Content

Published:

This is an archived release.

Stable, but high growth in housing loans

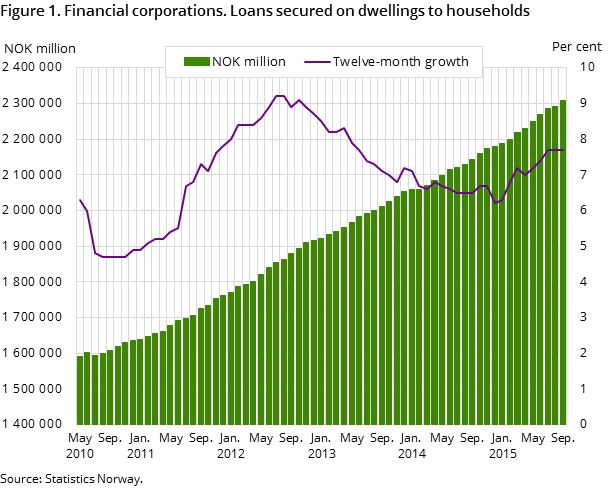

The twelve-month growth in housing loans from financial corporations to households was 7.7 per cent to end-September; unchanged growth since end-July. Compared to end-September last year, the twelve-month growth has increased by 1.1 percentage points.

| September 2014 | September 2015 | September 2014 - September 2015 | |

|---|---|---|---|

| Banks | |||

| Bank total assets | 4 266 674 | 4 884 434 | 14.5 |

| Deposits | 2 865 312 | 3 300 076 | 15.2 |

| Loans | 3 128 655 | 3 608 171 | 15.3 |

| Mortgage companies | |||

| Bank total assets | 1 808 721 | 1 996 219 | 10 |

| Loans | 1 500 023 | 1 573 168 | 4.9 |

Loans secured on dwellings from financial corporations to households amounted to NOK 2 309 billion at the end of September; an increase of NOK 165 billion from end-September last year. The twelve-month growth in housing loans has not been at this level since end-June 2013.

At end-September, total loans from financial corporations to households amounted to NOK 2 731 billion. A total of 85 per cent of these loans were secured on dwellings. The twelve-month growth in the remaining NOK 423 billion of the households’ loans was 5.4 per cent at the end of September. Other repayment loans, and overdrafts, working capital facilities and consumer credit constituted a share of 79 and 15 per cent respectively of the remaining loans.

Majority of loans are from banks and mortgage companies

The majority of loans to households are from banks and mortgage companies. These loans constituted a share of 90 per cent of total loans to households, and amounted to NOK 2 453 billion at the end of September.

State lending institutions and finance companies were the remaining lenders of the loans to households, with a share of 8 and 2 per cent respectively at the end of September.

How to find these numbers in STATBANKOpen and readClose

To find the numbers in this text, you have to combine the STATBANK tables 09562, 09563, 09564 and 10769; table 09560 can be helpful for finding the numbers for total loans. However, it should be noted that the specified level of the type of loan differs across the tables.

The statistics is now published as Banks and mortgage companies.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42