Content

Published:

This is an archived release.

Increase in deposits from corporations

In July 2013, the deposits from the non-financial corporations in Norwegian banks increased by NOK 22 billion. In the last twelve months, these corporations’ deposits increased by 5.5 per cent.

| July 2012 | July 2013 | July 2012 - July 2013 | |

|---|---|---|---|

| Banks | |||

| Bank total assets | 4 055 186 | 4 038 900 | -0.4 |

| Deposits | 2 683 330 | 2 759 057 | 2.8 |

| Loans | 2 770 560 | 2 921 527 | 5.4 |

| Mortgage companies | |||

| Bank total assets | 1 709 443 | 1 706 813 | 0 |

| Loans | 1 424 199 | 1 475 606 | 3.6 |

Non-financial corporations’ deposits in domestic banks amounted to NOK 572 billion by end-July 2013. In the last twelve months, the deposits increased by almost NOK 30 billion, of which NOK 29 billion was in Norwegian currency. Within the non-financial corporations sector, deposits from the sub-sector private non-financial corporations increased by almost NOK 24 billion, or 5.5 per cent, while the municipal non-financial corporations had the largest percentage increase, with 9.6 per cent.

Tax payments lead to large monthly volatility

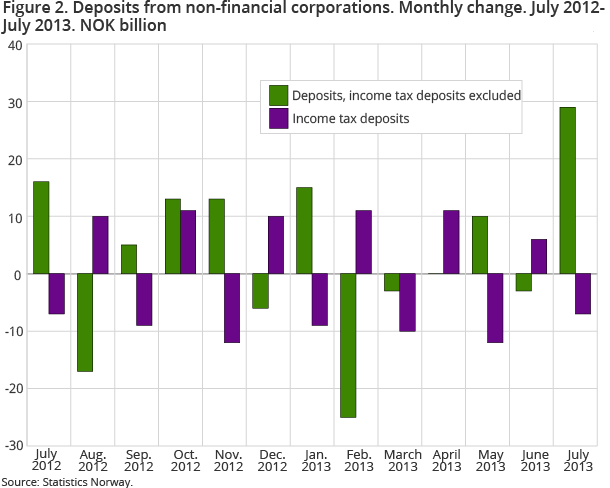

Non-financial corporations’ deposits in Norwegian currency increased by almost NOK 10 billion in July 2013. The monthly changes in the corporations’ deposits are correlated with the term of payments for taxes. The increase in deposits in July 2013 is related to the non-payments in value added taxes , corporation tax and petroleum revenue tax during this month.

Income tax for employees , which the corporations transfer to the income tax deposits, amounted to almost NOK 12 billion by end-July 2013, which is a decline of NOK 7 billion from end-June 2013. If the income tax deposits are excluded from the corporations’ deposits, the corporations’ deposits increased by more than NOK 29 billion in July 2013, which is NOK 13 billion more than in July 2012.

The monthly volatility in deposits is quite large. For example, in February 2013, the deposits excluding income tax deposits decreased by NOK 25 billion, which was due to large payments of both petroleum revenue tax and corporation tax.

Largest increase in foreign currency deposits

At the end of July, about 12 per cent of the non-financial corporations’ deposits were in foreign currencies. In July 2013, these deposits increased by NOK 12 billion, or 22.8 per cent. The Norwegian krone appreciated against most major currencies in July 2013, however this only contributed to a small decrease in the value of the foreign currency deposits.

Private non-financial corporations account for most deposits

By end-July 2013, the private non-financial corporations had NOK 502 billion in deposits in domestic banks. This amounted to 87.7 per cent of all the non-financial corporations’ deposits. In July this year, the deposits from private non-financial corporations increased by NOK 13 billion, while deposits from the government and municipal-owned corporations increased by NOK 7.6 billon and NOK 1.5 billion respectively.

The statistics is now published as Banks and mortgage companies.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42