

Record high holding gains for the central government

The central government’s net holding gains are calculated to as much as NOK 934 billion in 2013. Net holding gains to the rest of the world explain the development and amounted to NOK 864 billion. The major holding gains are due to the exchange rate development and increased market prices in the foreign shares held by the Government Pension Fund Global. Central government net financial transactions in 2013 amounted to NOK 365 billion, compared to NOK 436 billion in 2012. Central government’s net assets are calculated to NOK 6 332 billion at the end of 2013, while central government net foreign assets are calculated to NOK 4 846 billion.

Net foreign assets continue to increase

Norway’s net foreign assets are calculated to NOK 4 041 billion at the end of 2013. This is up NOK 1 126 billion from the end of 2012. Norway’s net lending abroad was NOK 318 billion in 2013 compared to NOK 416 billion in 2012. Net holding gains, due to exchange rate developments in foreign exchange and global securities markets, increased the value of net financial assets abroad by NOK 808 billion in 2013.

Contact

-

Torbjørn Cock Rønning

E-mail: torbjorn.cock.ronning@ssb.no

tel.: (+47) 97 75 28 57

-

Jon Ivar Røstadsand

E-mail: jon-ivar.rostadsand@ssb.no

tel.: (+47) 21 09 43 69

-

Marit Eline Sand

E-mail: marit.sand@ssb.no

tel.: (+47) 40 90 26 74