Content

Published:

Updated:

This is an archived release.

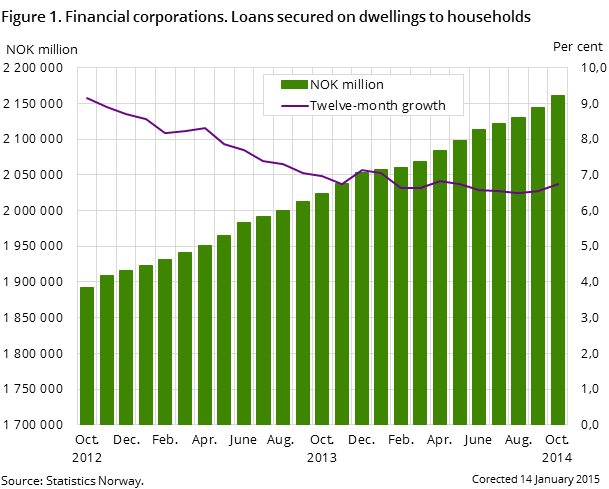

Stable growth in housing loans

The twelve-month growth in loans secured on dwellings from financial companies to households was 6.7 per cent to end-October. This is an increase of 0.2 percentage points from the previous month. Compared to October last year, the twelve-growth has declined by 0.3 percentage points.

| October 2013 | October 2014 | October 2013 - October 2014 | |

|---|---|---|---|

| Banks | |||

| Bank total assets | 4 130 828 | 4 417 999 | 7.0 |

| Deposits | 2 786 535 | 2 952 023 | 5.9 |

| Loans | 2 980 572 | 3 220 139 | 8.0 |

| Mortgage companies | |||

| Bank total assets | 1 706 151 | 1 859 055 | 9 |

| Loans | 1 490 437 | 1 514 596 | 1.6 |

Loans secured on dwellings from Norwegian financial corporations to Norwegian households amounted to NOK 2 161 billion by the end of October, an increase of NOK 137 billion from October last year. A total of 84.3 per cent of households’ total loans from financial corporations were secured on dwellings at end-October this year.

Reduced growth in repayment loans secured on dwellings

Loans secured on dwellings consist of two types of loans: repayment loans and credit lines. At the end of October, the households housing loans from Norwegian financial corporations amounted to NOK 1 713 billion. The twelve-month growth was 9.0 per cent at end-October, an increase from 8.8 per cent at end-September.

Credit lines secured on dwellings from Norwegian banks and mortgage companies to households amounted to NOK 448 billion by the end of October 2014. The twelve-month growth was -0.9 per cent to end-October. From June 2013, the twelve-month growth rate in credit lines secured on dwellings to households has been negative.

Largest share of housing loans from mortgage companies

At the end of October, housing loans from mortgage companies to households amounted to NOK 1 089 billion, a share of 50.4 per cent of the total housing loans to households. The twelve-month growth in housing loans from mortgage companies was 2.1 per cent, a decrease from 2.2 per cent compared to the previous month.

Banks and state lending institutions consisted for the rest of the housing loans to households, with a share of 46.7 and 2.9 per cent, respectively. Housing loans from banks amounted to NOK 1010 billion at the end of October, an increase from NOK 994 billion the previous month. The twelve-month growth was 12.5 per cent, an increase from 12.0 per cent at end-September. Housing loans from state lending institutions amounted to NOK 62 billion at the end of October and the twelve month growth was 3.7 per cent.

The statistics is now published as Banks and mortgage companies.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42