Content

Published:

This is an archived release.

Lower growth in mortgage loans for households

At end-August 2013, the twelve-month growth rate in households’ housing loans from Norwegian banks and mortgage companies was 7.4 per cent. This is a drop from 7.6 per cent at the end of the preceding month.

| August 2012 | August 2013 | August 2012 - August 2013 | |

|---|---|---|---|

| Banks | |||

| Bank total assets | 4 078 725 | 4 116 291 | 0.9 |

| Deposits | 2 685 651 | 2 818 977 | 5.0 |

| Loans | 2 777 190 | 2 930 066 | 5.5 |

| Mortgage companies | |||

| Bank total assets | 1 717 900 | 1 725 147 | 0 |

| Loans | 1 431 637 | 1 493 827 | 4.3 |

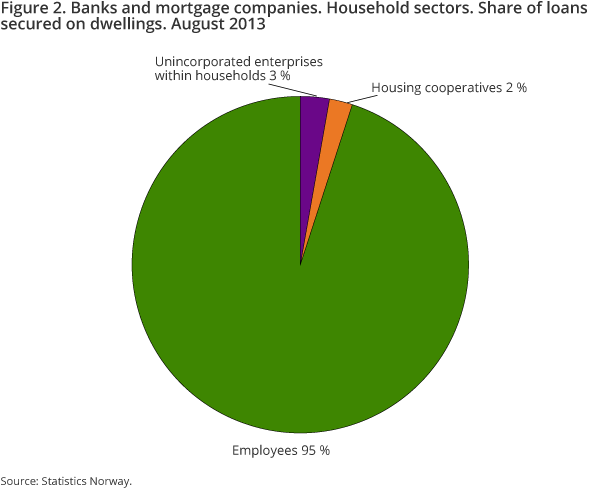

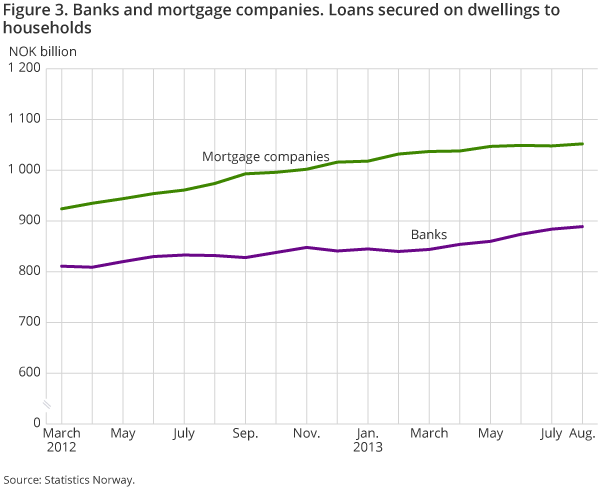

Loans secured on dwellings from banks and mortgage companies to households totalled NOK 1 940 billion at the end of August this year. This is an increase from NOK 1 932 billion in July. The household sector includes unincorporated enterprises, housing cooperatives and employees etc. Employees have the largest share of housing loans from banks and mortgage companies, which amounted to NOK 1 840 billion at the end-August this year. Unincorporated enterprises and housing cooperatives had the remaining share of loans secured on dwellings, which amounted to NOK 55 and NOK 45 billion respectively. As of March 2012, after implementation of the new international sector classification, these shares have been stable.

Total lending to households from banks and mortgage companies amounted to NOK 2 134 billion at end-August 2013, with a share of 90.9 per cent for loans secured on dwellings out of the total loans.

Slower growth in credit lines secured on dwellings

Loans secured on dwellings consist of two types of loans: repayment loans and credit lines. At end-August, the proportion of credit lines secured on dwellings was 23 per cent of total housing loans to households from banks and mortgage companies. Credit lines secured on dwellings totalled NOK 453 billion at end-August. This is a decrease of about NOK 3 billion, or -0.7 per cent, compared to the same period last year. There has been a slight fall in twelve-month growth for households’ credit lines, from 0.9 per cent at end-June 2013 to -0.7 per cent at end-August this year.

Repayment loans secured on dwellings from banks and mortgage companies to households totalled NOK 1 488 billion at end-August this year. This is an increase of NOK 137 billion from the same period last year. In recent periods, the twelve-month growth in repayment loans secured on dwellings fell from 11.1 per cent in March 2013 to 10.2 per cent in August 2013.

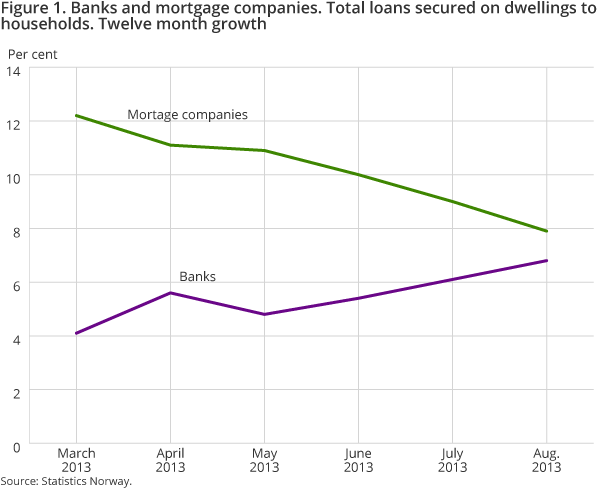

Higher growth in banks' loans secured on dwellings

Norwegian banks’ loans secured on dwellings to households totalled NOK 889 billion at end-August. This is an increase of NOK 57 billion, or 6.8 per cent, since end-August last year. Loans secured on dwellings from mortgage companies to households totalled NOK 1 052 billion at end-August. This is an increase of approximately NOK 77 billion from August last year. At the end of March 2013, the twelve-month growth in loans secured on dwellings was approximately three times higher to mortgage companies than to banks. However, this growth has levelled out in the current period. At the end of August, the twelve-month growth in housing loans from banks and mortgage companies was 6.8 and 7.9 per cent respectively.

The statistics is now published as Banks and mortgage companies.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42