Content

Published:

This is an archived release.

Money market funding remains stable

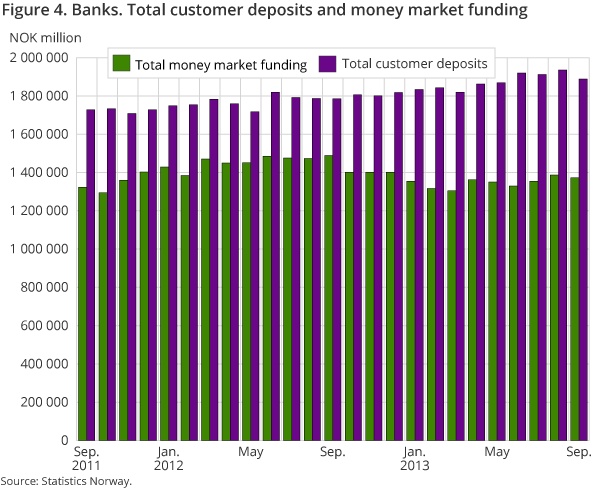

At the end of September, banks' total market funding was NOK 1 373 billion, while deposit funding totalled NOK 1 889 billion. Money market funding as a share of total bank activity has remained stable at 34 per cent over the last three months.

| September 2012 | September 2013 | September 2012 - September 2013 | |

|---|---|---|---|

| Banks | |||

| Bank total assets | 4 098 839 | 4 057 878 | -1.0 |

| Deposits | 2 712 548 | 2 732 413 | 0.7 |

| Loans | 2 745 497 | 2 933 895 | 6.9 |

| Mortgage companies | |||

| Bank total assets | 1 727 855 | 1 731 299 | 0 |

| Loans | 1 446 603 | 1 494 433 | 3.3 |

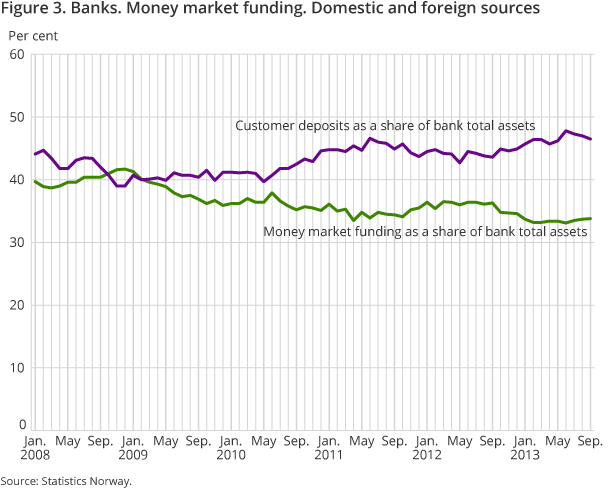

Money market funding as a share of banks’ total assets has remained stable at an average of 33.5 per cent in 2013, compared to a share of between 34.6 and 36.5 per cent in 2012. During September, Banks' total money market funding decreased by NOK 13.6 billion or 1.0 per cent from the previous month. Compared to September last year, the money market funding was NOK 115 billion lower in September this year.

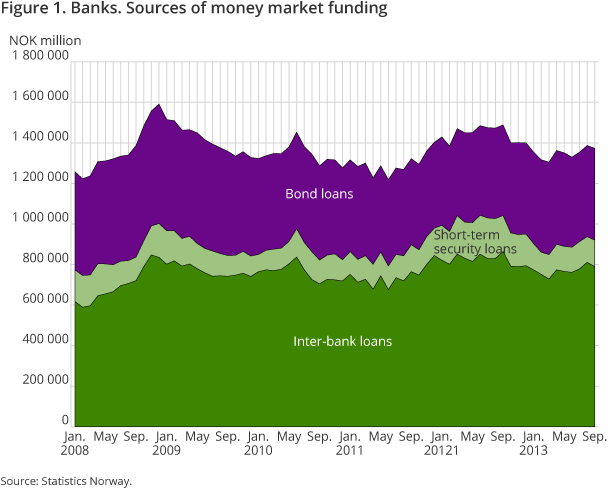

Norwegian banks finance their operations in the money market through different sources, such as inter-bank loans , bond loans and short-term security loans. F-loans from Norges Bank, loans and deposits from foreign central banks and customer deposits are other significant sources of bank funding.

