Content

Published:

This is an archived release.

Increased growth in housing loans

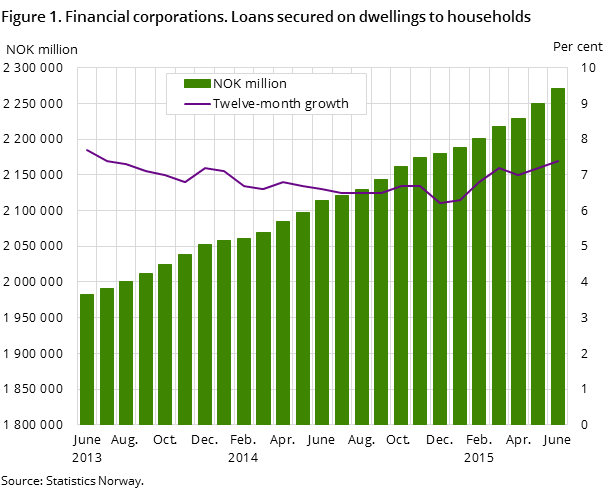

The twelve-month growth in housing loans from financial corporations to households was 7.4 per cent to end-June, up from 7.2 per cent to end-May. Compared to end-June last year, the twelve-month growth has increased by 0.8 percentage points.

| June 2014 | June 2015 | June 2014 - June 2015 | |

|---|---|---|---|

| Banks | |||

| Bank total assets | 4 308 987 | 4 712 240 | 9.4 |

| Deposits | 2 936 770 | 3 193 682 | 8.7 |

| Loans | 3 165 826 | 3 473 357 | 9.7 |

| Mortgage companies | |||

| Bank total assets | 1 815 575 | 1 919 137 | 6 |

| Loans | 1 500 453 | 1 544 156 | 2.9 |

Loans secured on dwellings from financial corporations to households amounted to NOK 2 271 billion at the end of June, an increase of NOK 157 billion from end-June last year. A total of 85 per cent of households’ loans from financial corporations were secured on dwellings at end-June.

Increased growth in repayment loans

Loans secured on dwellings consist of two types of loans: repayment loans and credit lines. At the end of June, the repayment loans constituted a share of 81 per cent of all housing loans to households, and amounted to NOK 1 828 billion. This is an increase of NOK 23 billion from the previous month and an increase of about NOK 162 billion from June last year. The twelve-month growth in the households’ repayment loans was 9.7 per cent to end-June; an increase from 9.5 per cent the previous month.

Credit lines secured on dwellings from financial corporations to households amounted to NOK 443 billion at the end of June, a decline of NOK 1.5 billion from the previous month. The twelve-month growth in credit lines secured on dwellings to households was -1.0 per cent at end-June, and has been negative since June 2013.

Higher growth in housing loans from banks and mortgage companies

Banks and mortgage companies’ housing loans to households constituted a share of 97 per cent of total housing loans, and amounted to NOK 2 209 billion at the end of June. This is an increase of NOK 156 billion compared to the end of June last year and corresponds to a twelve-month growth of 7.6 per cent. Compared to end-June last year, the twelve-month growth has increased by 0.9 percentage points.

Housing loans from state lending institutions to households totalled NOK 62 billion at the end of June. The twelve-month growth in these loans was 1.6 per cent; a decrease from 1.9 per cent the previous month.

The statistics is now published as Banks and mortgage companies.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42