Content

Published:

Updated:

This is an archived release.

NOK 434 billion in assessed taxes

In 2014, the total assessed taxes amounted to NOK 434 billion for residents aged 17 years and older. This was an increase of 3.7 per cent from 2013.

| 2014 | Percentage change in average | |||

|---|---|---|---|---|

| Number of persons with amount | Average for persons with amount (NOK) | 2013 - 2014 | 2009 - 2014 | |

| Gross income | 4 059 909 | 426 100 | 3.6 | 21.8 |

| Basis for Surtax on Gross income | 3 921 161 | 411 100 | 3.3 | 21.0 |

| Ordinary income after special deduction | 3 949 951 | 320 600 | 3.7 | 24.1 |

| Taxable gross wealth | 4 043 392 | 1 012 100 | 6.5 | 43.3 |

| Debt | 2 993 312 | 956 300 | 4.1 | 26.2 |

| Surtax on gross income | 958 398 | 26 000 | 7.0 | 25.0 |

| Wealth tax | 572 689 | 23 400 | 4.5 | 49.0 |

| Assessed taxes | 3 637 788 | 119 300 | 2.8 | 23.0 |

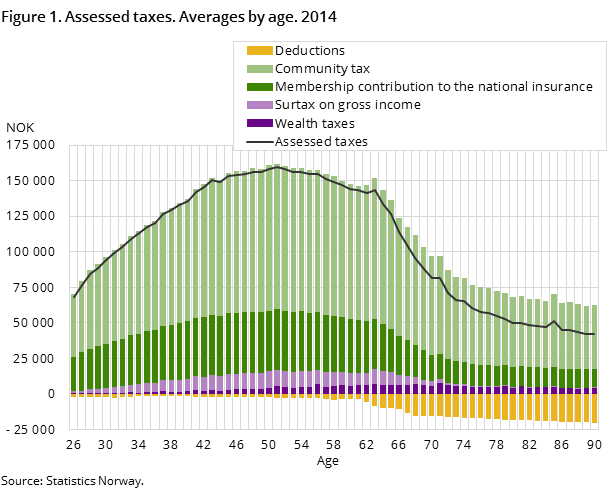

Average assessed taxes for residents aged 17 and older was NOK 119 300 in 2014; an increase of 2.8 per cent from 2013. The composition and level of assessed taxes varies with age. People around 50 years of age had on average NOK 155 000 in assessed taxes, while for 80 year-olds the amount was around NOK 50 000.

Strong increase in National Insurance contributions

As a result of an increased tax rate on national insurance contributions, the total national insurance contributions increased by 10 per cent to NOK 123.8 billion in 2014. The annual increase amounted to NOK 11.2 billion, or about 70 per cent of the total increase in assessed taxes in 2014 of NOK 15.6 billion. Fewer people were assessed with surtax on gross income in 2014, but total surtax increased. A total of 958 000 people were assessed with surtax in 2014; a reduction of 24 000 persons from the year before, while total surtax increased by 4.5 per cent to NOK 24.9 billion.

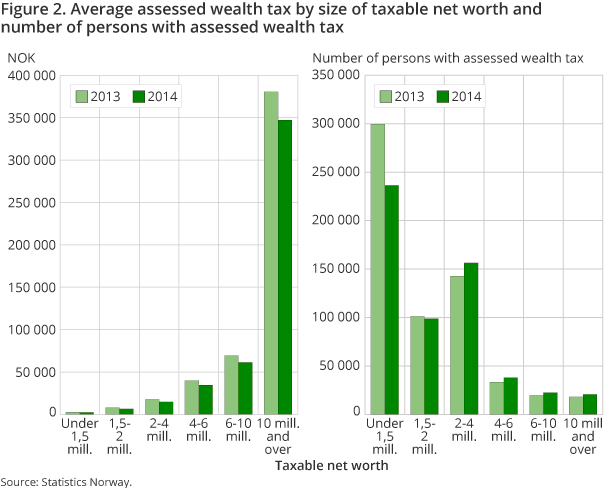

Fewer people assessed with wealth tax

In 2014, 573 000 residents were assessed with wealth tax, which is 42 000 fewer than in 2013. The activation threshold was raised from NOK 870 000 in 2013 to NOK 1 million in 2014, and the tax rate was reduced from 1.1 to 1 per cent. Those who were assessed with wealth tax in 2014 paid on average NOK 23 400, compared to NOK 22 400 the year before. For those persons with the highest net fortunes, i.e. with NOK 10 million or more, average wealth tax diminished by NOK 33 000, from NOK 380 000 to NOK 347 000 in 2014.

More than NOK 1 000 billion in bank deposits

Average bank deposits amounted to about NOK 250 000 in 2014 Total bank deposits amounted to NOK 1 016 billion. The average return on savings, on the other hand, was NOK 6 600 per person. The average interest rate on bank savings in 2014 was 2.2 per cent. Despite the low rate of return on bank deposits, total bank deposits increased by 8.3 per cent in 2014.

NOK 11.9 billion in assessed tax from non-residents

Tax payers that were not registered as residents in Norway were assessed with NOK 11.9 billion in taxes in 2014. In total, 258 000 non-resident persons were assessed with tax in Norway in 2014. This includes Norwegian and foreign citizens residing abroad and the estates of deceased persons.

About the dataOpen and readClose

The statistics are based on data from the tax assessment database of the Norwegian Tax Administration.

Contact

-

Oda Andersen Torgan

E-mail: oda.torgan@ssb.no

tel.: (+47) 40 90 23 29