Content

Published:

This is an archived release.

Falling growth in housing loans

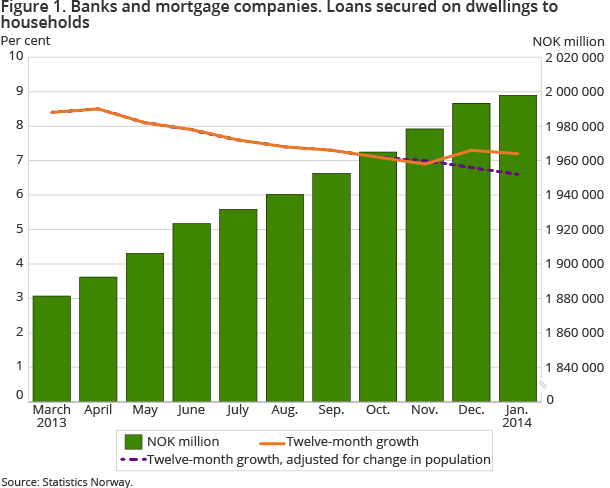

During the past twelve months to the end of January 2014, loans secured on dwellings from banks and mortgage companies to households grew by 7.2 per cent. This is a drop in the twelve-month growth rate of 0.1 percentage points compared to the previous month.

| January 2013 | January 2014 | January 2013 - January 2014 | |

|---|---|---|---|

| Banks | |||

| Bank total assets | 4 012 805 | 4 347 676 | 8.3 |

| Deposits | 2 672 660 | 2 917 093 | 9.1 |

| Loans | 2 806 290 | 3 087 416 | 10.0 |

| Mortgage companies | |||

| Bank total assets | 1 722 548 | 1 795 997 | 4 |

| Loans | 1 470 970 | 1 521 487 | 3.4 |

Loans secured on dwellings from Norwegian banks and mortgage companies to households amounted to NOK 1 998 billion at the end of January 2014. This is an increase of NOK 134 billion compared to the end of January 2013. Loans from mortgage companies were NOK 1 083 billion, while loans from banks were NOK 915 billion.

The twelve-month growth in loans secured on dwellings to households is slowly falling. From end of November 2013 to end of December 2013 there was an increase in the growth, but this is due to an increase in the bank population. When adjusted for this change in the bank population, the twelve-month growth in loans secured on dwellings has been falling during the last nine months; from 8.5 per cent at the end of April 2013 to 6.6 per cent at the end of January 2014.

Lower growth in repayment loans

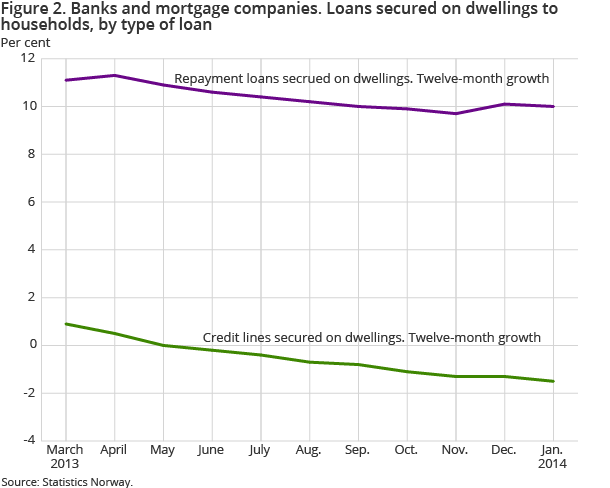

Households’ housing loans consist of repayment loans secured on dwellings and credit lines secured on dwellings . At the end of January 2014, 77 per cent of households’ housing loans from Norwegian banks and mortgage companies were repayment loans secured on dwellings.

Repayment loans secured on dwellings from Norwegian banks and mortgage companies to households amounted to NOK 1 548 billion at the end of January 2014. This implies an increase of about NOK 141 billion compared to the end of January 2013. The twelve-month growth in repayment loans has gradually fallen in the period after April 2013. The increase in the twelve-month growth from the end of November to the end of December 2013 is due to the increase in the bank population.

Credit lines secured on dwellings from Norwegian banks and mortgage companies to households amounted to NOK 450 billion at the end of January 2014. This is a decrease of about NOK 7 billion compared to the end of January 2013. During the last eight months there has been a negative twelve-month growth in the credit lines secured on dwellings in banks and mortgage companies.

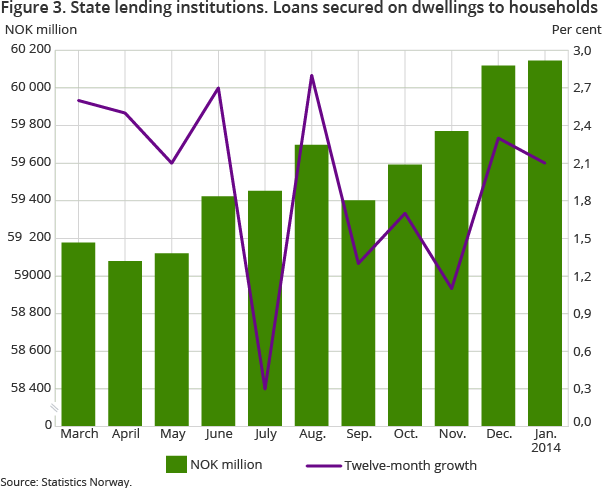

Increase in repayment loans from state lending institutions

Repayment loans secured on dwellings from state lending institutions to households amounted to NOK 60 billion at the end of January 2014. Since January 2013, there has been an increase of 2.1 per cent in these loans. Loans secured on dwellings to households in state lending institutions make up only 2.9 per cent of the total loans secured on dwellings from banks, mortgage companies and state lending institutions.

The statistics is now published as Banks and mortgage companies.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42