Content

Published:

This is an archived release.

Good results from banks in 2012

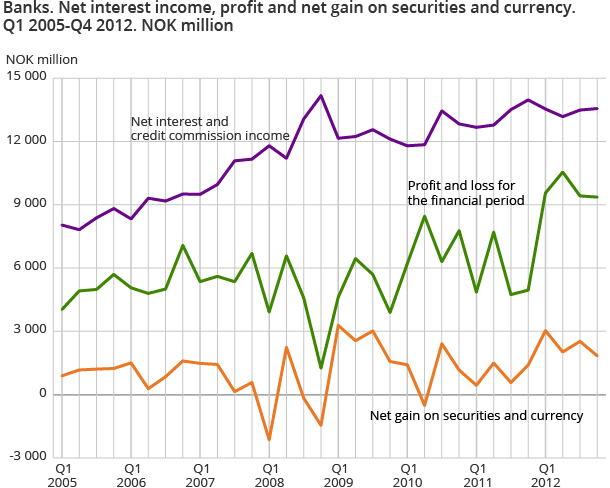

Norwegian banks’ pre-tax profit amounted to NOK 38.9 billion in 2012. Positive gains on securities and foreign exchange, as well as moderate operating costs, contributed to these results. The profit was just above NOK 8 billion higher than the year before.

| 4th quarter 2012 | 4th quarter 2011 | |

|---|---|---|

| Banks | ||

| Net interest income | 53 790 | 52 949 |

| Loss on loans | 5 334 | 5 224 |

| Pre-tax profit | 38 904 | 30 835 |

| Mortgage companies | ||

| Net interest income | 12 906 | 7 915 |

| Loss on loans | 147 | 279 |

| Pre-tax profit | -20 209 | 47 672 |

Banks’ net profit before tax amounted to NOK 9.4 billion in the 4th quarter of 2012, up NOK 1.9 billion compared to the same quarter last year. The results remained stable throughout 2012 at a level above NOK 9 billion for each quarter.

In the 4th quarter of 2012, the pre-tax profit was 0.23 per cent of total assets, up from 0.19 per cent in the 4th quarter of 2011. Throughout 2012, the quarterly results varied between 0.23 and 0.26 per cent of total assets.

Stable net interest income

The difference between interest income and interest expenses, or net interest income, amounted to NOK 13.6 billion in the 4th quarter of 2012. The net interest income was thus 2.9 per cent lower than in the 4th quarter of 2011. From the 3rd to the 4th quarter of 2012, the net interest income increased by 0.5 per cent. The net interest income as a percentage of total assets was 0.34 per cent in the 4th quarter of 2012, while the percentage was 0.36 per cent in the 4th quarter of 2011.

Gains on securities and currency

The Norwegian banks’ net gain on securities and foreign currency in banks amounted to NOK 9.4 billion in 2012, up from NOK 3.9 billion in 2011. Net gains ranged between NOK 3 billion in the 1st quarter of 2012 and NOK 1.8 billion in the 4th quarter in 2012. These net gains and losses were affected by fluctuations in the fair value of assets and liabilities, as well as in foreign exchange and financial derivatives.

Moderate losses on loans

Norwegian banks’ losses on loans amounted to NOK 1.9 billion in the 4th quarter of 2012, or 0.05 per cent of total assets. In the year 2012, losses on loans amounted to NOK 5.3 billion, an increase of NOK 110 million compared to 2011.

Weak results for mortgage companies

Norwegian mortgage companies' pre-tax profits in recent quarters were affected by the large fluctuations in the net change in value of securities, foreign currencies and derivatives. In 2012, the net loss was about NOK 28 billion, compared to a gain of NOK 42 billion in2011. Inthe 4th quarter of 2012, the pre-tax profit for mortgage companies amounted to NOK 4.8 billion. The net interest income remained stable throughout 2012 and amounted to NOK 3.7 billion in the 4th quarter of 2012. As a percentage of total assets, the net interest income was 0.22 per cent in the 4th quarter of 2012, up from 0.13 per cent in the last quarter of 2011.

Good results for finance companies

Norwegian finance companies’ pre-tax profits for the year 2012 amounted to NOK 2.8 billion, up NOK 213 million compared to2011. Inthe 4th quarter of 2012, the results amounted to NOK 0.7 billion. The pre-tax profits as a percentage of total assets ranged between 0.54 per cent and 0.68 per cent throughout the quarters of 2012. The net interest income remained stable throughout 2012 and varied between NOK 1.3 billion and NOK 1.6 billion.

The finance companies’ losses on loans in the finance companies amounted to NOK 656 million in 2012, up from NOK 533 million in 2011. As a percentage of total assets, the quarterly losses on loans were between 0.08 per cent and 0.21 per cent in 2012.

The statistics is now published as Banks and mortgage companies.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42