Content

Published:

This is an archived release.

Declining loans to commodity trade

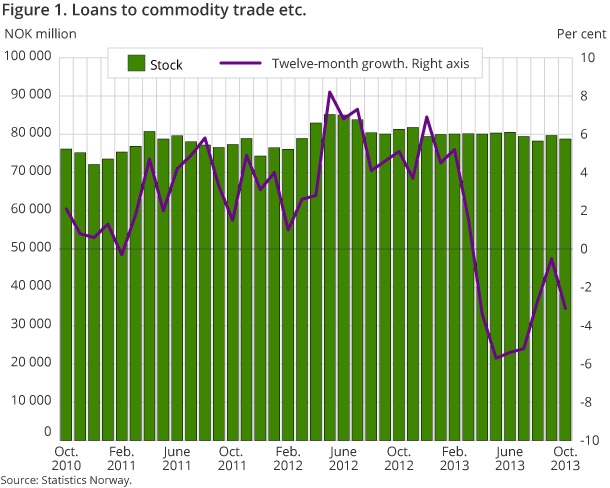

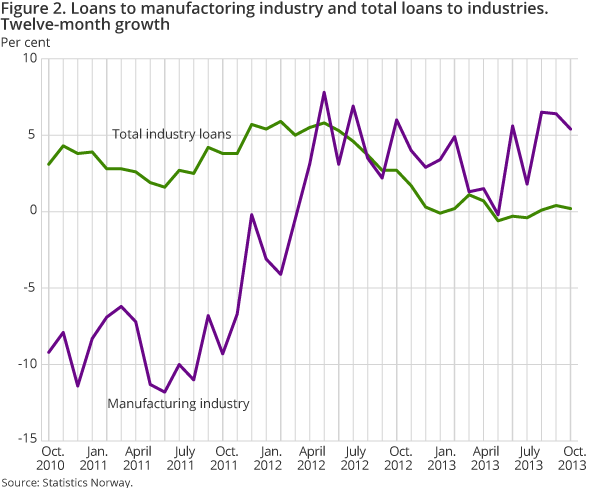

Loans to commodity trade etc. fell by 3.1 per cent from end-October last year to end-October this year. The growth in total industry loans increased by 0.2 per cent during the same period.

| October 2012 | October 2013 | October 2012 - October 2013 | |

|---|---|---|---|

| Banks | |||

| Bank total assets | 4 022 251 | 4 130 811 | 2.7 |

| Deposits | 2 671 999 | 2 786 535 | 4.3 |

| Loans | 2 693 998 | 2 980 568 | 10.6 |

| Mortgage companies | |||

| Bank total assets | 1 721 879 | 1 706 151 | -1 |

| Loans | 1 450 078 | 1 490 437 | 2.8 |

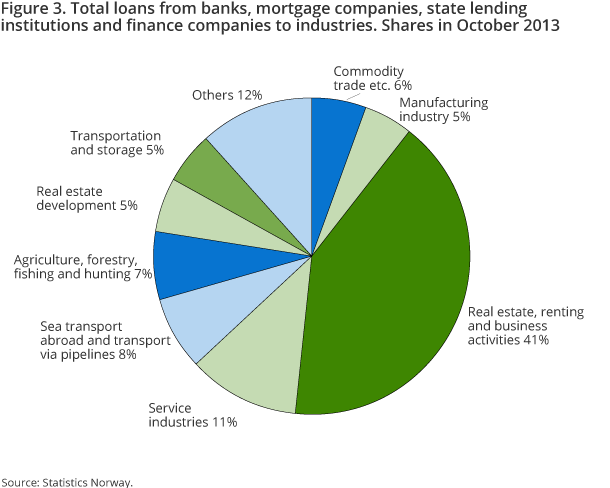

Loans from banks, mortgage companies, state lending institutions and finance companies to the commodity trade industry amounted to nearly NOK 79 billion at the end of October. This is a decrease of NOK 1 billion compared to end-September this year, and a decrease of NOK 3 billion compared to end-October 2012. The commodity trade etc. accounted for 5.6 per cent of total industry loans at end-October.

Lower growth in loans to manufacturing industry

The twelve-month growth for loans to the manufacturing industry was 5.4 per cent to end-October, down from 6.4 per cent to end-September. The manufacturing industry loans amounted to nearly NOK 73 billion at end-October. This is unchanged compared to end-September, and up from NOK 69 billion at end-October last year. The manufacturing industry accounted for 5.2 per cent of total industry loans at the end of October 2013.

The industry that accounted for the largest share of loans at end-October, reaching 40.9 per cent, was real estate, renting and business activities. Loans to this industry amounted to NOK 573 billion at end-October, unchanged compared to the previous month. The twelve-month growth was 2.2 per cent at end-October, down from 2.6 per cent to end-September.

Stable total industry loans

The total industry loans from banks, mortgage companies, state lending institutions and finance companies amounted to NOK 1 400 billion at the end of October this year, unchanged compared to the previous month. Compared to end-October 2012 total industry loans have increased by NOK 2.4 billion, which corresponds to an increase of 0.2 per cent.

Banks accounted for 77.2 per cent of the total industry loans at end-October, while the mortgage companies accounted for a share of 12.8 per cent. The state lending institutions and the finance companies accounted for shares of 5.3 and 4.7 per cent respectively.

Changes in StatBank tablesOpen and readClose

The Norwegian institutional sector classification was revised on 1 January 2012 in line with the international classification. For this statistics the changes was implemented from March 2012, and causes break in the affected time series. The period between May 2009 and February 2012 follow previous sector classification, while periods from March 2012 follows the new sector classification.

StatBank tables are revised for all periods prior to March 2012. The changes mainly relate to the sector private non-financial unincorporated enterprises. This sector is now a part of non-financial corporations in the new standard, while in the prior standard it was part of the household sector.

The statistics is now published as Banks and mortgage companies.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42