Content

Published:

This is an archived release.

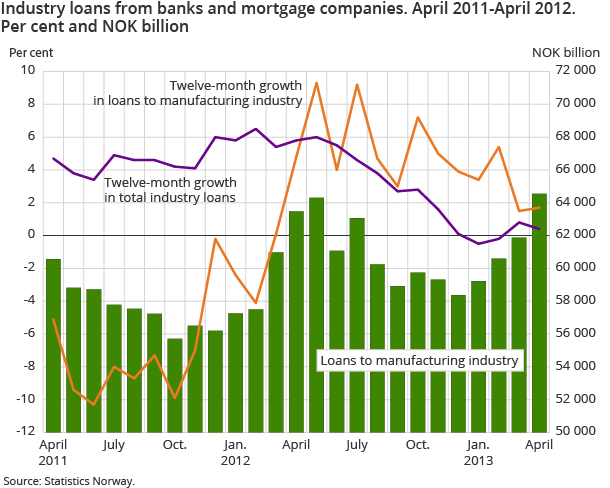

Growth in loans to manufacturing industry

Loans from banks and mortgage companies to the manufacturing industry amounted to nearly NOK 65 billion at end-April 2013. This is the highest level of lending to the manufacturing industry since end-June 2010.

| April 2012 | April 2013 | April 2012 - April 2013 | |

|---|---|---|---|

| Banks | |||

| Bank total assets | 3 985 646 | 4 076 305 | 2.3 |

| Deposits | 2 655 576 | 2 706 765 | 1.9 |

| Loans | 2 676 138 | 2 893 277 | 8.1 |

| Mortgage companies | |||

| Bank total assets | 1 651 461 | 1 721 197 | 4 |

| Loans | 1 391 130 | 1 478 307 | 6.3 |

Loans from banks and mortgage companies to the manufacturing industry increased by NOK 2.7 billion, or 4.3 per cent, from end-March to end-April this year.

Loans from Norwegian banks and mortgage companies to manufacturing industries increased gradually from NOK 58 billion at end-December 2012, until end-April this year. The manufacturing industry’s share of total industry loans was 5.1 per cent to end-April. This share remained unchanged at 4.7 per cent during the period from September 2012 to January 2013, and has increased in all the following months.

Moderate growth in total industry loans

Total loans from Norwegian banks and mortgage companies to the industries amounted to NOK 1 263 billion at end-April, up NOK 1.7 billion, or 0.1 per cent from end-March. In comparison, these loans amounted to NOK 1 258 billion at end-April 2012. This implies an increase of NOK 5.1 billion, or 0.4 per cent over the past twelve months.

Norwegian banks and mortgage companies’ total assets amounted to NOK 5 798 billion at end-April. Total loans to Norwegian industries as a share of total assets were 21.8 per cent.

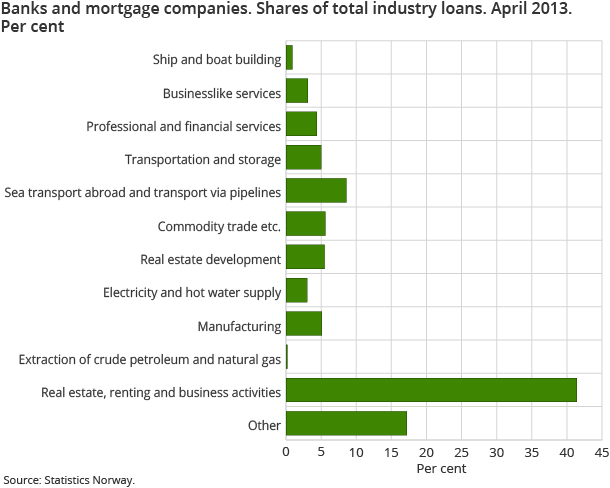

Significant growth in lending to ship and boat building

Banks and mortgage companies’ loans to ship and boat building added up to nearly NOK 12 billion at end-April this year, up from NOK 10 billion at end-March. This corresponds to an increase of NOK 2.0 billion, or 20.8 per cent. Compared to April 2012, these loans have increased by NOK 3.7 billion, or 44.7 per cent by end-April this year. Ship and boat building accounted for 0.9 per cent of total industry loans at end-April this year.

Increase in loans to real estate, renting and business activities

Loans to real estate, renting and business activities from banks and mortgage companies added up to NOK 523 billion at end-April this year, up from NOK 520 billion the previous month. The twelve-month growth in loans to this industry was 4.0 per cent to end-April 2013.

The real estate, renting and business activities industry was the major borrower among all the Norwegian industries, with a share of 41.1 per cent of total industry loans at end-April. This was followed by the sea transport abroad and transport via pipelines industry, also called shipping, the commodity trade etc. industry, and also the real estate development industry, with shares of 8.6 per cent, 5.6 per cent and 5.5 per cent respectively.

Less lending to shipping and professional and financial services

The banks and mortgage companies’ loans to shipping amounted to NOK 109 billion at end-April, down from NOK 115 billion the previous month. This is a decrease of NOK 6.3 billion, or 5.5 per cent. During the past twelve months, loans to shipping shrank by NOK 14 billion. The twelve-month growth was thus -11.5 per cent to end-April 2013.

Loans to professional and financial services amounted to NOK 56 billion at end-April, marginally down compared to the previous month. Compared to end-April last year, this was a decrease of NOK 14.2 billion, or 20.4 per cent. Professional and financial services’ share of total industry loans from banks and mortgage companies was 4.4 per cent at end-April.

Considerable growth rate in loans to crude petroleum and natural gas extraction

The banks and mortgage companies’ loans to extraction of crude petroleum and natural gas amounted to nearly NOK 3 billion at end-April. This is an increase of NOK 71 million, or 2.5 per cent, from end-March and an increase of NOK 1.0 billion, or 53.3 per cent from end-April 2012. Thus, this industry experienced the highest growth during the past twelve months, but only accounts for 0.2 per cent of total industry loans from banks and mortgage companies.

The statistics is now published as Banks and mortgage companies.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42