Content

Published:

Strongest income rise in the north

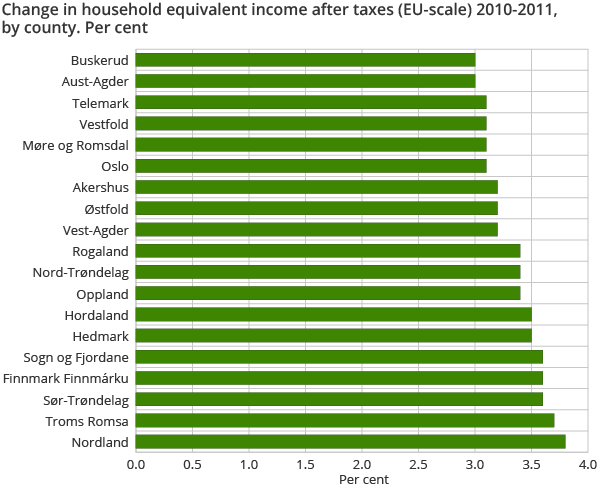

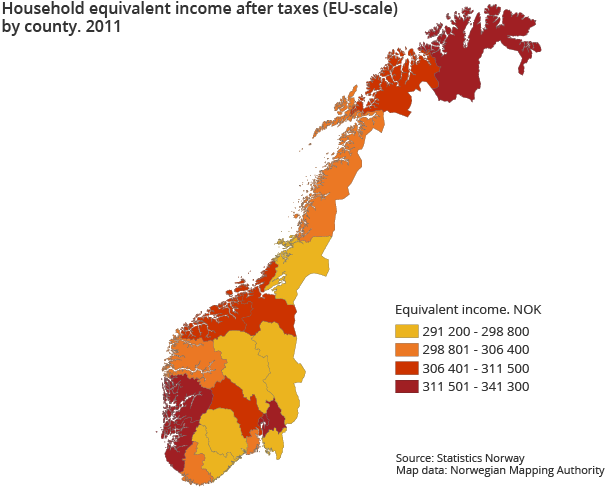

Households in the northernmost counties saw the strongest rise in equivalent income after taxes from 2010 to 2011. Income grew fastest in Nordland, where household income rose by 3.8 per cent in real terms.

| Median household equivalent income after tax | Change in household equivalent income after tax 2010-2011, constant prices | |

|---|---|---|

| The whole country | 312 000 | 3.3 |

| Østfold | 296 000 | 3.2 |

| Akershus | 341 000 | 3.2 |

| Oslo | 317 000 | 3.1 |

| Hedmark | 291 000 | 3.5 |

| Oppland | 295 000 | 3.4 |

| Buskerud | 311 000 | 3.0 |

| Vestfold | 304 000 | 3.1 |

| Telemark | 299 000 | 3.1 |

| Aust-Agder | 297 000 | 3.0 |

| Vest-Agder | 302 000 | 3.2 |

| Rogaland | 331 000 | 3.4 |

| Hordaland | 318 000 | 3.5 |

| Sogn og Fjordane | 306 000 | 3.6 |

| Møre og Romsdal | 311 000 | 3.1 |

| Sør-Trøndelag | 310 000 | 3.6 |

| Nord-Trøndelag | 296 000 | 3.4 |

| Nordland | 305 000 | 3.8 |

| Troms | 311 000 | 3.7 |

| Finnmark | 318 000 | 3.6 |

Median equivalent income after tax grew by 3.3 per cent in the population at large between 2010 and 2011 in real terms. Household income grew fastest in the three northernmost counties in Norway and in Sør-Trøndelag, while the slowest income growth was experienced by households living in the counties Buskerud and Aust-Agder.

In a longer time perspective, Rogaland is the county with the strongest rise in household equivalent income. From 2004 to 2011, median income grew by roughly 27 per cent in real terms in this county. On the other hand, Akershus, Oslo and Østfold saw the weakest growth in income, by slightly less than 20 per cent in real terms.

Income per consumption unit (equivalent income) Open and readClose

In order to be able to compare the incomes of different types of households, the household income is normally adjusted using equivalence scales or consumption weights. In this way, the income is calculated after tax per consumption unit. These consumer weights take into account that large households need higher incomes than small households in order to have an equivalent standard of living, and also that large households will benefit from economies of scale with regard to some goods (e.g. TV, washing machine, newspapers, electricity costs etc.). There are numerous types of equivalence scales but there is no consensus of opinion on which scale is the best. In these statistics, the EU scale or the ’modified’ OECD scale is used. This is the most commonly used scale in Europe today.

The statistics is published with Income and wealth statistics for households.

Additional information

Some of the figures from households' income geographic distribution are available as open data with API.

The household income statistics include all registered income in cash received by private households in Norway during the calendar year. Since 2004, the household income statistics have been based solely on register data and include all persons in private households living in Norway at the end of the year.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42