Content

Published:

This is an archived release.

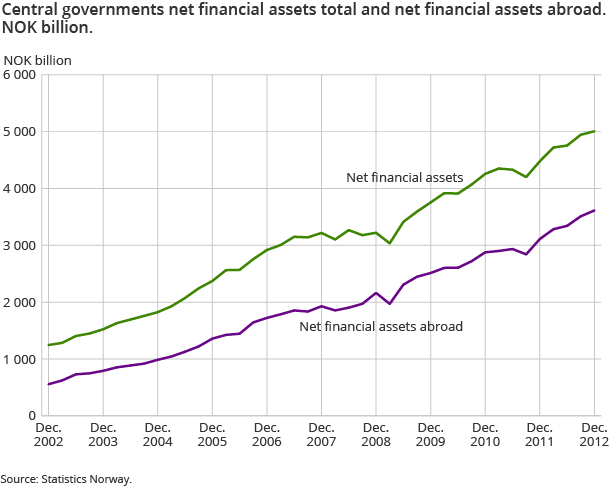

Central government’s net financial assets over NOK 5 000 billion

Central government’s net financial assets are estimated at NOK 5 006 billion at the end of 2012. This is almost NOK 1 million per capita.

| Non financial corp. etc. | Financial corporations | General government | Households and NPISH | Rest of the world | |

|---|---|---|---|---|---|

| 4th quarter 2012 | |||||

| Net financial assets, start of period | -2 690 405 | 328 490 | 4 797 161 | 404 285 | -2 839 531 |

| Net lending | 65 392 | -6 809 | 61 053 | -14 849 | -104 786 |

| Other changes | -28 998 | -36 113 | -11 397 | -1 434 | 77 942 |

| Net financial assets, end of period | -2 654 011 | 285 567 | 4 846 817 | 388 001 | -2 866 375 |

| 1st quarter 2012 - 4th quarter 2012 | |||||

| Net lending (sum) | 5 269 | 18 379 | 394 147 | -5 352 | -412 442 |

| Other changes (sum) | -204 127 | -39 412 | 113 297 | 106 339 | 23 902 |

| Growth in debt (per cent) | 3.3 | 5.3 | 7.4 | 7.0 | 8.6 |

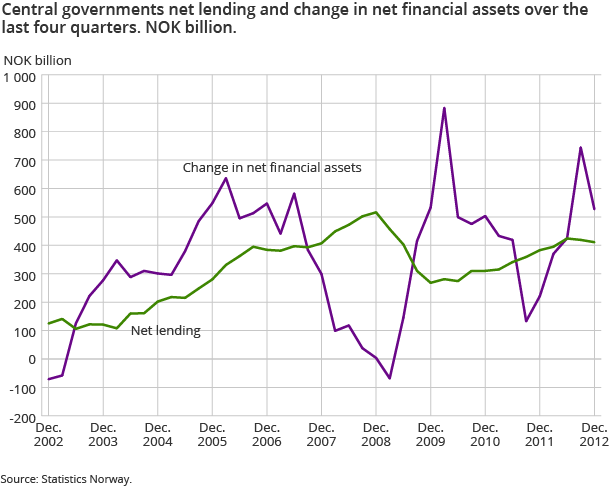

Central government’s net lending in 2012 is estimated in the financial accounts at NOK 411 billion. At the same time, central government’s net holding gains amounted to NOK 116 billion. This led to an increase of NOK 527 billion in net financial assets.

Net holding gains abroad amounted to NOK 122 billion, while net holding losses led to a decline in value by NOK -6 billion on domestic securities. Financial assets abroad are mainly holdings by the Government Pension Fund Global. The market value of the Fund was NOK 3 816 billion at the end of 2012.

The central government also holds stocks issued by Norwegian companies quoted on Oslo stock exchange. The market value of this portfolio was NOK 549 billion at the end of 2012. The central government had a holding loss of NOK 2.6 billion on this portfolio in 2012. This can be explained by a fall in the listed price of Statoil, which is dominant in the domestic portfolio.

