Content

Published:

This is an archived release.

Further increase in pension fund profit

The result of pension funds was NOK 2.2 billion in 2013, compared to NOK 3 billion in 2012. The reason for the lower result is the increase in provisions to the revaluation reserves in 2013.

| Total | ||

|---|---|---|

| 2012 | 2013 | |

| Assets | 230 319 | 260 205 |

| Shares, participation and primary capital certificates | 95 418 | 117 534 |

| Bonds and certificates | 115 292 | 123 726 |

| Gross premium written | 15 281 | 13 733 |

| Net income from financial assets | 16 269 | 24 107 |

| profitt/loss on ordinary activities | 3 058 | 2 234 |

| Gross pensions and claims payment | 5 811 | 6 291 |

| Value-adjusted result | 10 280 | 16 173 |

Net income from financial assets was NOK 16.9 billion in 2013. The corresponding figure was NOK 9.1 billion in 2012. The reason for the increase was the development in the stock market in 2013. This development resulted in unrealised gains on shares and primary capital certificates of NOK 14.3 billion. Provisions to the revaluation reserves were NOK 12.2 billion in 2013, compared to NOK 5.2 billion in 2012.

Higher premiums

Earned premiums were NOK 14.9 billion in 2013. This is a decrease of 4 per cent from 2012. Claims incurred, net of reinsurance, show a slight decrease from NOK 8.2 billion in 2012 to NOK 7.5 billion in 2013.

Increase in total assets

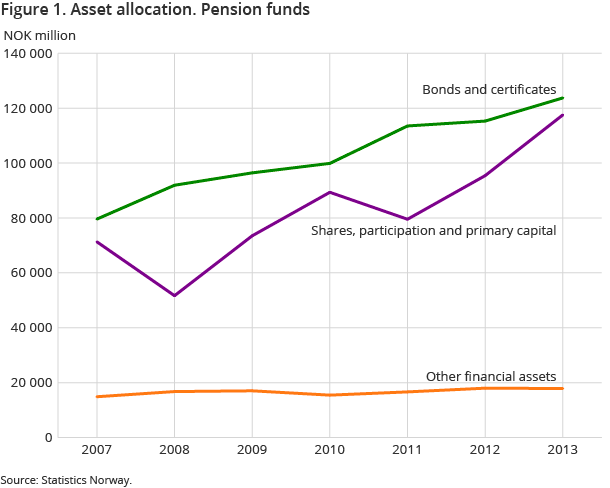

Total assets of pension funds increased from NOK 230.3 billion in 2012 to NOK 260.2 billion in 2013. This represents an increase of 13 per cent, or NOK 29.9 billion; a slight increase from last year’s 9.1 per cent increase.

At the end of 2013, pension funds had placed 92.8 per cent of total assets in securities. The corresponding figures in 2012 and 2011 were 91.9 per cent and 91.8 per cent respectively.

Holdings of shares and primary capital certificates were NOK 117.5 billion in 2013; an increase of 23 per cent from the previous year. In the same period, bonds and certificates had a small increase of 7.3 per cent, from NOK 115.3 billion in 2012 to NOK 123.7 billion in 2013.

Contact

-

Kjell Hammer

E-mail: kjell.hammer@ssb.no

tel.: (+47) 40 90 26 76

-

Dag Waage Gausdal

E-mail: dag.gausdal@ssb.no

tel.: (+47) 40 90 26 82