Moderate changes in the share for bond loans

At the end of September, the banks' bond loans totalled NOK 453 billion. This is an increase of NOK 3.5 billion, or 0.8 per cent compared to the previous month. At the end of September, bond loans amounted to 33 per cent of total money market funding. This share has varied between 30.0 per cent in September last year and 34.9 per cent in March this year. At end-September, 55.4 per cent of banks' bond loans were issued in Norway. This share fell from 59.2 per cent in September 2012.

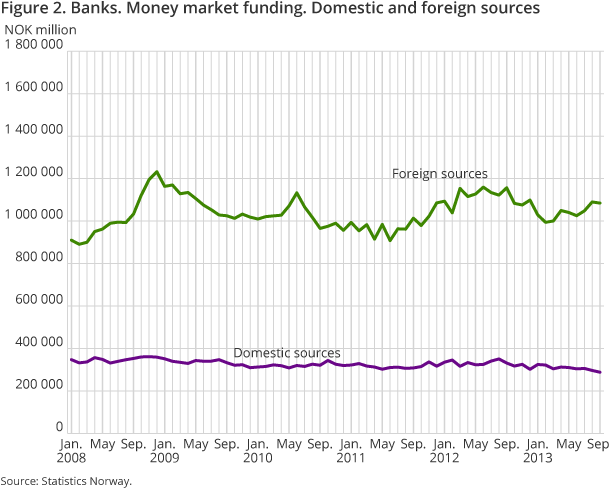

Stable high share of money market funding from foreign sources

At the end of September, about 79 per cent of money market funding stemmed from foreign sources. This totalled NOK 1 085 billion; a decrease of NOK 5.3 billion from the previous month. Domestic sources totalled NOK 289 billion at the end of September 2013 and the domestic funding has varied between 21.0 and 24.5 per cent of total money market funding during the current year.

A significant proportion of market funding through inter-bank loans

At the end of September, inter-bank loans constituted 57.5 per cent of banks' money market funding and amounted to NOK 789 billion. This is a decrease of NOK 21.2 billion compared to end-August. The share of inter-bank loans has fluctuated between 55.8 and 58.5 per cent during the current year. Inter-bank loans represent a stable high proportion of banks' money market funding.

Inter-bank loans from foreign banks at end-September this year amounted to NOK 760 billion. This corresponds to 55.4 per cent of total money market funding or 96.3 per cent of total inter-bank loans in September. This share can be affected by changes in foreign exchange rates.

Inter-bank loans from Norwegian sources amounted to a moderate NOK 29 billion in September, down from NOK 31.9 billion in the previous month. At end-September, the share of domestic inter-bank loans was equivalent to 2.1 per cent of the total money market funding. This share has remained stable between 2.1 and 3.7 per cent during the last year.

Moderate growth in banks’ short-term security loans

Banks' short-term security loans peaked in July 2012 at NOK 200 billion, and subsequently fell to NOK 130.5 billion at end-September 2013. This is a slight increase of NOK 4 billion or 3.2 per cent compared to the previous month. Banks' short-term security loans accounted for 9.5 per cent of the total money market funding at end-September 2013. The majority of short-term security loans are issued abroad, and at the end of September this amounted to NOK 122 billion.

Decreasing lending from central banks

Norwegian banks can also get funding from Norges Bank and foreign central banks. Since June 2013, loans have not been given by Norges Bank. Loans and deposits from foreign central banks were NOK 48.8 billion in September, down from NOK 62.2 billion at the end of August. In September 2013, loans and deposits from foreign central banks were at their lowest during the last 13 months. By comparison, the total loans from foreign central banks to Norwegian banks peaked in April 2013 with NOK 112.8 billion.

Stable funding from customer deposits

In addition to money market funding, Norwegian banks also finance their activity through customer deposits. The total customer deposits amounted to NOK 1 889 billion at end-September this year, down from NOK 1 935 billion at the end of August; a decrease of 2.4 per cent. Customer deposits as a share of banks’ total assets varied between 45.7 and 47.8 per cent up to September this year. Last year, the average share was about 44 per cent.

The statistics is now published as Banks and mortgage companies.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42