Content

Published:

This is an archived release.

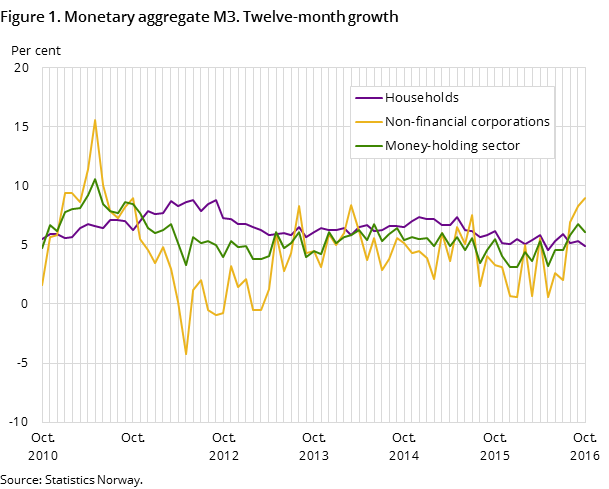

Decrease in money supply growth

The twelve-month growth in the monetary aggregate M3 was 6.1 per cent to end-October, down from 6.8 per cent the previous month. Households’ growth in M3 was 4.9 per cent to end-October, down from 5.3 per cent the previous month.

| July 2016 | August 2016 | September 2016 | October 2016 | |

|---|---|---|---|---|

| Money holding sector | 4.6 | 5.8 | 6.8 | 6.1 |

| Households etc. | 5.9 | 5.2 | 5.3 | 4.9 |

| Non-financial corporations | 2.0 | 6.9 | 8.3 | 9.0 |

| Municipal government | 12.7 | 9.3 | 18.4 | 12.6 |

| Other financial corporations | 1.0 | 4.1 | 5.6 | -0.8 |

The twelve-month growth in households’ money supply was lower than the growth in households’ gross domestic debt, which was 6.3 per cent to end-October according to the credit indicator C2.

The money supply growth for non-financial corporations was 9.0 per cent to end-October, while the growth for municipal government was 12.6 per cent. Other financial corporations accounted for the last share of the money supply, and this sector’s money supply growth was -0.8 per cent to end-October.

More than half of the money supply in households

The monetary aggregate M3 was NOK 2 036 billion at the end of October, up from NOK 2 026 billion the previous month. Households’ money supply constitutes more than half of the total monetary aggregate M3. At end-October households’ money supply amounted to NOK 1 163 billion, marginally down from NOK 1 166 billion at end-September.

The money supply for non-financial corporations was NOK 651 billion at end-October, up from 635 billion the previous month. The money supply for municipal government and other financial corporations amounted to NOK 92 billion and NOK 130 billion respectively.

Steady composition of money supply

The composition of the money supply remains steady. Transaction deposits accounted for 89.1 per cent of the total money supply, while other deposits accounted for 8.4 per cent at the end of October. Notes and coins accounted for 2.2 per cent, while repurchase agreements, debt securities and bonds in total accounted for 0.4 per cent of the money supply at end-October.

Contact

-

Monetary aggregates

E-mail: pengemengde@ssb.no

-

Mons Even Oppedal

E-mail: mons.even.oppedal@ssb.no

tel.: (+47) 98 68 18 24