Content

Published:

This is an archived release.

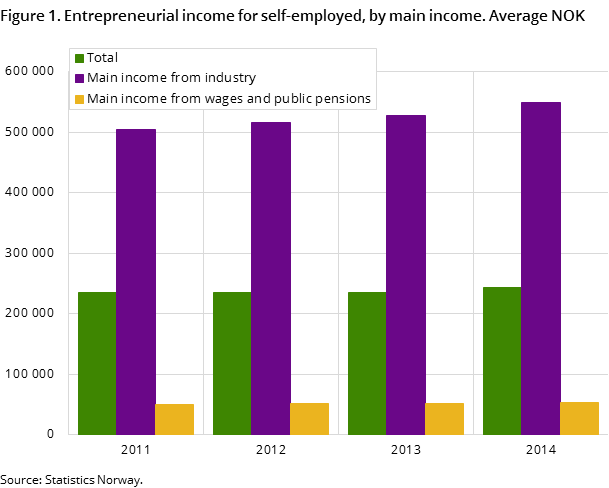

Entrepreneurial income up 3 per cent

Entrepreneurial income for the self-employed amounted to NOK 243 000 on average in 2014. This is an increase of NOK 8 000 or 3 per cent from the previous year.

| 2014 | |||

|---|---|---|---|

| Total | Industry | Wages and public pensions | |

| Number of self-employed (persons) | 330 540 | 126 336 | 204 204 |

| Gross income (NOK) | 613 200 | 668 100 | 579 200 |

| Entreprenurial income (NOK) | 243 400 | 549 400 | 54 100 |

| Wages and public pensions | 314 900 | 63 600 | 470 400 |

| Capital income (NOK) | 53 400 | 53 000 | 53 600 |

| Assessed taxes (NOK) | 179 600 | 221 400 | 153 800 |

A total of 330 540 persons reported entrepreneurial income in 2014. This is a decrease of 3 000 from 2013.

Wages and public pensions form main income for about 6 in 10

About 60 per cent of the self-employed have their main income from wages and public pensions. The number of self-employed whose main income is from wages was the same compared to the previous year, while the self-employed whose main income is from industries decreased by 2 per cent.

Increase in operating profit in sole proprietorships

About 273 000 persons were assessed as a sole proprietorship in 2014. Sole proprietorships with main income from industries had operating profit just over NOK 494 000 on average; about NOK 12 000 more than 2013. Operating income amounted to NOK 1 314 000 on average, which is an increase of NOK 9 000 from the previous year, while operating expenses amounted to NOK 820 000.

About the statisticsOpen and readClose

The data is collected electronically from the Directorate of Taxes.

A self-employed person is a person who conducts business at his or her own risk. Married couples are counted as two self-employed persons when they share the taxable entrepreneurial income. One self-employed person can run more than one business. The self-employed are classified by whether their main income comes from industries or wages and pensions.

For more information please see About the statistics.

Contact

-

Christian Brovold

E-mail: christian.brovold@ssb.no

tel.: (+47) 91 75 31 32