Content

Published:

This is an archived release.

Weaker growth in loans to manufacturing industry

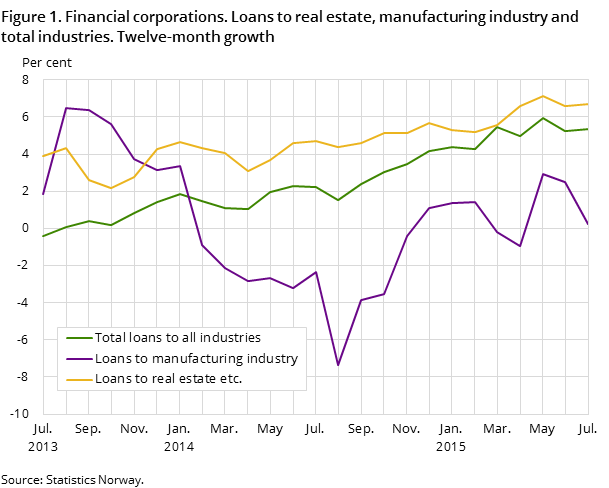

Twelve-month growth in lending by Norwegian financial institutions to manufacturing industries declined from 2.5 per cent to end-June to 0.2 per cent to end-July.

| July 2014 | July 2015 | July 2014 - July 2015 | |

|---|---|---|---|

| Banks | |||

| Bank total assets | 4 274 223 | 4 896 236 | 14.6 |

| Deposits | 2 914 481 | 3 329 374 | 14.2 |

| Loans | 3 145 451 | 3 584 167 | 13.9 |

| Mortgage companies | |||

| Bank total assets | 1 819 036 | 1 977 559 | 9 |

| Loans | 1 496 845 | 1 549 259 | 3.5 |

Loans from Norwegian financial institutions to the manufacturing industry amounted to NOK 72 billion at the end of July, down from NOK 74 billion the previous month, and unchanged from July last year.

During the last year, the twelve-month growth ranged between -7.4 per cent to end-August last year and 2.9 per cent to the end of May this year.

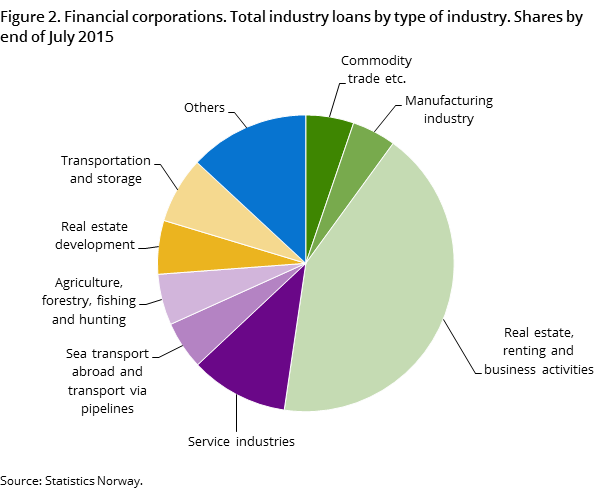

Industry accounted for 4.8 per cent of the total industry distributed borrowing at the end of July.

Stronger growth in lending to real estate, renting and business activities

Real estate, renting and business activities’ outstanding debt to Norwegian financial institutions was NOK 635 billion at end-July, unchanged from the previous month. Lending increased by 6.7 per cent from the end of July last year until the end of July this year. By comparison, the twelve-month growth was 6.6 per cent to end-June this year.

The real estate, renting and business activities industry accounts for the largest share of total industry loans, with 42.3 per cent at the end of July. By comparison, the service industries account for 10.7 per cent of the same loan portfolio.

Unchanged growth in total industry loans

Total loans divided by industries amounted to NOK 1 502 billion at the end of July this year, down from NOK 1 507 billion the previous month. Compared with the end of July last year, total industry loans have increased by NOK 76 billion. This corresponds to a growth of 5.3 per cent to end-July, unchanged from the previous month.

Growth rate calculations based on stocks that include foreign currency loans are not adjusted for exchange rate fluctuations.

The statistics is now published as Banks and mortgage companies.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42