Content

Published:

This is an archived release.

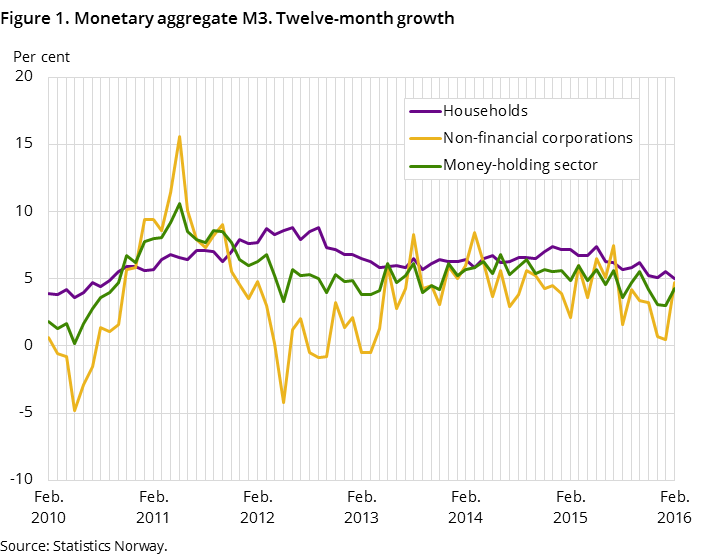

Increase in money supply growth

The twelve-month growth in the monetary aggregate M3 was 4.3 per cent to end-February, up from 3.0 per cent the previous month. Households’ growth in M3 was 5.0 per cent to end-February, down from 5.5 per cent the previous month.

| November 2015 | December 2015 | January 2016 | February 2016 | |

|---|---|---|---|---|

| Money holding sector | 4.2 | 3.1 | 3.0 | 4.3 |

| Households etc. | 5.2 | 5.1 | 5.5 | 5.0 |

| Non-financial corporations | 3.2 | 0.7 | 0.5 | 4.7 |

| Municipal government | 11.2 | 18.1 | 17.3 | 10.8 |

| Other financial corporations | -2.9 | -7.6 | -10.6 | -6.2 |

The twelve-month growth in households’ money supply was lower than the growth in households’ gross domestic debt, which was 6.0 per cent to end-February according to the credit indicator C2.

The money supply growth for non-financial corporations was 4.7 per cent to end-February, while the growth for municipal government was 10.8 per cent. Other financial corporations accounted for the remainder of the money supply, and this sector’s money supply growth was –6.2 per cent to end-February.

More than half of the money supply in households

The monetary aggregate M3 was NOK 1 940 billion at the end of February, marginally down from NOK 1 941 billion the previous month. Households’ money supply constitutes more than half of the total monetary aggregate M3. At end-February households’ money supply amounted to NOK 1 138 billion, up from NOK 1 134 billion at end-January.

The money supply for non-financial corporations was NOK 599 billion at end-February, down from NOK 608 billion at end-January. The money supply for municipal government and other financial corporations amounted to NOK 72 billion and NOK 130 billion respectively.

Steady composition of money supply

The composition of the money supply remains steady. Transaction deposits accounted for 89.2 per cent of the total money supply, while other deposits accounted for 8.0 per cent at the end of February. Notes and coins accounted for 2.4 per cent, while repurchase agreements, debt securities and bonds in total accounted for 0.4 per cent of the money supply at end-February.

Contact

-

Monetary aggregates

E-mail: pengemengde@ssb.no

-

Mons Even Oppedal

E-mail: mons.even.oppedal@ssb.no

tel.: (+47) 98 68 18 24