Content

Published:

This is an archived release.

Stable growth in savings scheme for youths

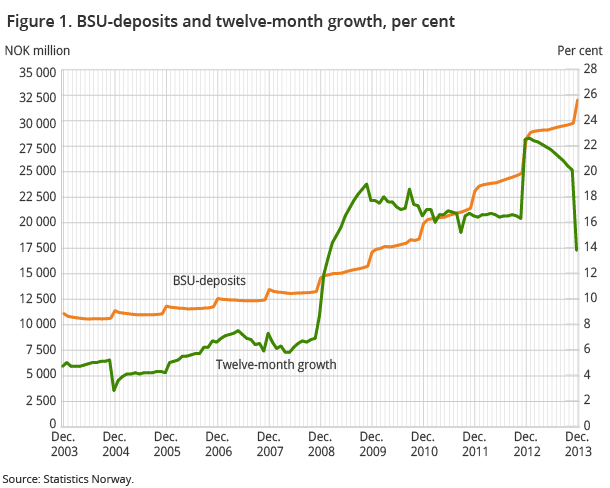

Home investment savings with tax deduction for young people (BSU) rose by NOK 3.8 billion in 2013. BSU deposits amounted to NOK 32.1 billion at end-December.

| December 2012 | December 2013 | December 2012 - December 2013 | |

|---|---|---|---|

| Banks | |||

| Bank total assets | 4 046 836 | 4 247 606 | 5.0 |

| Deposits | 2 694 245 | 2 878 883 | 6.9 |

| Loans | 2 713 476 | 2 988 357 | 10.1 |

| Mortgage companies | |||

| Bank total assets | 1 713 380 | 1 746 388 | 2 |

| Loans | 1 464 230 | 1 502 924 | 2.6 |

The twelve-month growth in deposits for Home investment savings with tax deduction for young people (BSU) was 13.5 per cent at end-December 2013. The twelve-month growth has been stable above 15 per cent since the regulations for BSU deposits were revised in 2009. From November to December 2013, BSU deposits rose by NOK 2.3 billion. This is equivalent to a monthly increase of 7.7 per cent. More than half of BSU deposits in 2013 were placed in December, in line with the seasonal pattern for these types of deposits. It may be affected by the tax benefits to its holders as well as the fact that tax-related adjustments are usually done at the end of the tax year.

It should be noted that revised data from a reporting bank has led to a break in series in December 2012, which affects growth rates and changes for the period December 2012 to November 2013.

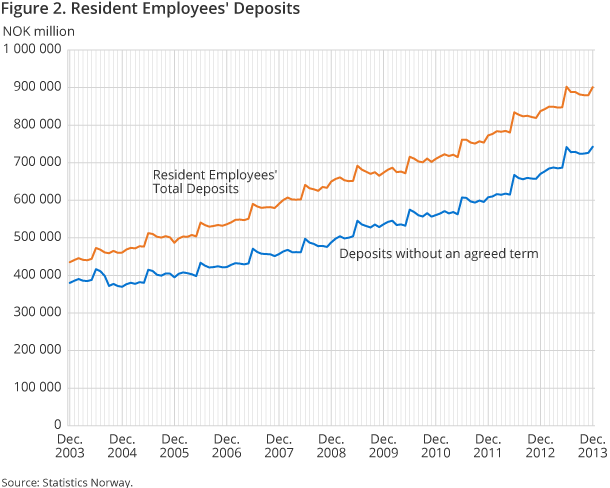

Resident employees' bank deposits without agreed maturity grow steadily

At end-December 2013 the total resident employees’ deposits in banks amounted to NOK 901 billion. This is an increase by NOK 63.7 billion, or 7.6 per cent compared to December 2012. At the end of December 2013, the twelve-month growth in bank deposits without agreed maturity was 10.8 per cent, while the twelve-month growth rate for deposits with agreed maturity was - 5.1 per cent. At the end of December 2013, a share of 82.4 per cent of bank deposits from resident employees was placed in deposits without agreed maturity.

The statistics is now published as Banks and mortgage companies.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42