Content

Published:

This is an archived release.

Mortgages up 55 per cent in 5 years

Homeowners’ mortgages continue to rise. In 2012, owner occupier households had an average mortgage of almost NOK 1 million. Housing expenses have also increased, but not at the same rate. This does not affect the structure of ownership, where eight out of ten are owner occupiers.

| 2012 NOK/year | 2007 - 2012 Change in per cent | |

|---|---|---|

| Rettet 24 June 2016. | ||

| Interest and installments. Average for owners | 64 678 | 20 |

| Rent. Average for tenants | 61 178 | 35 |

| Share of persons | Change in percentage points | |

| Own their dwelling | 82 | 1 |

| Live in detached one-family house or farm house | 63 | .. |

| Live in crowded dwelling | 6 | 0 |

| Live in a dwelling damp and/or rot | 8 | .. |

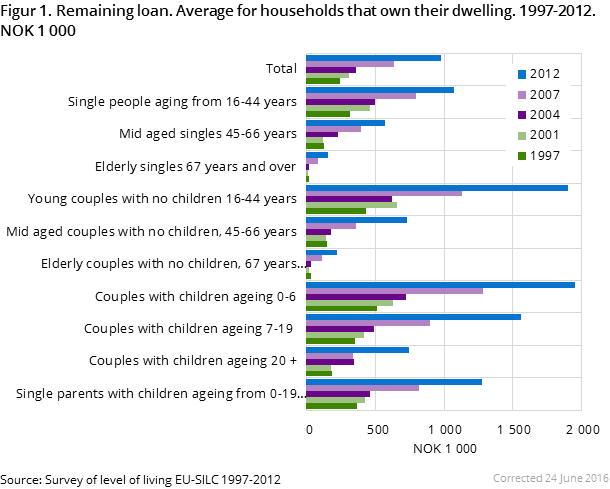

Remaining mortgages increased by almost 80 per cent for Norwegian owner occupier households from 2004 to 2007. The increase is still considerable from 2007 to 2012, but not to the same degree. On average, remaining mortgages increased by 53 per cent, and owner occupier households now have NOK 980 000 inremaining debts on their dwellings.

Young couples’ mortgages almost NOK 2 million

Mortgages are increasing among all parts of the population. The relative increase is highest for the middle aged and elderly. On average, couples aged 67 years and over have NOK 225 000 remaining on their mortgage, while couples aged 45-66 years have more than three times as much, with NOK 728 000.

Despite the large increase in these groups, they still have far smaller mortgages than younger households. Couples with children below the age of 7 have almost NOK 2 million remaining on their mortgage, and couples aged 16-44 years without children have almost the same. Going back to 2004, both groups had far less than NOK 1 million, with NOK 730 000 and 630 000 respectively.

The increase in mortgages for single parents has been almost equal to the average increase for the population. On average, single parents now have NOK 1.2 million remaining on their mortgage. Compared to couples with children, the amount is high when considering that single parents have smaller household incomes. When compared to persons in couple households, the share of owners is also lower among single parents. The increase in mortgages among single households has been lower than average, but notwithstanding, young persons aged 16-44 years living alone have almost NOK 1.1 million remaining on their mortgage, which is more than double that of 2004.

Largest increase in total housing expenditure for older couples…

On average, Norwegian households spent NOK 69 900 on mortgages and rent. This is an increase of NOK 12 000, or 22 per cent, since 2007. Calculated in 2007 NOK, this equates to an increase of 9.7 per cent.

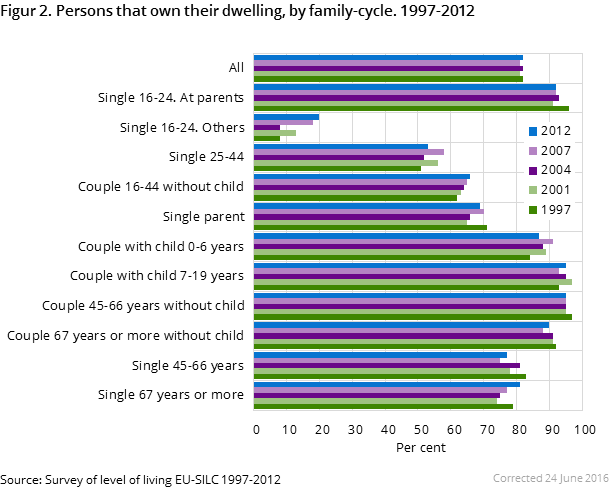

Almost all kinds of households are experiencing an increase in housing expenditure, but this does not seem to affect the share of owners, with more than eight out of ten adults living in an owner occupier household. This share has remained stable over the last 15 years.

In per cent, the largest increase in total housing expenditure is found among couples aged 67 and over without children, where expenses have increased by 52 per cent from 2007, to NOK 20 700 in 2012. Inthis group, nine out of ten live in an owner occupier household, and one out of four households have mortgages. In recent years, the tendency has been a clear increase in expenses for interest rates and instalments among the elderly. For older couples, paid interest and instalments increased by 91 per cent from 2007 to 2012. Total annual expenses are NOK 15 400. For elderly persons living alone, the 15 per cent increase has been a lot smaller; up to NOK 8 700, while the corresponding figure for 2004 was only NOK 3 000.

…but expenses are highest for families with children

As in 2007, the highest total housing expenditure is found among couples with children aged 0-19 years. Couples with children aged 0-6 years pay NOK122 000 ininterest, instalments and rent, and couples with children aged 7-19 pay almost NOK 10 000 less. Families with children are mainly owners, so changes in total expenditure are therefore mainly affected by changes in interest rates and instalments. The share of families with children owning their dwelling increased slightly around the new millennium, but has remained stable during the last decade. Ninety-five per cent of adults living as couples with children aged 7-19 are owners, and the corresponding share among persons in couples with children aged 0-6 years is 88 per cent.

Living alone is expensive

If we compare persons living alone to couples without children at the same age, we see that expenses are relatively high and the share of owners is smaller. The share of owners is smallest among the youngest. Twenty-one per cent of those living alone aged 16-24 are owners, while 53 per cent of those living alone aged 25-44 own their dwelling. For the youngest, the share of owners has increased slightly in the last 10-15 years, while the share has been stable for those aged 25-44. The share of owners has increased somewhat over the last years for young couples without children. Sixty-two per cent were owners in 1997 and in 2012 this had increased to 66 per cent.

Persons aged 16-44 living alone have had an increase in total housing expenditure equal to the population average. An expense of NOK 69 400 is also quite similar to the average expenditure. On average, owners living alone in this age group pay NOK71 600 ininterest and instalments, and couples without children “only” pay NOK 28 000 more. Young tenants living alone pay NOK56 000 inrent, and young couples without children pay NOK 78 300. Total housing expenditure has barely changed for single parents from 2007 t o2012. In 2012, they paid NOK 76 200. 70 per cent are owners. This is approximately the same share as in 1997.

More spacious dwellings

One conclusion is that Norwegians are paying more and more for their accommodation, and the share of owners remains high. Are the dwellings thus getting bigger and better? A total of 6 per cent of the population live in a crowded dwelling measured by the number of persons per room. This is at the same level as in 2007, and a small reduction compared to older results. Thirty-five per cent are living in a very spacious dwelling; a small increase compared to earlier years. When respondents were asked whether they experience a lack of space in their dwelling, the impression is the same. A total of 11 per cent reported experiencing a lack of space in their dwelling; a very small reduction compared to the 13 per cent in 2007. The general impression is therefore that Norwegians homes are slightly more spacious now than 10-15 years ago.