Content

Published:

This is an archived release.

Stable growth in real estate loans

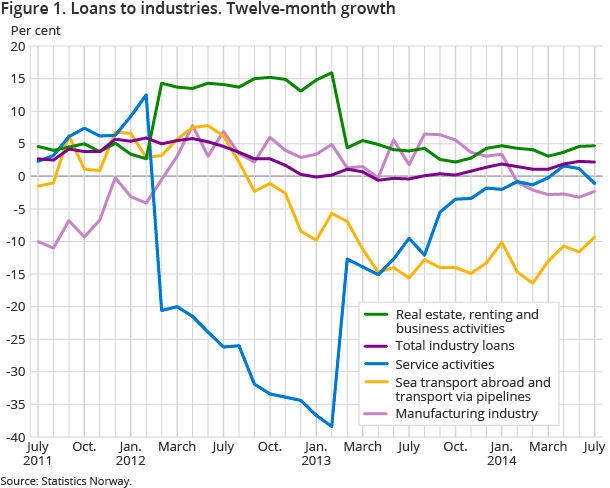

Lending from banks, mortgage companies, state lending institutions and financial corporations to real estate, renting and business activities grew by 4.7 per cent from the end of July last year to the end of July this year. The growth in total industry lending was 2.2 per cent during the same period.

| July 2013 | July 2014 | July 2013 - July 2014 | |

|---|---|---|---|

| Banks | |||

| Bank total assets | 4 038 900 | 4 274 223 | 5.8 |

| Deposits | 2 759 071 | 2 914 481 | 5.6 |

| Loans | 2 921 527 | 3 145 451 | 7.7 |

| Mortgage companies | |||

| Bank total assets | 1 706 813 | 1 819 036 | 7 |

| Loans | 1 475 606 | 1 496 845 | 1.4 |

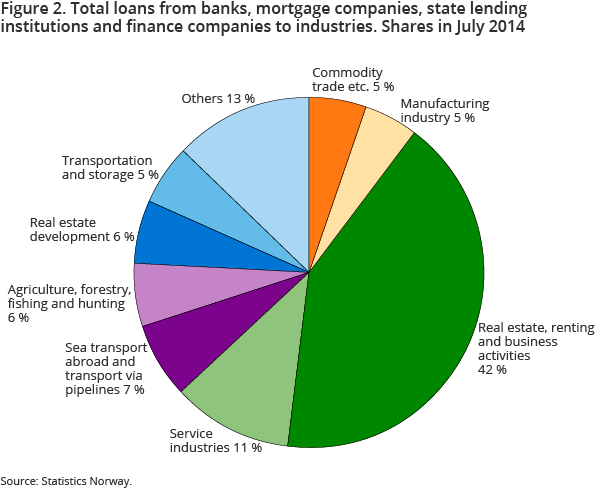

Lending from banks, mortgage companies, state lending institutions and financial corporations to the real estate, renting and business activities was NOK 595 billion at the end of July 2014. This is the industry with the clearly largest share of total industry loans, at 41.8 per cent.

Decline in loans to the manufacturing industry and the service industries

The twelve-month growth in lending to the manufacturing industry was -2.3 per cent at the end of July 2014; an increase from -3.2 per cent at the end of June. The loans to this industry were nearly NOK 72 billion at the end of July. This is a decrease from NOK 74 billion at the end of July last year. Lending to the manufacturing industry was 5.0 per cent of total industry loans at the end of July this year.

Loans to the service industries were NOK 158 billion at the end of July this year, which is a decrease of NOK 2 billion, or 1.1 per cent since July last year. In the last twelve months, the largest fall in loans was for the business-related services, with 12 per cent. At the end of July this year, the service industries’ loans were 11.1 per cent of total industry loans.

Continued fall in loans to sea transport abroad and transport via pipelines

In the period from July last year to July this year, there was a decrease in loans to sea transport abroad and transport via pipelines of NOK 10 billion, or 9.3 per cent. The twelve-month growth in lending to this industry has been negative since the end of May 2012. At the end of July 2014, this industry had borrowed NOK 99 billion, which is a decrease from NOK 132 billion at the end of May 2012. Loans to sea transport abroad and transport via pipelines’ share of total industry loans were 7.0 per cent at the end of July this year.

Stable growth in total industry loans

Loans from banks, mortgage companies, state lending institutions and financial corporations to the total industry were NOK 1 426 billion at the end of July this year. Compared to the end of July last year, total industry loans increased by NOK 30.8 billion, or 2.2 per cent. The twelve-month growth in lending to the total industry was almost unchanged compared with the end of the previous month.

The statistics is now published as Banks and mortgage companies.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42