Content

Published:

This is an archived release.

Increase in pension liabilities for defined contribution schemes

Pension liabilities in defined contribution schemes increased by 29.2 per cent from 2012 to 2013. The main reason for the increase is that more and more companies are switching from defined benefit pension schemes to defined contribution schemes.

| Total | ||

|---|---|---|

| 2012 | 2013 | |

| Earned premiums | 95 637 | 92 744 |

| Pension payments | 52 682 | 57 461 |

| Pension liabilities | 1 354 735 | 1 454 824 |

Total pension liabilities increased by 7.4 per cent, from NOK 1 355 billion in 2012 to NOK 1 455 billion in 2013. The largest increase in liabilities was in defined contribution schemes, with an increase of NOK 21.3 billion.

Earned premiums for occupational pensions decreased by 6.4 per cent, to NOK 92.7 billion. The biggest decrease was in private pension schemes, with a 7.9 per cent decrease, while for the public pension schemes the decrease in earned premiums was 5.7 per cent from 2012 to 2013.

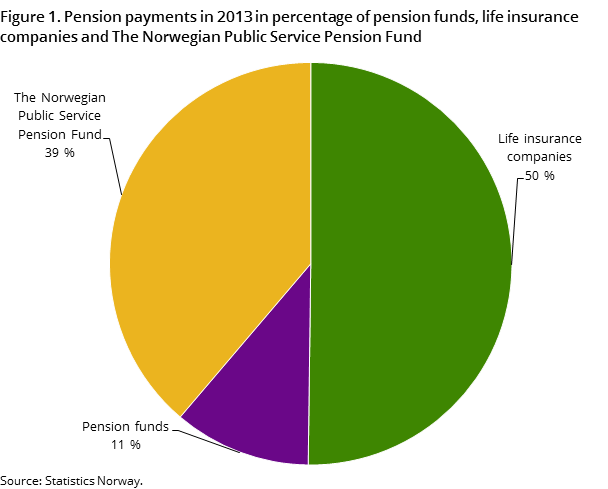

The total pension payments increased by 9.1 per cent from 2012 to 2013, to NOK 57.4 billion. The Norwegian Public Service Pension Fund accounts for more than 38 per cent of the payments.

Contact

-

Dag Waage Gausdal

E-mail: dag.gausdal@ssb.no

tel.: (+47) 40 90 26 82

-

Ola Tveita

E-mail: ola.tveita@ssb.no

tel.: (+47) 99 73 45 83