Content

Published:

This is an archived release.

Reduced growth in housing loans

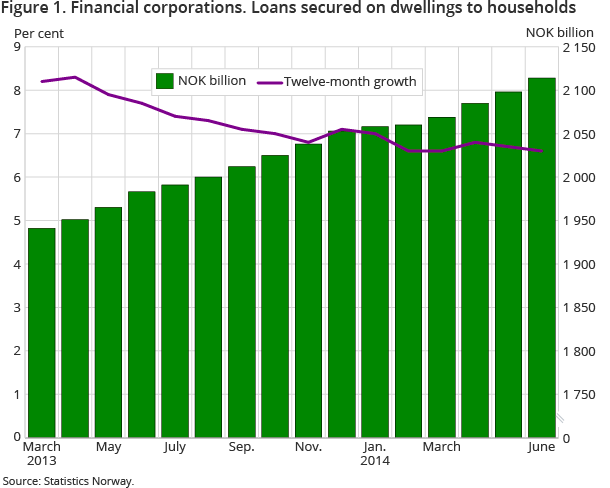

During the past twelve months to the end of June 2014, loans secured on dwellings from financial companies to households grew by 6.6 per cent. This is an increase in the twelve-month growth rate of 0.1 percentage points compared to the previous month.

| June 2013 | June 2014 | June 2013 - June 2014 | |

|---|---|---|---|

| Banks | |||

| Bank total assets | 4 019 820 | 4 308 988 | 7.2 |

| Deposits | 2 749 032 | 2 936 770 | 6.8 |

| Loans | 2 890 337 | 3 166 462 | 9.6 |

| Mortgage companies | |||

| Bank total assets | 1 726 696 | 1 815 575 | 5 |

| Loans | 1 496 600 | 1 500 453 | 0.3 |

Loans secured on dwellings from Norwegian financial corporations to Norwegian households amounted to NOK 2 114 billion by the end of June. This is an increase of NOK 131 billion compared to the end of June 2013. A total of 84.4 per cent of households’ total loans from financial corporations were secured on dwellings at end-June this year.

Reduced growth in repayment loans

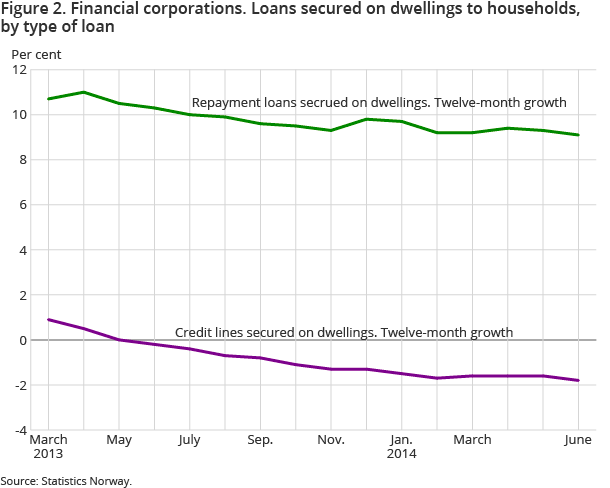

Households’ housing loans consist of repayment loans secured on dwellings and credit lines secured on dwellings . By the end of June, the households’ housing loans from Norwegian financial corporations amounted to NOK 1666 billion. This is an increase of 9.1 per cent compared to the end of June 2013.

Credit lines secured on dwellings from Norwegian banks and mortgage companies to households amounted to NOK 447 billion by the end of June 2014. This is a decrease of 1.8 per cent compared to the end of June 2013. During the last thirteen months there has been a negative twelve-month growth in the credit lines secured on dwellings in banks and mortgage companies.

Weaker growth in housing loans from banks and state lending institutions

At the end of June, housing loans from mortgage companies to households constituted 50.8 per cent of total housing loans to households. In the same period, housing loans from banks and state lending institutions constituted 46.3 and 2.9 per cent respectively of total housing loans to households.

At the end of June, the twelve-month growth rate in housing loans from banks and state lending institutions to households was 12.0 and 2.5 per cent respectively, down 0.4 percentage points compared to the previous twelve-month period. In the same period, the twelve-month growth rate in housing loans from mortgage companies was 2.3 per cent, unchanged from the previous month.

The statistics is now published as Banks and mortgage companies.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42