Content

Published:

This is an archived release.

Reduced growth in households’ debt

The households’ total debt to financial corporations increased by 6.6 per cent from end-May 2012 to end-May 2013. This twelve-month growth is a reduction from 6.9 per cent in the last twelve-month period. The composition of these loans is stable.

| May 2012 | May 2013 | May 2012 - May 2013 | |

|---|---|---|---|

| Banks | |||

| Bank total assets | 4 026 698 | 4 047 533 | 0.5 |

| Deposits | 2 593 751 | 2 705 939 | 4.3 |

| Loans | 2 766 274 | 2 919 317 | 5.5 |

| Mortgage companies | |||

| Bank total assets | 1 686 687 | 1 726 230 | 2 |

| Loans | 1 407 728 | 1 491 795 | 6.0 |

The households’ debt from financial corporations amounted to NOK 2 335 billion at end-May this year. This is an increase of nearly NOK 14 billion compared to last month, and an increase of NOK 145 billion compared to end-May 2012.

High share of loans secured on dwellings

A total of 84.2 per cent of households’ total loans from financial corporations were secured on dwellings at end-May this year. These loans amounted to NOK 1 965 billion; an increase of NOK 14 billion compared to the previous month. Compared to end-May 2012, the households’ total loans secured on dwellings amounted to NOK 1 822 billion. This gives a twelve-month growth of 7.9 per cent to end-May, down from 8.4 per cent in the previous twelve-month period.

Loans secured on dwellings are divided into two types: repayment loans and credit lines. The households’ repayment loans secured on dwellings were NOK 1 509 billion at end-May this year; a 10.5 per cent increase compared to the same period last year. The households’ credit lines secured on dwellings amounted to NOK 456 billion at end-May this year; nearly unchanged compared to end-May 2012.

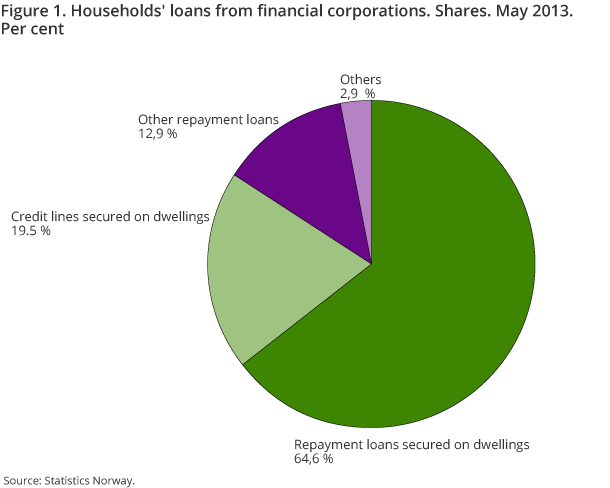

Repayment loans secured on dwellings as a share of households’ total debt from financial corporations was 64.6 per cent at end-May. At the same time, credit lines secured on dwellings accounted for a share of 19.5 per cent.

Stable composition of households’ loans

The types of loans’ share of total loans from financial corporations have been stable for households in all periods with new sector definitions from March 2012 to May this year.

The households’ other repayment loans (including leasing) amounted to nearly NOK 302 billion at the end of May, and hence accounted for 12.9 per cent for households’ total loans. The remaining household loans from financial corporations consist of overdrafts, working capital facilities, consumer credit, discount credit, house building loans and other building loans, and accounted for 2.9 per cent of households’ total loans at end-May, with a total of NOK 68 billion.

The statistics is now published as Banks and mortgage companies.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42