Content

Published:

This is an archived release.

Moderate results in Norwegian banks

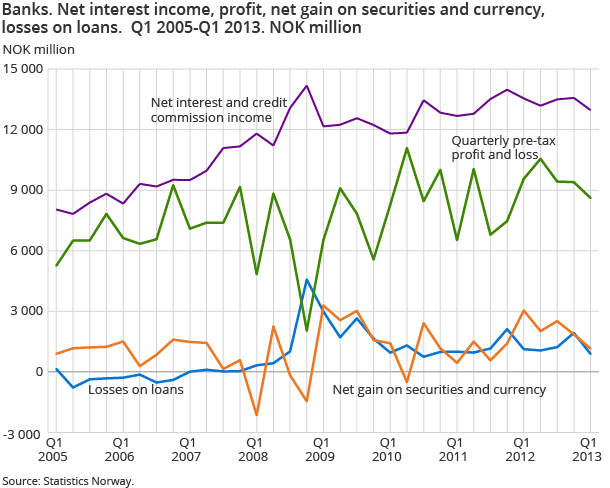

Norwegian banks’ profit before tax amounted to NOK 8.6 billion in the 1st quarter of 2013, which is NOK 954 million lower than in the 1st quarter of 2012. Moderate growth of interest income and interest expenses, positive gains on securities and currency as well as a slight fall in operating costs, contributed to this development.

| 1st quarter 2013 | 1st quarter 2012 | |

|---|---|---|

| Banks | ||

| Net interest income | 12 966 | 13 545 |

| Loss on loans | 887 | 1 122 |

| Pre-tax profit | 8 607 | 9 561 |

| Mortgage companies | ||

| Net interest income | 4 133 | 2 546 |

| Loss on loans | 44 | 1 |

| Pre-tax profit | -1 229 | -14 360 |

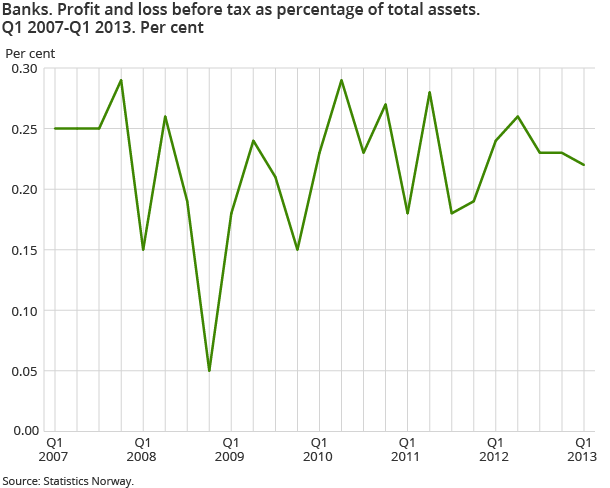

In the 1st quarter of 2013, banks' profit before tax was 10.0 per cent lower than in the 1st quarter last year. As a share of total assets, the profit before tax fell from 0.24 per cent in the 1st quarter of 2012 to 0.22 per cent in the 1st quarter of 2013. Thus the banks’ profit before tax was NOK 789 million lower than in the 4th quarter last year. Throughout the last five quarters, the quarterly results have varied between 0.22 and 0.26 per cent of total assets.

Fall in interest income and interest expenses showed a slight decline in net interest income

Net interest income, measured as the difference between interest income and interest expenses, was barely NOK 13 billion in the 1st quarter of 2013. The net interest income was thus 4.3 per cent lower than the 1st quarter last year and 4.4 per cent lower than the 4th quarter of 2012. The net interest income as a share of total assets was 0.33 per cent in the 1st quarter of 2013, down from 0.34 per cent in the 4th quarter of 2012. The interest income was NOK 31.1 billion in the 1st quarter of 2013, which is 10.3 per cent lower than in the 1st quarter last year. The decrease in net interest income stems from lower interest income from loans, certificates and bonds. Interest expenses amounted to NOK 18.2 billion, which is nearly NOK 3 billion lower compared to the same quarter last year.

Slight decrease in gains on securities and currency

Norwegian banks' net gain on securities and currency amounted to NOK 1.2 billion in the 1st quarter of 2013. This is a decrease in net gains of NOK 1.9 billion and NOK 0.8 billion from the 1st and 4th quarters of 2012 respectively. The drop in net gains on treasury bills, bonds and other fixed income securities, together with the currency contributed to the decrease in the 1st quarter this year. However, the Norwegian banks received moderate gains on financial instruments. These net gains and losses were affected by fluctuations in the fair value of assets and liabilities as well as exchange rates and financial derivatives.

Moderate losses on loans

Norwegian banks’ losses on loans are low. In the 1st quarter of 2013, Norwegian banks' losses on loans amounted to NOK 887 million. In the 1st quarter of 2012, the losses on loans amounted to NOK 1.1 billion, and remained stable at the same level for the following two quarters, before increasing to NOK 1.9 billion in the 4th quarter of 2012. As a share of total assets, banks’ losses on loans were 0.02 per cent in the 1st quarter of 2013.

Improved, but still weak results for mortgage companies

The pre-tax profit for mortgage companies has increased compared to previous quarters, but remains negative. The result amounted to NOK -1.2 billion in the 1st quarter of 2013, compared to NOK -14.4 billion in the 1st quarter of 2012. The negative pre-tax profit in the 1st quarter of 2013 was due to unrealized losses on financial derivatives of NOK 3.8 billion and unrealized losses on securities of NOK 1.5 billion that were partially offset by a net gain on currency of NOK 1.8 billion. The unrealized losses on financial instruments in the 1st quarter this year were NOK 16.3 billion lower than in the same quarter last year. During the last five quarters, the mortgage companies’ pre-tax profit has been strongly affected by changes in the fair value of securities and unrealized gains and losses on financial instruments.

The net interest income was stable and amounted to NOK 4.1 billion in the 1st quarter of 2013, up from NOK 3.7 billion in 4th quarter of 2012. Thus the net interest income was NOK 1.6 billion higher compared to the same quarter last year. As a percentage of total assets, the net interest income was 0.24 per cent in the 1st quarter of 2013.

Norwegian mortgage companies' losses on loans were very low. In the 1st quarter of 2012, losses on loans were only NOK 1 million, followed by an increase to NOK 75 million in the 4th quarter last year. In the 1st quarter this year, losses on loans decreased to NOK 44 million. As a percentage of total assets, the losses on loans were only 0.003 percent in the 1st quarter of 2013.

Slight growth in profit before taxes for finance companies

Finance companies’ pre-tax profit in the 1st quarter of 2013 amounted to NOK 817 million, up from NOK 663 million in the 1st quarter of 2012. As a percentage of total assets, the pre-tax profit was 0.65 per cent and has varied between 0.54 and 0.68 per cent during the last five quarters. The net interest income amounted to NOK 1.6 billion and has remained stable between NOK 1.3 billion and NOK 1.6 billion over the last five quarters.

Finance companies’ losses on loans amounted to NOK 138 million in the 1st quarter of 2013, down from NOK 175 million in the 4th quarter of 2012. As a percentage of total assets, losses on loans remained stable and were 0.11 per cent in the 1st quarter this year.

The statistics is now published as Banks and mortgage companies.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42