Content

Published:

This is an archived release.

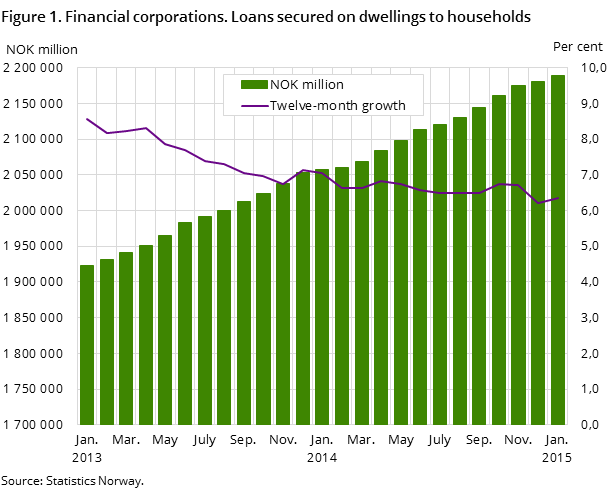

Stable growth in housing loans

The twelve-month growth in loans secured on dwellings from financial companies to households was 6.3 per cent to end-January. This is an increase of 0.1 percentage point from the previous month. Compared to January last year, the twelve-growth has declined by 0.7 percentage points.

| January 2014 | January 2015 | January 2014 - January 2015 | |

|---|---|---|---|

| Banks | |||

| Bank total assets | 4 347 735 | 4 682 332 | 7.7 |

| Deposits | 2 917 152 | 3 065 769 | 5.1 |

| Loans | 3 087 475 | 3 351 314 | 8.5 |

| Mortgage companies | |||

| Bank total assets | 1 792 809 | 1 975 697 | 10 |

| Loans | 1 521 266 | 1 528 174 | 0.5 |

Loans secured on dwellings from Norwegian financial corporations to Norwegian households amounted to NOK 2 189 billion at the end of January, an increase of NOK 131 billion from January last year. A total of 84.4 per cent of households’ total loans from financial corporations were secured on dwellings at end-January 2015.

Continued growth in repayment loans secured on dwellings

Loans secured on dwellings consist of two types of loans: repayment loans and credit lines. At the end of January, the households’ housing repayment loans from Norwegian financial corporations amounted to NOK 1 741 billion. The twelve-month growth was 8.3 per cent at end-January; an increase of 0.1 percentage point from end-December.

Credit lines secured on dwellings from Norwegian banks and mortgage companies to households amounted to NOK 447 billion at the end of January 2015. The twelve-month growth was -0.6 per cent to end-January. Since June 2013, the twelve-month growth rate in credit lines secured on dwellings to households has been negative.

Largest share of housing loans from mortgage companies

At the end of January, housing loans from mortgage companies to households amounted to NOK 1 102 billion, a share of 50.4 per cent of the total housing loans to households. The twelve-month growth in housing loans from mortgage companies was 1.8 per cent; a decrease from 2.2 per cent compared to the previous month.

Banks and state lending institutions were the remaining lenders of the housing loans to households, with a share of 46.8 and 2.9 per cent respectively. Housing loans from banks amounted to NOK 1 024 billion at the end of January; an increase of NOK 8.6 billion from the previous month. The twelve-month growth was 12.0 per cent, an increase from 11.1 per cent at end-December. Housing loans from state lending institutions amounted to NOK 62 billion at the end of January and the twelve month growth was 3.1 per cent.

The statistics is now published as Banks and mortgage companies.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42