Content

Published:

This is an archived release.

Increased growth in housing loans

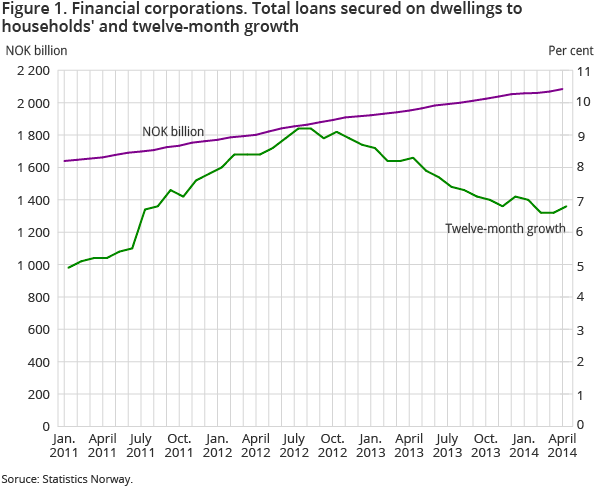

Over the past twelve months to the end of April 2014, loans secured on dwellings from financial companies to households have grown by 6.8 per cent. This is an increase in the twelve-month growth rate of 0.2 percentage points compared to the previous month.

| April 2013 | April 2014 | April 2013 - April 2014 | |

|---|---|---|---|

| Banks | |||

| Bank total assets | 4 076 305 | 4 301 229 | 5.5 |

| Deposits | 2 706 772 | 2 945 921 | 8.8 |

| Loans | 2 893 277 | 3 177 080 | 9.8 |

| Mortgage companies | |||

| Bank total assets | 1 721 197 | 1 769 957 | 3 |

| Loans | 1 478 307 | 1 499 109 | 1.4 |

Loans secured on dwellings from Norwegian financial corporations to Norwegian households amounted to NOK 2 085 billion at the end of April 2014. This is an increase of NOK 133 billion compared to the end of April 2013. Loans from mortgage companies totalled NOK 1 075 billion, loans from banks totalled NOK 949 billion, and loans from state lending institutions totalled NOK 60 billion.

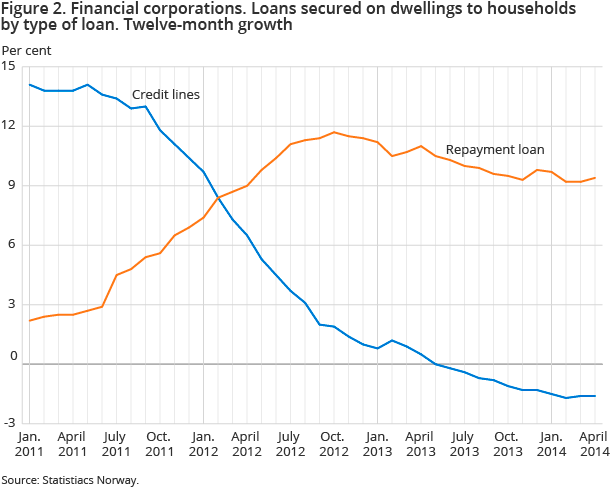

Growth in repayment loans

Households’ housing loans consist of repayment loans secured on dwellings and credit lines secured on dwellings . At the end of April 2014, households’ housing loans from Norwegian financial corporations amounted to NOK 1 636 billion. This is an increase of 9.4 per cent compared to the end of April 2013.

Credit lines secured on dwellings from Norwegian banks and mortgage companies to households amounted to NOK 448 billion at the end of April 2014. This is a decrease of 1.6 per cent compared to the end of April 2013. Over the last eleven months, there has been a negative twelve-month growth in the credit lines secured on dwellings in banks and mortgage companies.

Households’ total debt

Households’ debt from financial corporations amounted to NOK 2 476 billion at end-April this year. This is an increase of nearly NOK 13 billion compared to last month. Compared to end-April 2013, this is an increase of NOK 154 billion or 6.6 per cent.

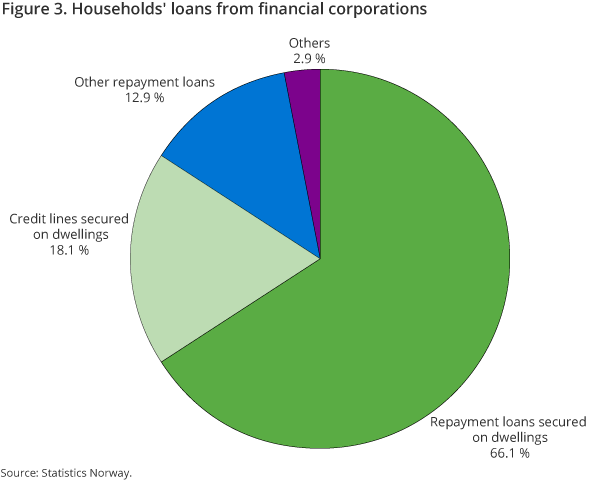

A total of 84.2 per cent of households’ total loans from financial corporations were secured on dwellings at end-April this year.

Households’ other repayment loans (including leasing) amounted to NOK 319 billion at the end of April, and hence accounted for 12.9 per cent for households’ total loans. The remaining household loans from financial corporations consist of overdrafts, working capital facilities, consumer credit, discount credit, house building loans and other building loans, and accounted for 2.9 per cent of households’ total loans at end-April, with a total of NOK 72 billion.

The statistics is now published as Banks and mortgage companies.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42