Content

Published:

This is an archived release.

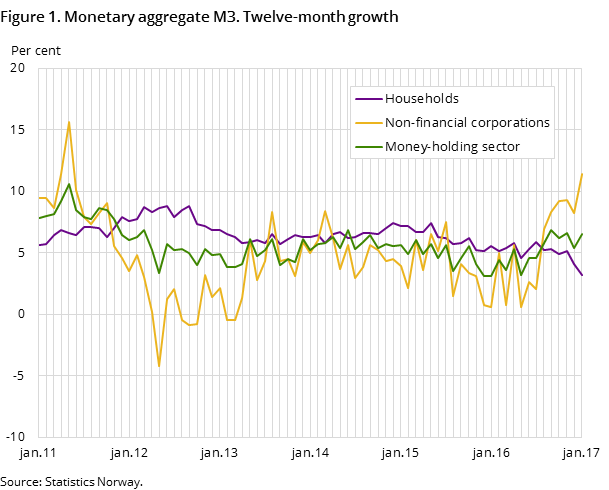

Stronger money supply growth

The twelve-month growth in the monetary aggregate M3 was 6.5 per cent to end-January, up from 5.4 per cent the previous month. Households’ growth in M3 was 3.2 per cent to end-January, down from 4.1 per cent the previous month.

| October 2016 | November 2016 | December 2016 | January 2017 | |

|---|---|---|---|---|

| Money holding sector | 6.2 | 6.6 | 5.4 | 6.5 |

| Households etc. | 4.9 | 5.1 | 4.1 | 3.2 |

| Non-financial corporations | 9.2 | 9.3 | 8.2 | 11.4 |

| Municipal government | 12.6 | 14.2 | 18.5 | 16.2 |

| Other financial corporations | -0.7 | 1.5 | -5.0 | 7.5 |

The twelve-month growth in households’ money supply was lower than the growth in households’ gross domestic debt, which was 6.5 per cent to end-January according to the credit indicator C2.

The money supply growth for non-financial corporations was 11.4 per cent to end-January, while the growth for municipal government was 16.2 per cent. Other financial corporations accounted for the last share of the money supply, and this sector’s money supply growth was 7.5 per cent to end-January.

More than half of the money supply in households

The monetary aggregate M3 was NOK 2 054 billion at the end of January, up from NOK 2 025 billion the previous month. Households’ money supply constitutes more than half of the total monetary aggregate M3. At end-January, households’ money supply amounted to NOK 1 169 billion, down from NOK 1 171 billion at end-December.

The money supply for non-financial corporations was NOK 671 billion at end-January, up from NOK 646 billion the previous month. The money supply for municipal government and other financial corporations amounted to NOK 85 billion and NOK 129 billion respectively.

Steady composition of money supply

The composition of the money supply remains steady. Transaction deposits accounted for 88.3 per cent of the total money supply, while other deposits accounted for 9.1 per cent at the end of January. Notes and coins accounted for 2.2 per cent, while repurchase agreements, debt securities and bonds in total accounted for 0.5 per cent of the money supply at end-January.

Revision of seasonally-adjusted figures Open and readClose

The seasonally-adjusted figures have been revised with new seasonal components. For more information see About seasonal adjustment.

Contact

-

Monetary aggregates

E-mail: pengemengde@ssb.no

-

Mons Even Oppedal

E-mail: mons.even.oppedal@ssb.no

tel.: (+47) 98 68 18 24