Content

Published:

This is an archived release.

Deposits ratio increases

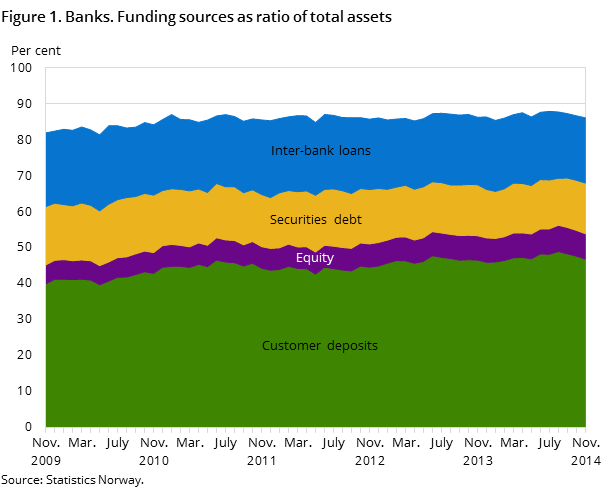

Customer deposits amounted to NOK 2 090 billion at the end of November 2014, which equals 46.8 per cent of banks’ total assets. Between end-November 2009 and end-November 2014, the deposits-to-assets ratio increased by 6.9 percentage points.

| November 2013 | November 2014 | November 2013 - November 2014 | |

|---|---|---|---|

| Banks | |||

| Bank total assets | 4 184 840 | 4 463 370 | 6.7 |

| Deposits | 2 803 115 | 2 935 052 | 4.7 |

| Loans | 3 001 762 | 3 264 837 | 8.8 |

| Mortgage companies | |||

| Bank total assets | 1 757 881 | 1 890 062 | 8 |

| Loans | 1 507 323 | 1 518 487 | 0.7 |

Customer deposits increased by NOK 141 billion, or 7.2 per cent from end-November 2013 to end-November 2014. As a ratio of total assets, the customer deposits increased by 0.3 percentage points in the same period.

At end-November 2014, 8.7 per cent of the customer deposits were from foreign sources, an increase of 0.2 percentage points since end-November 2013.

A significant proportion of foreign inter-bank loans

At the end of November 2014, inter-bank loans amounted to NOK 810 billion; which equals 18.1 per cent of banks’ total assets. From end-November 2013 to end-November 2014, the inter-bank loans increased by NOK 25 billion, or 3.2 per cent.

Inter-bank loans from foreign banks constituted 94.9 per cent of banks’ total inter-bank loans at end-November 2014. At the end of November 2014, these loans amounted to NOK 769 billion, of which NOK 493 billion was in foreign currency. Fluctuations in foreign exchange rates will, therefore, affect the amount of inter-bank loans from foreign sources.

Falling debt securities ratio

Banks’ debt securities were NOK 629 billion, which amounted to14.1 per cent of total assets at the end of November 2014. In the period from November 2009 to November 2014, the ratio fell by 2.1 percentage points. The ratio for long-term bonds decreased by 2.8 percentage points, while the short-term bonds increased by 0.7 percentage points in the same period.

At end-November 2014, 55.4 per cent of banks’ debt securities were issued abroad. This share is the same as at the end of November 2013.

Increased equity ratio

Between end-November 2009 and end-November 2014, banks’ equity-to-assets ratio increased by 1.8 percentage points, to 7.1 per cent. At the end of November 2014, banks’ equity was NOK 315 billion, of which NOK 221 billion was retained earnings. The increase in equity ratio since end-November 2009 stems primarily from retained earnings. The increased equity ratio should be viewed in conjunction with the new capital and liquidity standards that have been introduced for the financial institutions.

The statistics is now published as Banks and mortgage companies.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42