Deposits in the central bank, other assets (mainly accrued not received taxes) and capital contributions in central government companies amounted to NOK 587 billion at the end of 2012.

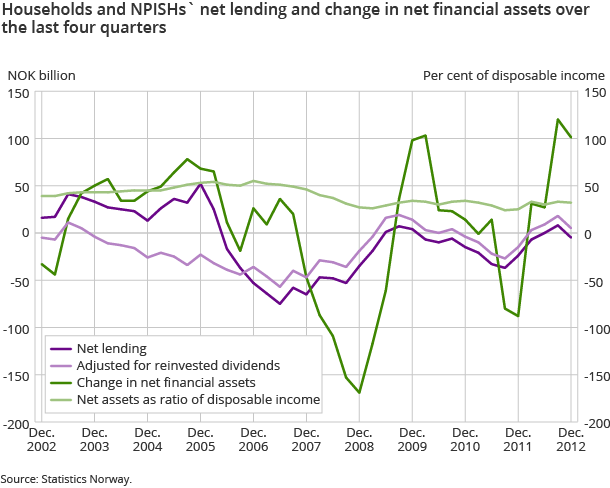

The household sector increases its financial investments

Households and non-profit institutions serving households increased their net lending by NOK 19 billion from 2011 to 2012. Net lending is estimated in the financial accounts at NOK -5.4 billion in 2012 compared to NOK-24.5 billion in 2011. The increase is mainly explained by financial investments and in particular the acquisition of insurance technical reserves and shares and other equity.

Only in 2005 has there been higher financial investments undertaken by the household sector. This year was characterised by high dividends motivated by tax planning. It is estimated that NOK 75 billion of the dividends was reinvested in the companies as shares and loans. Investments in financial assets amounted to NOK 167 billion in 2012, NOK143 billion in 2011 and NOK 229 billion in 2005.

The growth in deposits went down from NOK 66 billion in 2011 to NOK 65 billion in 2012. The development is explained by the growth in the fourth quarter, which fell from NOK 22 billion in 2011 to NOK 10 billion in 2012.. Investments in insurance technical reserves went up from NOK 63 to 72 billion, while investments in shares and mutual funds went up from NOK -8.4 to 1.6 billion.

Stable growth in total debt for the household sector

The growth in total debt over the last four quarters for the household sector has been stable in the last seven quarters and is estimated at 7.0 per cent in the fourth quarter of 2012. The incurring of debt in 2012 was NOK 173 billion compared to NOK 167 billion in 2011. The incurring of debt from the government sector and the financial sector was NOK 19 and 149 billion respectively in 2012, compared to NOK 12 and 142 billion in 2011.

Increase in net financial assets abroad

Norway’s financial assets abroad increased from NOK 7 350 billion at the end of 2011 to NOK 7 933 billion at the end of 2012. At the same time, Norway’s foreign debt increased from NOK 4 872 billion to NOK 5 066 billion. Net financial assets abroad increased from NOK 2 478 to 2 866 billion.

The central government’s financial assets Open and readClose

The central government’s financial assets are made up of foreign and domestic assets. Assets abroad is dominated by stocks and bonds held by the Government Pension Fund Global. The Government Pension Fund Norway also has assets abroad in the Nordic countries.

One substantial component of assets in Norway is quoted shares in large domestic listed companies like Statoil, DNB, Telenor and Norsk Hydro. The central government also has stakes in the form of equity in government-owned unlisted units and deposits in the central bank.

Contact

-

Torbjørn Cock Rønning

E-mail: torbjorn.cock.ronning@ssb.no

tel.: (+47) 97 75 28 57

-

Jon Ivar Røstadsand

E-mail: jon-ivar.rostadsand@ssb.no

tel.: (+47) 21 09 43 69

-

Marit Eline Sand

E-mail: marit.sand@ssb.no

tel.: (+47) 40 90 26 74