Content

Published:

This is an archived release.

Steady growth in savings scheme for youths

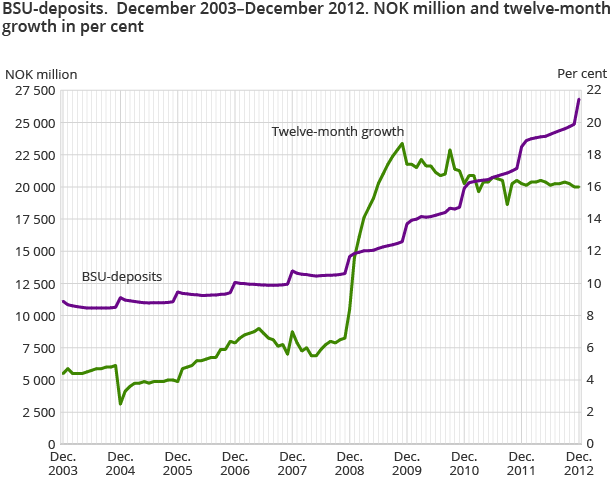

Deposits in the scheme known as Home investment savings with tax deduction for young people (BSU) is still an attractive type of deposit. At the end of December 2012, BSU deposits amounted to NOK 26.8 billion. This is an increase of NOK 3.7 billion compared to December 2011.

| December 2011 | December 2012 | December 2011 - December 2012 | |

|---|---|---|---|

| Banks | |||

| Bank total assets | 3 950 544 | 4 047 109 | 2.4 |

| Deposits | 2 641 470 | 2 694 252 | 2.0 |

| Loans | 2 679 220 | 2 713 482 | 1.3 |

| Mortgage companies | |||

| Bank total assets | 1 615 773 | 1 713 380 | 6 |

| Loans | 1 320 548 | 1 464 230 | 10.9 |

The twelve-month growth in BSU deposits was 16.0 per cent at end-December 2012. This is a decrease of 0.2 percentage points compared to December 2011. The twelve-month growth has been stable since the regulations for BSU deposits were revised in 2009. From November 2012 to December 2012, BSU deposits increased by nearly NOK 2 billion. This is equivalent to a monthly increase of 7.9 per cent. More than half of BSU deposits in 2012 were placed in December 2012. This is in line with the seasonal pattern for these types of deposits. It may be affected by the fact that savings in BSU accounts give tax benefits to the account holder. In addition, all tax-related adjustments are usually made at the end of the tax year.

Growth in bank deposits without agreed maturity for employees in Norway

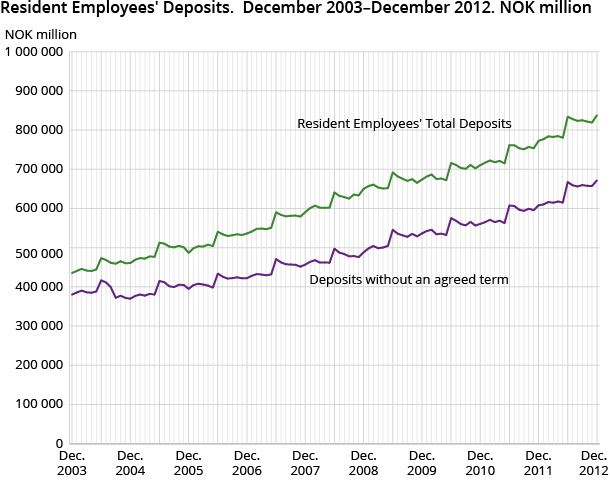

At end-December 2012, the total bank deposits of employees in Norway amounted to NOK 838 billion. This is an increase of NOK 65 billion, or 8.4 per cent compared to December 2011. At the end of December 2012, the twelve-month growth in bank deposits without agreed maturity was 10.5 per cent, while the twelve-month growth rate for deposits with agreed maturity was only 0.9 per cent. At the end of December 2012, 80.2 per cent of bank deposits of employees in Norway were placed in deposits without agreed maturity, and the corresponding figure for deposits with agreed maturity was just 19.8 per cent.

The statistics is now published as Banks and mortgage companies.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42