Content

Published:

This is an archived release.

More money in the bank

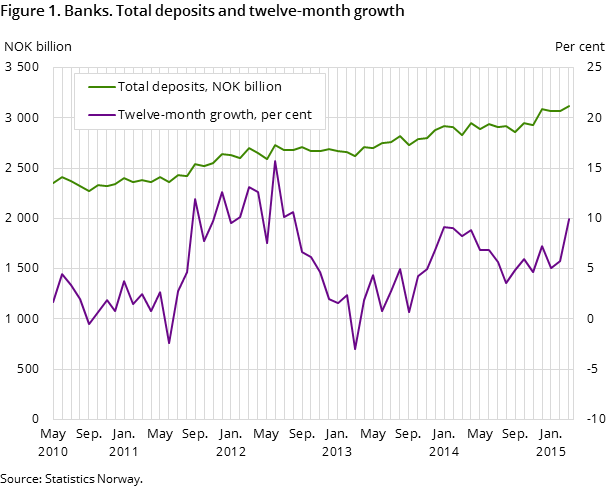

Total deposits in domestic banks amounted to NOK 3 115 billion at the end of March, up 10.0 per cent from end-March last year. Growth in deposits from non-financial corporations was strongest in the public sectors.

| March 2014 | March 2015 | March 2014 - March 2015 | |

|---|---|---|---|

| Banks | |||

| Bank total assets | 4 214 486 | 4 700 805 | 11.5 |

| Deposits | 2 832 265 | 3 114 749 | 10.0 |

| Loans | 3 065 284 | 3 457 262 | 12.8 |

| Mortgage companies | |||

| Bank total assets | 1 767 724 | 1 967 280 | 11 |

| Loans | 1 511 143 | 1 534 874 | 1.6 |

Bank deposits from domestic non-financial corporations amounted to NOK 636 billion at end-March 2015, up from NOK 585 billion at end-March 2014, which equals a twelve-month growth in deposits of 8.7 per cent. Deposits from domestic non-financial corporations constituted a share of 20 per cent of total deposits at end-March.

Deposits from domestic households totalled NOK 1 028 billion at end-March, up from NOK 985 billion at end-March the previous year, which is an increase of 7.3 per cent. The households’ deposits constituted a share of 33 per cent of total deposits at end-March.

Highest growth in deposits from foreign Sources

The twelve-month growth in deposits from foreign sources increased from 3.7 per cent at end -February to 14.1 per cent at end-March. Deposits from foreign sources account for the largest share of deposits, with 35 per cent of total deposits.

At end-March, the deposits from foreign sources amounted to NOK 1 079 billion. Deposits from foreign banks and other financial corporations constituted a share of 85 per cent of these deposits.

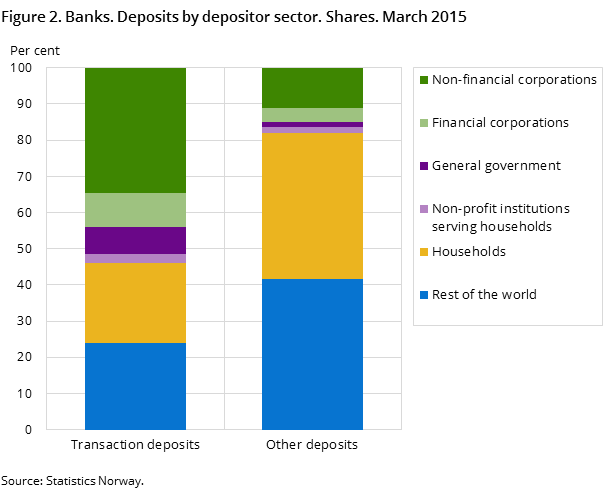

Non-financial corporations place most in transaction deposits

Total transaction deposits amounted to NOK 1 230 billion at end-March. Domestic non-financial corporations and households placed NOK 426 and NOK 272 billion of these deposits respectively. As a share of total transaction deposits, this constituted 35 and 22 per cent respectively.

Other deposits totalled NOK 1 884 billion at end-March, of which NOK 756 billion came from domestic households. Domestic non-financial corporations had NOK 210 billion in other deposits at end-March.

The statistics is now published as Banks and mortgage companies.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42