Content

Published:

This is an archived release.

Households’ withdraw deposits

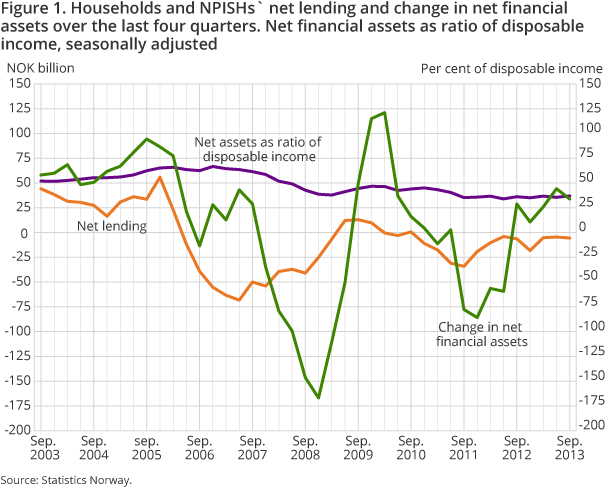

Households’ growth in deposits has decreased over the last four quarters. In the same period, growth in liabilities also decreased. This resulted in a steady development in households’ net lending, which are calculated to NOK -5.5 billion over the last four quarters.

| Non financial corp. etc. | Financial corporations | General government | Households and NPISH | Rest of the world | |

|---|---|---|---|---|---|

| 3rd quarter 2013 | |||||

| Net financial assets, start of period | -2 746 708 | 363 248 | 5 448 586 | 477 400 | -3 542 525 |

| Net lending | 8 695 | 21 821 | 67 348 | -22 285 | -75 578 |

| Other changes | -142 872 | 23 194 | 290 871 | 20 291 | -191 484 |

| Net financial assets, end of period | -2 880 886 | 408 263 | 5 806 804 | 475 405 | -3 809 587 |

| 4th quarter 2012 - 3rd quarter 2013 | |||||

| Net lending (sum) | -25 143 | 30 739 | 350 123 | -5 500 | -350 218 |

| Other changes (sum) | -150 051 | 30 414 | 646 296 | 39 362 | -566 022 |

| Growth in debt (per cent) | 2.5 | 1.0 | 6.4 | 6.5 | 6.2 |

The household sector normally decreases its holdings of deposits in the third quarter due to a quarterly pattern of tax deduction and higher holiday spending. The decrease in deposits this quarter was still higher than normal. The decrease in deposits amounted to NOK 21 billion. Net lending in the third quarter of 2013 amounted to NOK -22 billion, compared to NOK -21 billion in the third quarter of 2012.

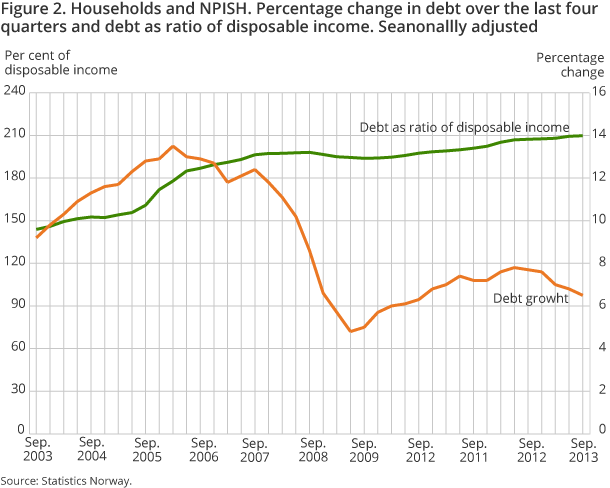

Debt growth levels off, but the debt to income ratio still increases

Household borrowing is calculated to NOK 170 billion in the last four quarter period, which is a decrease of NOK 6 billion from the previous period. The estimated annual growth rate for households’ debt levelled off in the third quarter of 2013 and the seasonally-adjusted growth rate is calculated to 6.5 per cent, compared to 6.8 per cent in the second quarter. The debt to income ratio still increased from 209.4 per cent in the second quarter to 209.8 per cent in the third quarter of 2013.

Households’ debt is composed of two instruments; loans and other accounts payable. Debt growth is mostly influenced by loans from the financial corporations, but borrowing from the government sector has also influenced the development recently. Borrowing from these two sectors amounted to NOK 145 and 28 billion respectively. This corresponds to an annual growth of 6 and 35 per cent respectively.

Modest decrease in net financial assets

Households’ net financial assets had a modest decrease of NOK 2 billion in the third quarter of 2013, but are NOK 34 billion higher than at the end of the third quarter of 2012. Net financial assets amounted to NOK 475 billion at the end of the quarter. Holding gains in the third quarter of 2013 amounted to NOK 20 billion and net financial transactions to NOK -22 billion.

Record high holding gains for the central government

The central government’s net holding gains are calculated to NOK 654 billion in the four-quarter period to the end of the third quarter of 2013. Net holding gains to the rest of the world explain the development and amounted to NOK 641 billion. The major holding gains are due to the exchange rate development and increased market prices in the foreign shares held by the Government Pension Fund Global. Central government’s net foreign assets are calculated to NOK 4 526 billion at the end of the third quarter of 2013. Central government net lending in the last four quarters amounted to NOK 387 billion, a modest increase from the last period.

Net foreign assets continue to increase

Norway’s net foreign assets are calculated to NOK 3 810 billion at the end of the third quarter of 2013. This is up NOK 267 billion from the end of the second quarter of 2013. Norway’s net lending abroad was NOK 76 billion in the third quarter of 2013, which is NOK 6 billion lower than in the previous quarter. Net holding gains, due to exchange rate developments in foreign exchange and global securities markets, increased the value of net financial assets abroad by NOK 191 billion in the third quarter of 2013.

Planned changes in the national accounts statisticsOpen and readClose

New revised figures for national accounts and related statistics will be published in November and December 2014. Statistics Norway complies with international guidelines in its preparation of national accounts and statistics on foreign affairs. New international guidelines have now been issued for these statistics. Statistics Norway is currently in the process of implementing the changes, in addition to new source data for some of the statistics.

Contact

-

Torbjørn Cock Rønning

E-mail: torbjorn.cock.ronning@ssb.no

tel.: (+47) 97 75 28 57

-

Jon Ivar Røstadsand

E-mail: jon-ivar.rostadsand@ssb.no

tel.: (+47) 21 09 43 69

-

Marit Eline Sand

E-mail: marit.sand@ssb.no

tel.: (+47) 40 90 26 74